- United States

- /

- Capital Markets

- /

- NYSE:GAM

A Look at General American Investors Company’s Valuation Following New Board Appointment

Reviewed by Simply Wall St

Price-to-Earnings of 7.5x: Is it justified?

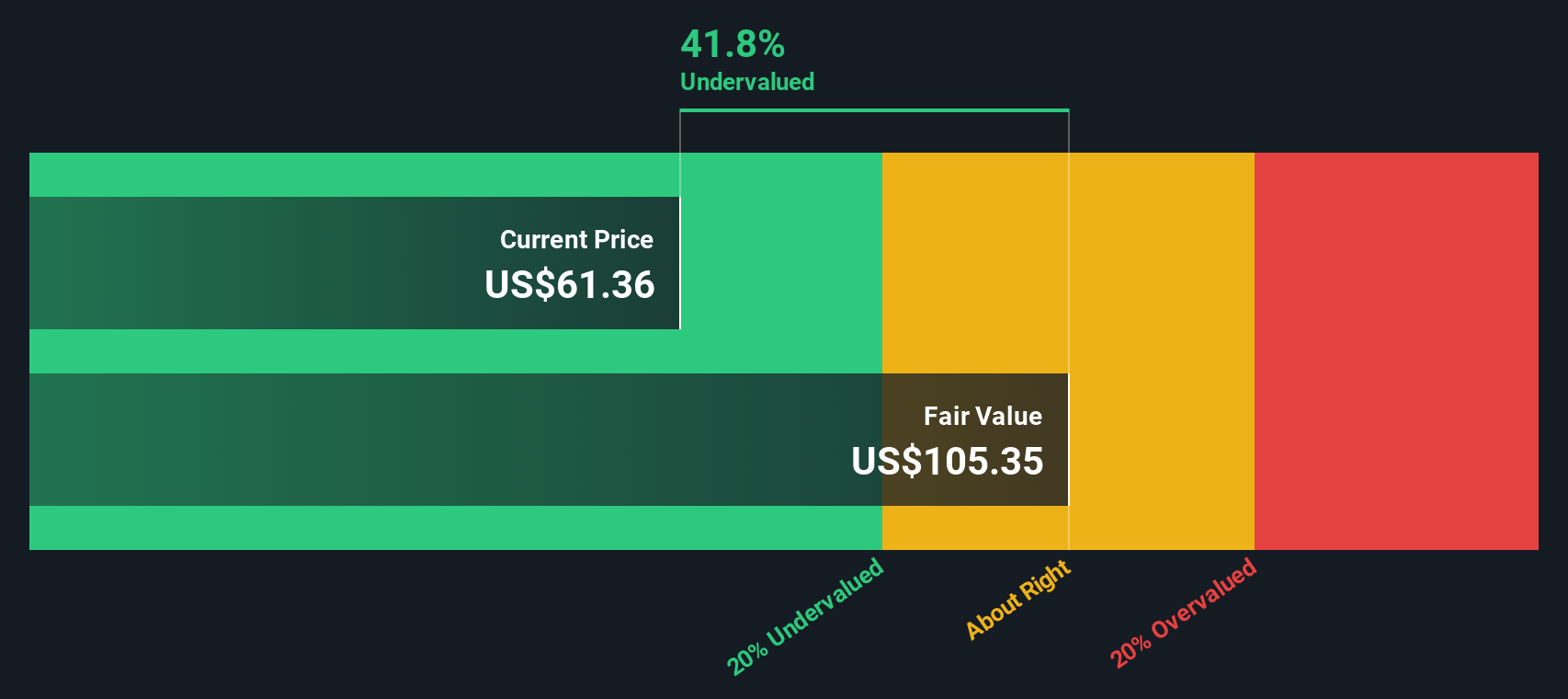

General American Investors Company currently trades at a price-to-earnings (P/E) ratio of 7.5x, which is significantly below both the US Capital Markets industry average of 27.2x and the average of its direct peers at 30.5x. This places GAM firmly in undervalued territory based on this traditional valuation metric.

The price-to-earnings multiple measures how much investors are willing to pay for each dollar of a company's earnings. In the financial sector, this ratio is particularly watched because it summarizes market expectations for growth and profitability against the company's actual earnings power.

A P/E this much lower than industry norms suggests the market may be underpricing GAM's earnings potential, possibly overlooking drivers such as the board's experience and recent profitability improvements. However, valuations like this often invite closer inspection into reasons for the gap, whether due to one-off accounting gains, volatile profits, or a lack of consistent growth.

Result: Fair Value of $105.69 (UNDERVALUED)

See our latest analysis for General American Investors Company.However, persistent questions over GAM's revenue growth and the lack of recent financial disclosures could quickly dampen market optimism if these issues are not addressed soon.

Find out about the key risks to this General American Investors Company narrative.Another View: Discounted Cash Flow Offers a Second Opinion

Turning to our DCF model for a fresh perspective, the results align with the value suggestion from the earnings ratio. This reinforces the case that shares may still be trading beneath their true worth. Could both approaches be overlooking a key risk, or is an opportunity hiding in plain sight?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own General American Investors Company Narrative

If you want a different perspective, or enjoy crunching the numbers yourself, you can shape your own narrative for General American Investors Company in just minutes. Do it your way

A great starting point for your General American Investors Company research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more smart investment moves?

Set yourself up for the next great opportunity. Use the Simply Wall Street Screener to hunt for stocks with the tailwinds that matter most, so you never miss what could be your next big winner.

- Boost your search for stability and income potential by scanning for businesses offering dividend stocks with yields > 3% and see which yield leaders might fit your strategy.

- Spot breakout companies riding the artificial intelligence wave by analyzing firms at the forefront of innovation through our AI penny stocks picks.

- Target value plays with growth ahead: zero in on stocks trading below their fair value using our market-tested undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GAM

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives