- United States

- /

- Capital Markets

- /

- NYSE:GS

Assessing Goldman Sachs Shares After 40% Rally and Wealth Management Expansion in 2025

Reviewed by Bailey Pemberton

- If you've ever wondered whether Goldman Sachs Group is trading at a bargain, you're in the right place. We're diving deep into what moves its value and what those numbers might really mean for investors.

- The stock has kept momentum, jumping 2.3% over the past week and climbing a hefty 40.1% year-to-date. This has sparked fresh conversations about its growth prospects and shifting risk profile.

- Recent headlines point to strategic moves in wealth management and investment banking, with market sentiment buoyed by optimism around the company's expansion into alternative assets and new tech-driven initiatives. These developments are helping fuel renewed interest among institutional and retail investors alike.

- Currently, Goldman Sachs earns a 3 out of 6 on our valuation checks, meaning it appears undervalued in half of the key areas we examine. In the next sections, we'll break down exactly how those valuation scores are calculated, plus share a more insightful way to think about value that is often overlooked.

Approach 1: Goldman Sachs Group Excess Returns Analysis

The Excess Returns valuation model measures how much value Goldman Sachs Group creates for shareholders beyond its cost of equity. It considers not just profits, but how effectively the company reinvests those profits to generate returns higher than what investors expect as compensation for risk.

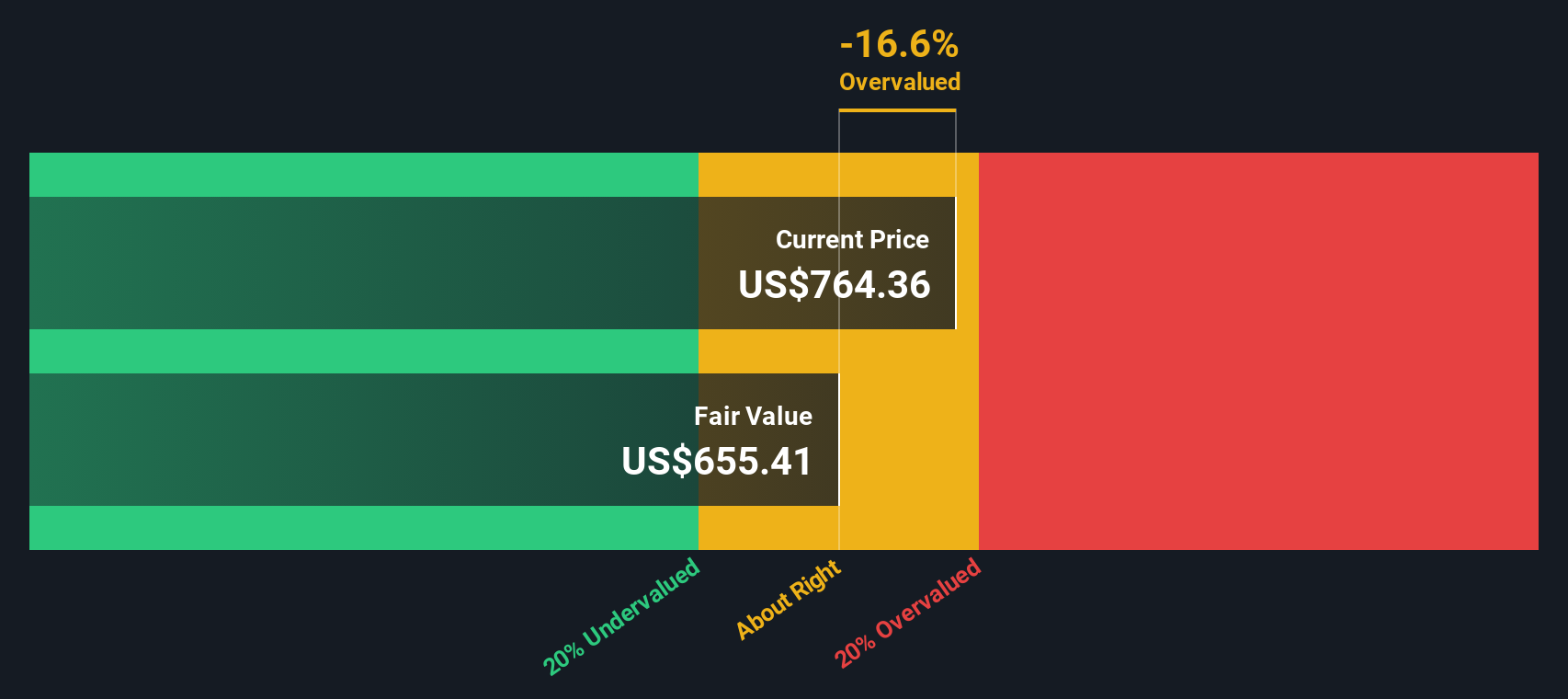

For Goldman Sachs, the current Book Value is $348.02 per share and is projected to rise to a stable estimate of $385.53 per share according to the weighted forecasts of 14 analysts. Meanwhile, Stable EPS is estimated at $58.67 per share, based on future Return on Equity estimates from 13 analysts, resulting in an average Return on Equity of 15.22%. The Cost of Equity is $48.19 per share, which means the company is generating an Excess Return of $10.48 per share above what equity holders require.

Despite these solid figures, the Excess Returns model estimates the intrinsic value of Goldman Sachs Group's stock is about 61.4% below its current market price. This suggests it is significantly overvalued according to this approach. The large discount implies the stock price already reflects lofty expectations that may be hard to meet with current fundamentals.

Result: OVERVALUED

Our Excess Returns analysis suggests Goldman Sachs Group may be overvalued by 61.4%. Discover 875 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Goldman Sachs Group Price vs Earnings

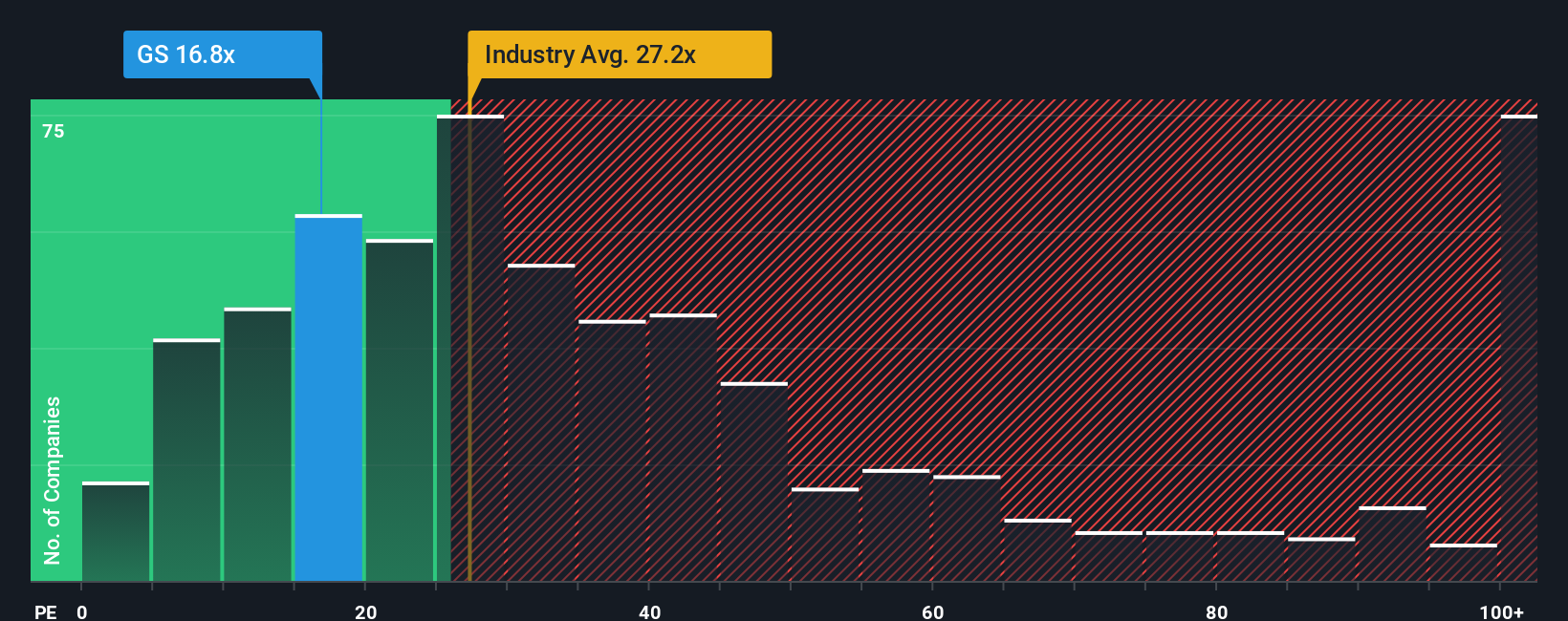

For established, profitable companies like Goldman Sachs Group, the Price-to-Earnings (PE) ratio is a widely used valuation metric as it directly relates the company’s stock price to its per-share earnings. This makes it particularly meaningful when assessing financial institutions with consistent earnings streams.

Determining what constitutes a "normal" or "fair" PE ratio requires some context. Higher growth expectations and lower perceived risks can justify a higher PE, while slower-growing or riskier firms might trade at a lower multiple. As of now, Goldman Sachs trades at a PE of 16.01x. This is noticeably below the Capital Markets industry average of 24.04x and also trails its peer group average of 30.27x, highlighting a degree of market skepticism or a potential discount.

Simply Wall St’s proprietary Fair Ratio offers a more nuanced benchmark by calculating the PE multiple Goldman Sachs should trade at, considering its unique mix of earnings growth forecasts, risk profile, profit margins, industry dynamics, and market capitalization. Unlike a simple industry or peer comparison, this approach adapts to the specific strengths and risks of the business. For Goldman Sachs, the Fair Ratio is 19.02x, moderately above its current 16.01x multiple. Since the difference between the Fair Ratio and actual PE is greater than 0.10, this suggests the stock is undervalued by this metric and might offer value for investors willing to look past current market sentiment.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Goldman Sachs Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, Simply Wall St’s breakthrough tool that helps you layer your perspective or “story” onto the numbers behind Goldman Sachs Group.

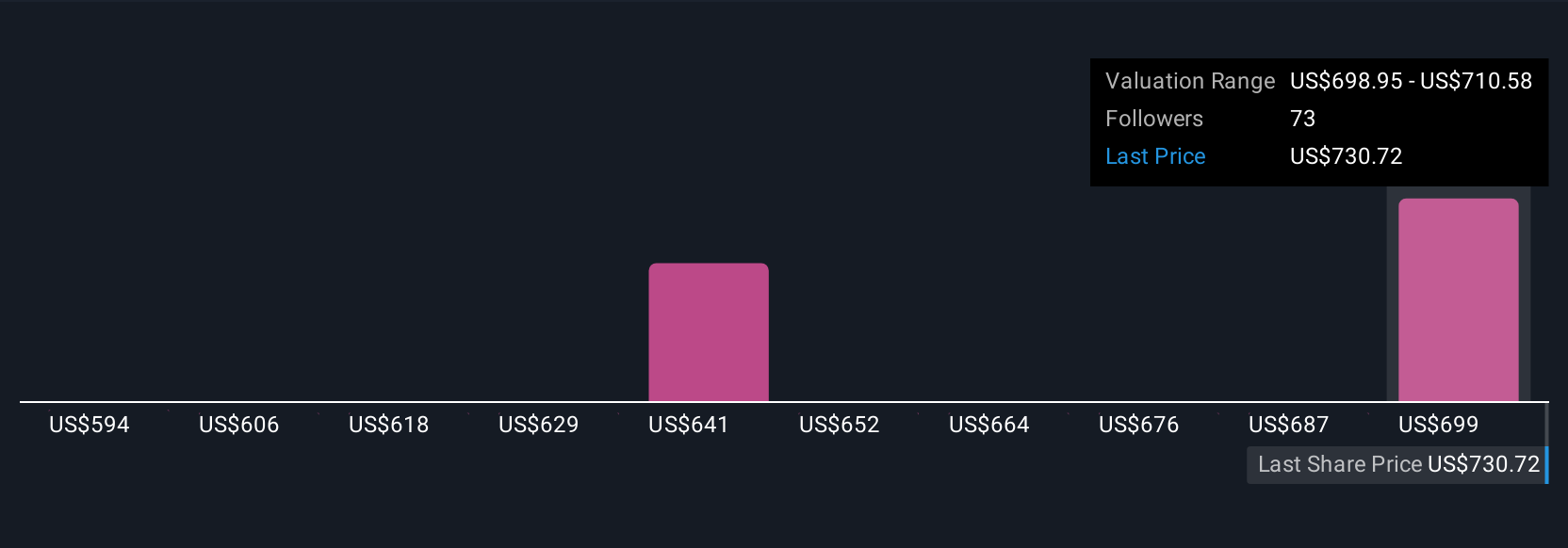

A Narrative connects your view of the business, its future prospects, and key events directly to a specific forecast, tying together everything from expected revenue and profit margins to your own estimate of fair value.

With Narratives, anyone can easily map their expectations for Goldman Sachs Group, compare fair value to the latest share price, and decide if now looks like a good time to buy or sell. Narratives update automatically when news or earnings are announced.

Available in the Community section and used by millions of investors, Narratives make it simple to explore different scenarios. For instance, some investors see strong momentum in asset management and digital transformation as grounds for a fair value of $815 per share, while others focusing on regulatory and geopolitical risks land closer to $538. This allows you to weigh both bull and bear cases before making your move.

Do you think there's more to the story for Goldman Sachs Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GS

Goldman Sachs Group

A financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals in the Americas, Europe, the Middle East, Africa, and Asia.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives