- United States

- /

- Diversified Financial

- /

- NYSE:GB

Global Blue Group Holding AG's (NYSE:GB) Shares Leap 27% Yet They're Still Not Telling The Full Story

Global Blue Group Holding AG (NYSE:GB) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 4.5% isn't as attractive.

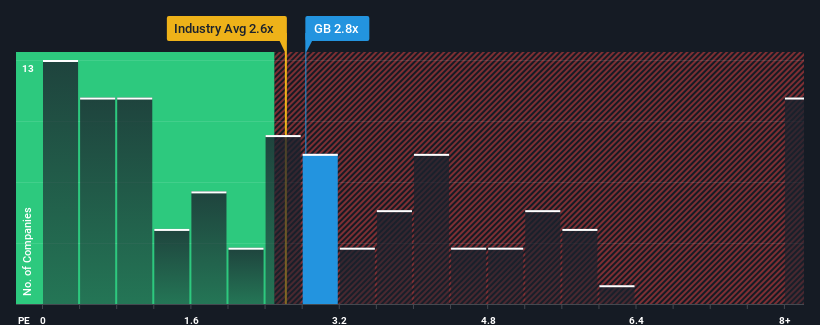

Even after such a large jump in price, it's still not a stretch to say that Global Blue Group Holding's price-to-sales (or "P/S") ratio of 2.8x right now seems quite "middle-of-the-road" compared to the Diversified Financial industry in the United States, where the median P/S ratio is around 2.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Global Blue Group Holding

How Has Global Blue Group Holding Performed Recently?

With revenue growth that's superior to most other companies of late, Global Blue Group Holding has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Global Blue Group Holding.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Global Blue Group Holding's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 27%. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 14% as estimated by the only analyst watching the company. That's shaping up to be materially higher than the 4.6% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Global Blue Group Holding's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Global Blue Group Holding appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Global Blue Group Holding's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 4 warning signs for Global Blue Group Holding (2 make us uncomfortable!) that we have uncovered.

If you're unsure about the strength of Global Blue Group Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:GB

Global Blue Group Holding

Provides technology and payments solutions for merchants, acquirers, customs, authorities, travelers, shoppers, and guests in Europe, the Asia Pacific, and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives