- United States

- /

- Capital Markets

- /

- NYSE:GS

Assessing Goldman Sachs (GS) Valuation Following a Strong Year of Share Price Gains

Reviewed by Simply Wall St

Goldman Sachs Group (GS) stock has recently shown a steady upward trend. This has caught the attention of investors who are curious about the company’s valuation after a strong year. Recent performance is prompting fresh interest in the shares.

See our latest analysis for Goldman Sachs Group.

Goldman Sachs Group’s share price has climbed steadily to $786.34 after a powerful year, with its recent 90-day price return of 5.78% contributing to a striking 36.76% gain year-to-date. Long-term shareholders have enjoyed an impressive 33.21% total shareholder return over the past 12 months, and the multi-year momentum remains firmly intact.

If Goldman’s rally has you thinking bigger, now is a great moment to broaden your investing scope and discover fast growing stocks with high insider ownership

With Goldman’s stock near record highs and delivering strong returns, investors are left to wonder if the current price still leaves room for upside or if all the growth has already been reflected in the price.

Most Popular Narrative: 1.9% Undervalued

Market watchers are eyeing Goldman Sachs Group with curiosity, as the narrative fair value of $801.58 stands modestly above its last close price of $786.34. This slight gap is generating fresh debate about how much future growth is already baked in, and which business shifts could propel the stock higher from here.

Record growth and momentum in Asset & Wealth Management, including strong fee-based net inflows for 30 consecutive quarters and rising demand for alternative assets from high-net-worth and institutional clients, are shifting the revenue mix toward less volatile, high-margin streams. This is supporting higher and more durable net margins.

Want to know what’s pushing Goldman’s value beyond its current price? Analysts are betting on a new mix of stable income streams and persistent efficiency gains. The real insight? The underlying math leans on bold profit margin upgrades and steady top-line expansion, but only the full narrative reveals the exact playbook.

Result: Fair Value of $801.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering regulatory changes or unpredictable geopolitical events could quickly challenge the optimistic outlook and put pressure on Goldman's growth expectations.

Find out about the key risks to this Goldman Sachs Group narrative.

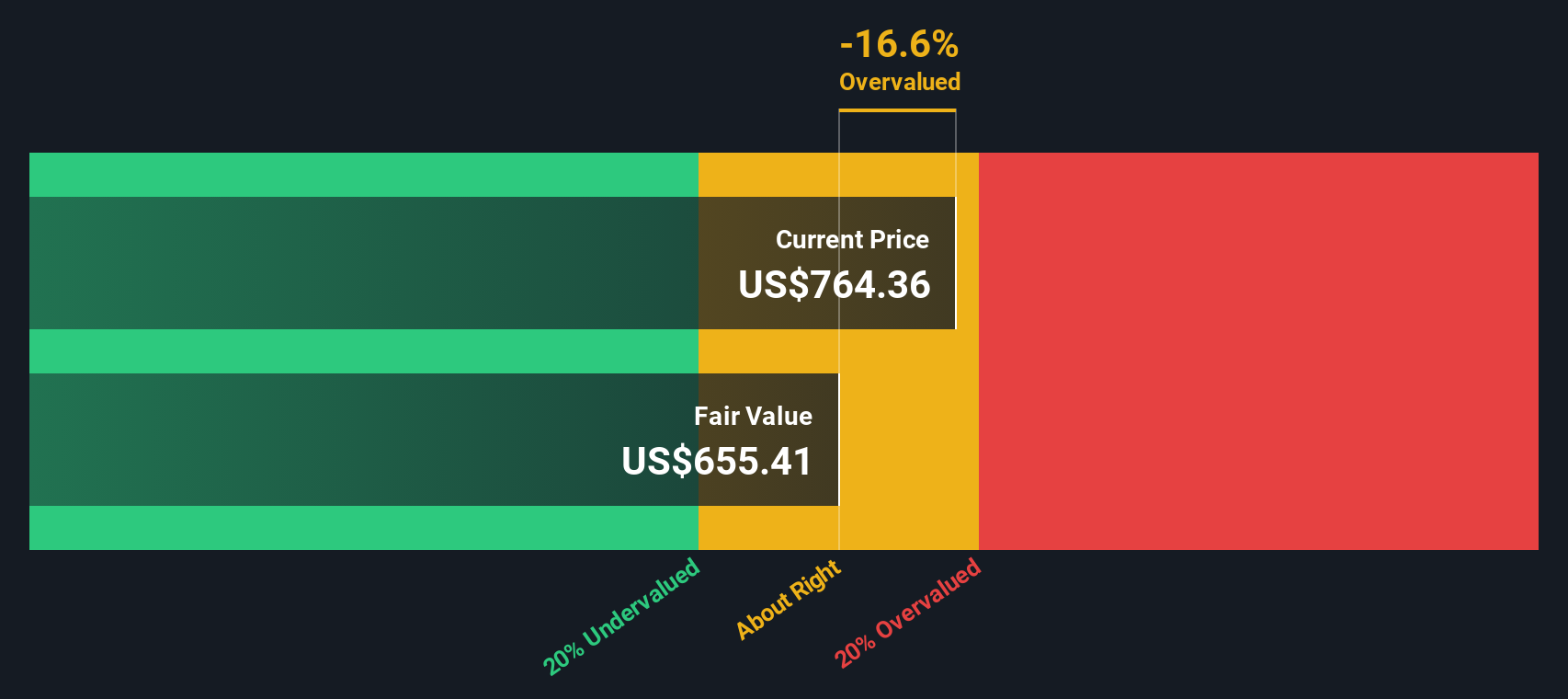

Another View: Discounted Cash Flow Model Suggests Little Upside

While the market focuses on earnings and multiples, our SWS DCF model paints a different picture. By estimating future cash flows, this model puts Goldman's fair value at just $498.93 per share, which is well below recent trading levels. Could the recent optimism be pricing in too much future growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Goldman Sachs Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Goldman Sachs Group Narrative

If you have your own perspective or want to dig deeper into the numbers, you can craft a personalized narrative for Goldman Sachs Group in just a few minutes. Do it your way

A great starting point for your Goldman Sachs Group research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

You don’t want to miss out on exciting opportunities outside Goldman Sachs. Use the Simply Wall Street Screener to spot tomorrow’s winners before everyone else does.

- Lock in reliable returns by checking out these 16 dividend stocks with yields > 3% offering high yields above 3% for income-focused investors.

- Uncover the growth potential of tomorrow’s tech leaders through these 25 AI penny stocks at the forefront of artificial intelligence innovation.

- Stay ahead of the market by evaluating these 876 undervalued stocks based on cash flows that may be trading below their intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GS

Goldman Sachs Group

A financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals in the Americas, Europe, the Middle East, Africa, and Asia.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives