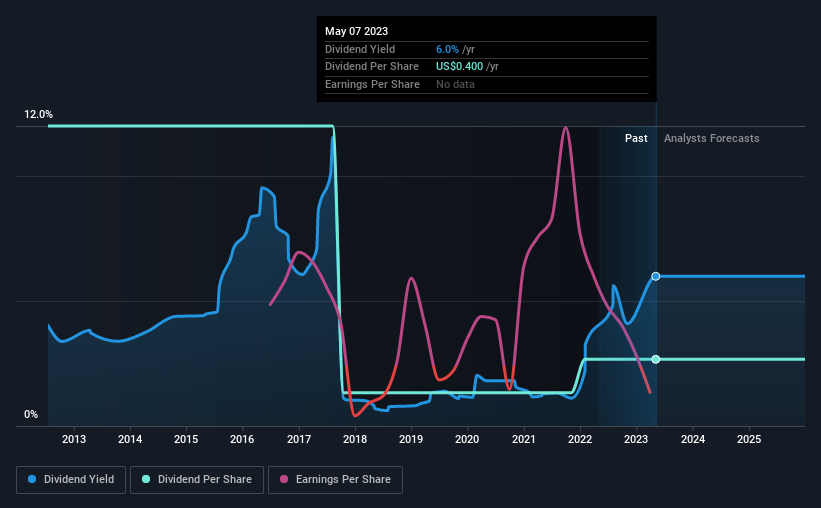

The board of Greenhill & Co., Inc. (NYSE:GHL) has announced that it will pay a dividend on the 21st of June, with investors receiving $0.10 per share. This means the annual payment is 6.0% of the current stock price, which is above the average for the industry.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Greenhill's stock price has reduced by 52% in the last 3 months, which is not ideal for investors and can explain a sharp increase in the dividend yield.

Check out our latest analysis for Greenhill

Greenhill's Distributions May Be Difficult To Sustain

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Even though Greenhill isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. This gives us some comfort about the level of the dividend payments.

Looking forward, earnings per share is forecast to expand by 87.6% over the next year. It's encouraging to see things moving in the right direction, but this probably won't be enough for the company to turn a profit. The positive free cash flows give us some comfort, however, that the dividend could continue to be sustained.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The dividend has gone from an annual total of $1.80 in 2013 to the most recent total annual payment of $0.40. This works out to a decline of approximately 78% over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Company Could Face Some Challenges Growing The Dividend

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. It's encouraging to see that Greenhill has been growing its earnings per share at 26% a year over the past five years. Even though the company is not profitable, it is growing at a solid clip. If the company can turn a profit relatively soon, we can see this becoming a reliable income stock.

Our Thoughts On Greenhill's Dividend

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We don't think Greenhill is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 2 warning signs for Greenhill you should be aware of, and 1 of them can't be ignored. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

If you're looking to trade Greenhill, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:GHL

Greenhill

Greenhill & Co., Inc., an independent investment bank, provides financial and strategic advisory services to corporations, partnerships, institutional investors, and governments worldwide.

Slightly overvalued unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives