- United States

- /

- Mortgage REITs

- /

- NYSE:GPMT

Scienjoy Holding Leads Our Selection Of 3 US Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market experiences a surge, highlighted by a big tech rally pushing the Nasdaq Composite above 20,000 points for the first time, investors are exploring various opportunities across different segments. Penny stocks, often seen as remnants of previous market eras, continue to offer potential for growth due to their affordability and association with smaller or newer companies. When these stocks are supported by strong financials and solid fundamentals, they can present unique opportunities that might not be immediately apparent in larger-cap investments.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.807 | $6.3M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.58 | $1.89B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $153.34M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.90 | $87.96M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.239 | $9.28M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.48 | $49.83M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.7413 | $13.25M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.879 | $79.96M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.94 | $422.84M | ★★★★☆☆ |

Click here to see the full list of 707 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Scienjoy Holding (NasdaqCM:SJ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Scienjoy Holding Corporation operates mobile live streaming platforms in the People’s Republic of China and has a market cap of $38.92 million.

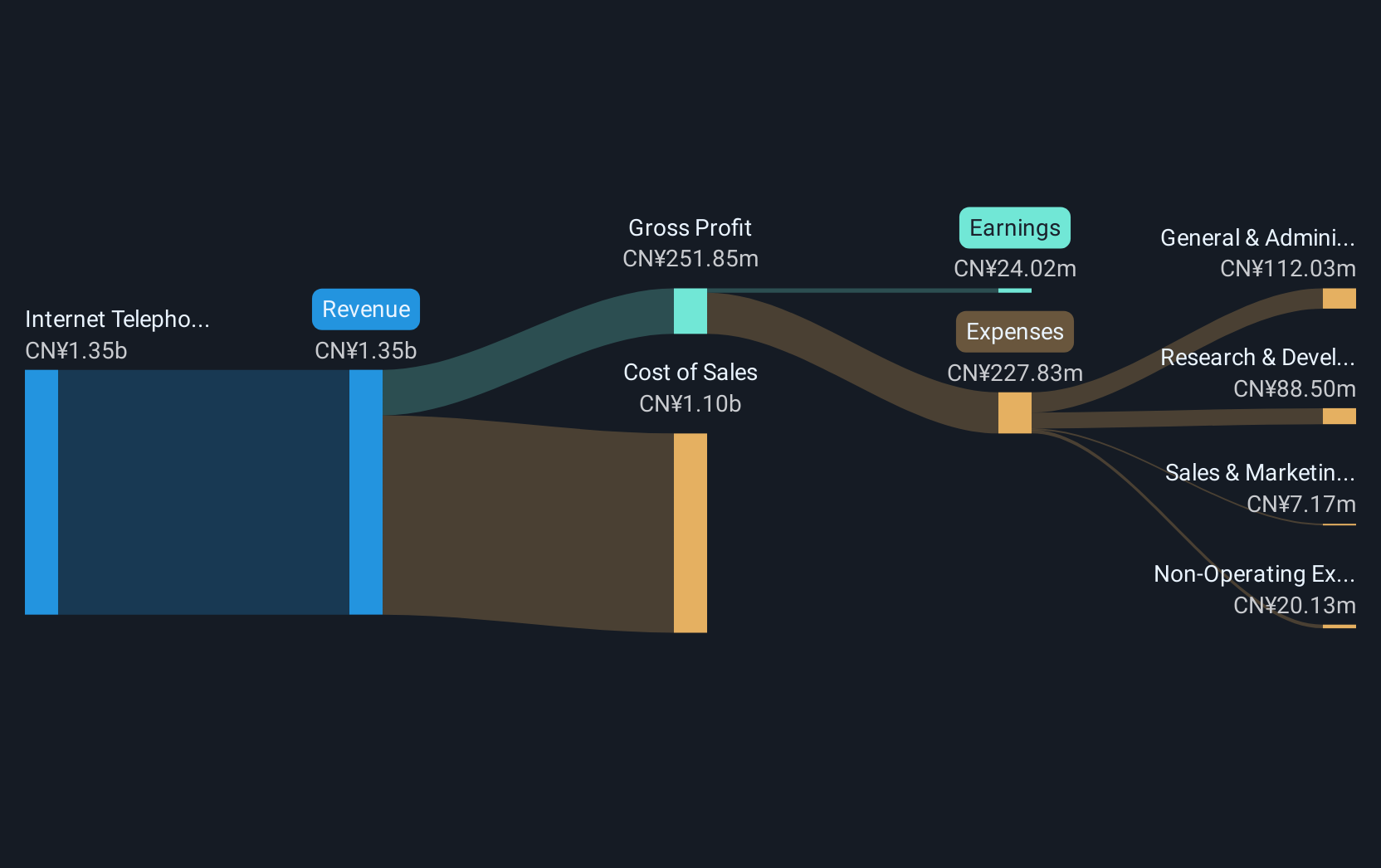

Operations: The company's revenue is derived from its Internet Telephone segment, totaling CN¥1.44 billion.

Market Cap: $38.92M

Scienjoy Holding Corporation, with a market cap of US$38.92 million, has recently achieved profitability, reporting net income of CN¥42.69 million for the first nine months of 2024. Despite its volatile share price and low return on equity at 3.1%, the company is debt-free and trades significantly below its estimated fair value. Its short-term assets comfortably cover both short- and long-term liabilities, reflecting strong financial health in this regard. Revenue guidance for Q4 2024 suggests stability with expectations between RMB 300 million to RMB 330 million, following slight revenue contraction over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of Scienjoy Holding.

- Assess Scienjoy Holding's previous results with our detailed historical performance reports.

MoneyHero (NasdaqGM:MNY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MoneyHero Limited operates as a personal finance company with a market cap of $49.57 million.

Operations: No revenue segments have been reported for MoneyHero Limited.

Market Cap: $49.57M

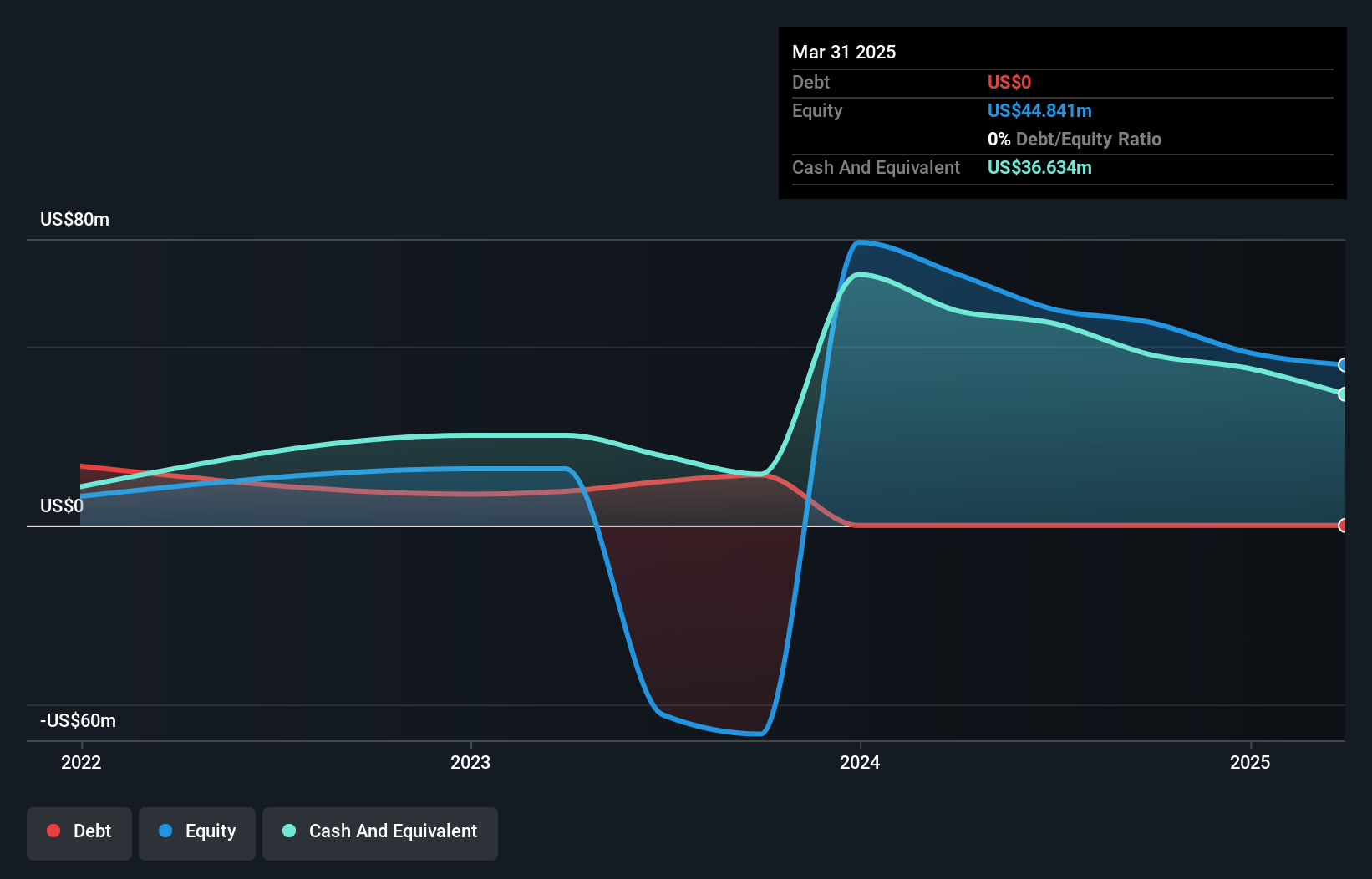

MoneyHero Limited, with a market cap of US$49.57 million, has shown promising financial improvements recently. The company reported third-quarter sales of US$20.94 million and a net income of US$5.72 million, reversing a net loss from the previous year. Despite being unprofitable over the past five years, MoneyHero is debt-free and its short-term assets exceed liabilities significantly. However, shareholder dilution occurred with shares growing by 7.6% in the past year. Recent board changes include appointing Wallace Pai to strengthen governance and strategic oversight as part of its growth strategy in Greater Southeast Asia's personal finance sector.

- Click to explore a detailed breakdown of our findings in MoneyHero's financial health report.

- Examine MoneyHero's earnings growth report to understand how analysts expect it to perform.

Granite Point Mortgage Trust (NYSE:GPMT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Granite Point Mortgage Trust Inc. is a real estate investment trust that focuses on originating, investing in, and managing senior floating-rate commercial mortgage loans and other debt-related commercial real estate investments in the United States, with a market cap of $166.36 million.

Operations: The company's revenue segment is primarily derived from its REIT - Mortgage operations, which reported a revenue of -$140.09 million.

Market Cap: $166.36M

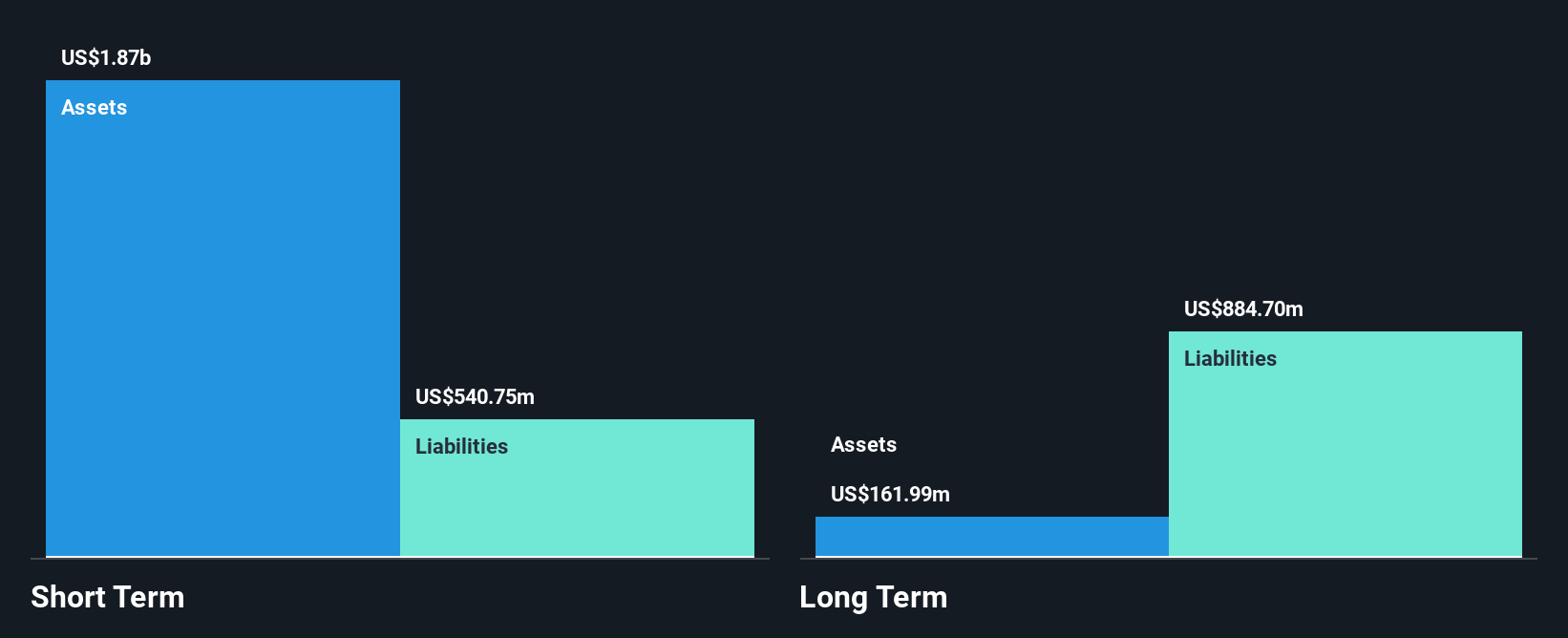

Granite Point Mortgage Trust Inc. faces challenges typical of penny stocks, with a market cap of US$166.36 million and significant financial hurdles. The company is unprofitable, reporting a net loss of US$31.02 million for Q3 2024, and has seen losses escalate over the past five years at an annual rate of 60.8%. Despite having short-term assets exceeding liabilities by a substantial margin, its high net debt to equity ratio (223.6%) raises concerns about financial stability. While the company has completed significant share buybacks recently, its dividend sustainability remains questionable due to insufficient earnings coverage.

- Unlock comprehensive insights into our analysis of Granite Point Mortgage Trust stock in this financial health report.

- Explore Granite Point Mortgage Trust's analyst forecasts in our growth report.

Taking Advantage

- Unlock more gems! Our US Penny Stocks screener has unearthed 704 more companies for you to explore.Click here to unveil our expertly curated list of 707 US Penny Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPMT

Granite Point Mortgage Trust

A real estate investment trust, originates, invests in, and manages senior floating-rate commercial mortgage loans, and other debt and debt-like commercial real estate investments in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives