- United States

- /

- Consumer Finance

- /

- NYSE:GDOT

A Look at Green Dot’s (GDOT) Valuation After New Stripe Partnership Expands Cash Access Nationwide

Reviewed by Simply Wall St

Green Dot (GDOT) just made headlines by announcing a partnership with Stripe, a move that puts its Arc embedded finance platform front and center. By allowing Stripe Treasury users to add cash at more than 90,000 locations nationwide, Green Dot is directly addressing a growing need among underbanked and cash-reliant communities at a time when traditional branches are becoming harder to find. For investors wondering whether there is actionable upside here, this could mark a meaningful expansion in Green Dot’s long-term addressable market.

This is not the company’s first major initiative of the year. Green Dot has been steadily widening its reach through BaaS deals with partners like Samsung and Credit Sesame and also delivered a sizeable beat in Q2 earnings, driving upward revisions in expectations for 2025 and beyond. The momentum has been clear, with shares up 38% over the past month and gaining 23% compared to last year. This is a stark reversal from the multi-year slide that preceded it. The stock’s pivot higher reflects shifting sentiment around Green Dot’s strategic execution and its ability to tap new revenue sources.

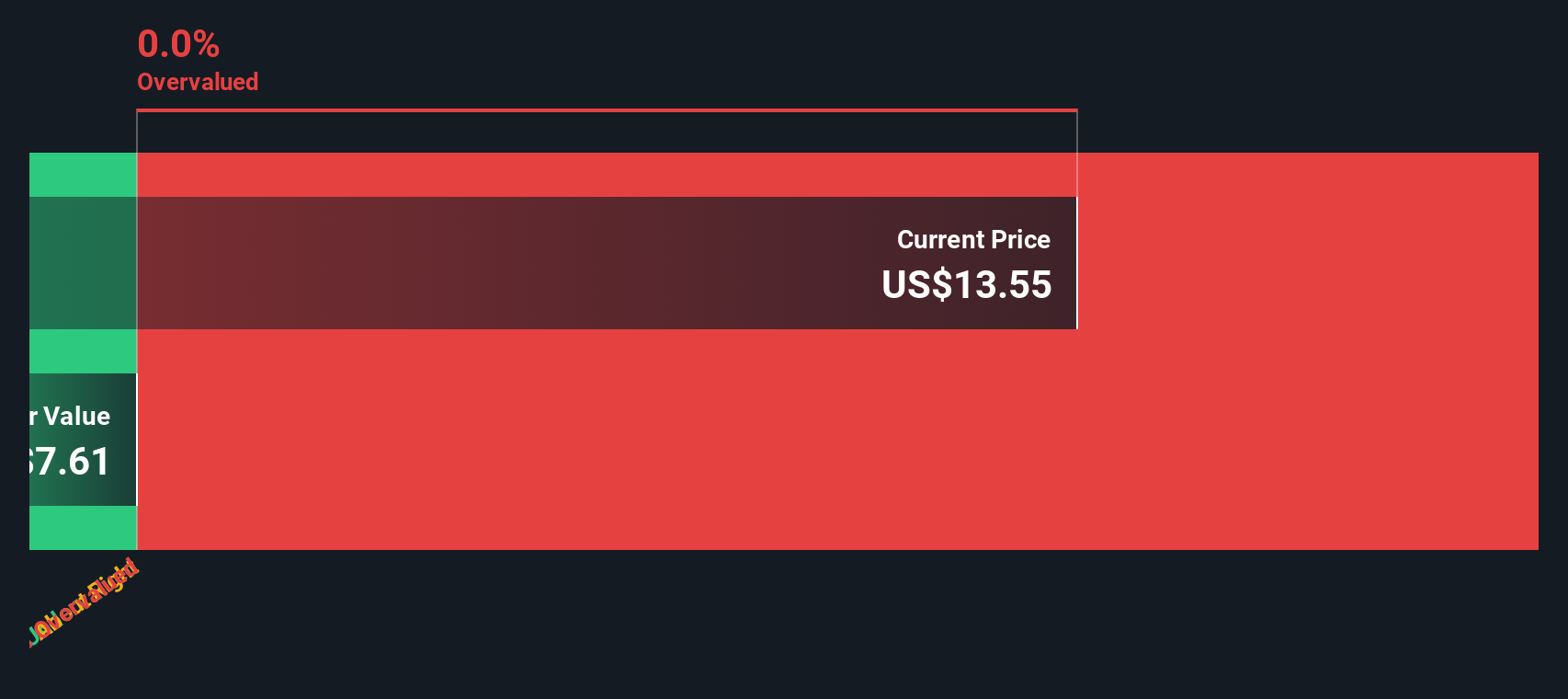

So after a year marked by both recovery and expansion, is Green Dot trading below its true value today, or are investors already pricing in this new phase of growth?

Price-to-Book of 0.8x: Is it justified?

Based on its price-to-book ratio, Green Dot's shares appear undervalued compared to both the US Consumer Finance industry and its peers. The current multiple stands at 0.8x, while the US industry average is 1.3x and peers trade at an average of 6.3x.

The price-to-book ratio measures how much investors are willing to pay for a company's net assets. For diversified financial companies like Green Dot, this metric is particularly relevant because it emphasizes the value of tangible assets and underlying book equity. This is in contrast to metrics focused on profits, which may be more volatile due to market or operational fluctuations.

As a result, investors may be underappreciating Green Dot's potential value or future growth prospects, especially given recent business momentum. If the company’s turnaround continues and revenue growth remains strong, the market could eventually recalibrate the valuation upward.

Result: Fair Value of $18.00 (UNDERVALUED)

See our latest analysis for Green Dot.However, slower revenue growth or continued net losses could challenge the view that Green Dot is meaningfully undervalued at current levels.

Find out about the key risks to this Green Dot narrative.Another View

Looking at things from another angle, our DCF model cannot be fully applied because of limited data. This casts some uncertainty on whether the recent market optimism is justified or if the current pricing is fair. Will more clarity emerge as the business evolves?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Green Dot to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Green Dot Narrative

If you see things differently or want to dig into the numbers yourself, it only takes a few minutes to create your own view and narrative. You can always Do it your way.

A great starting point for your Green Dot research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let today’s opportunity be your only one. Uncover more potential winners with these unique angles; your next smart move could be just a click away.

- Boost your income by searching for companies offering steady returns through dividend stocks with yields > 3%. This highlights stocks with yields that outpace the market average.

- Capitalize on the fast-growing world of artificial intelligence with AI penny stocks. Here you can spot companies pushing the boundaries of innovation and real-world AI solutions.

- Find exceptional bargains by targeting opportunities identified in undervalued stocks based on cash flows. This focuses on stocks trading below their intrinsic value based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GDOT

Green Dot

A financial technology and registered bank holding company, provides various financial services to consumers and businesses in the United States.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives