- United States

- /

- Diversified Financial

- /

- NYSE:FOUR

Is Leadership Consolidation at Shift4 Payments (FOUR) Altering the Investment Case for the Stock?

Reviewed by Sasha Jovanovic

- Earlier this month, Shift4 Payments announced that founder Jared Isaacman resigned as Executive Chairman, with CEO Taylor Lauber stepping up as Chairman of the Board, consolidating leadership roles at the top of the company.

- This governance shift places both operational and boardroom control in Lauber’s hands, which could influence how Shift4 balances growth ambitions with risk management and capital allocation decisions.

- We’ll now examine how consolidating the CEO and Chairman roles might alter Shift4’s acquisition-led expansion and buyback-focused investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Shift4 Payments Investment Narrative Recap

To own Shift4, you need to believe its acquisition driven expansion and exposure to hospitality and restaurants can still create value despite recent share price weakness and higher leverage. The consolidation of CEO and Chairman roles does not materially change the near term focus on integrating Global Blue and Smartpay as the key catalyst, while the biggest current risk, in my view, remains financial flexibility given rising debt and a more complex capital structure.

The new US$1,000,000,000 share repurchase program, announced alongside Q3 2025 results, ties directly into this leadership change, because it sits at the intersection of capital allocation, shareholder returns and balance sheet risk. How aggressively Shift4 executes on buybacks while funding large acquisitions and servicing euro and dollar notes will likely shape how the market weighs its growth potential against concerns about leverage and earnings volatility.

Yet behind the buybacks and leadership changes, investors should also be aware of how rising debt and mandatory convertible preferred stock could...

Read the full narrative on Shift4 Payments (it's free!)

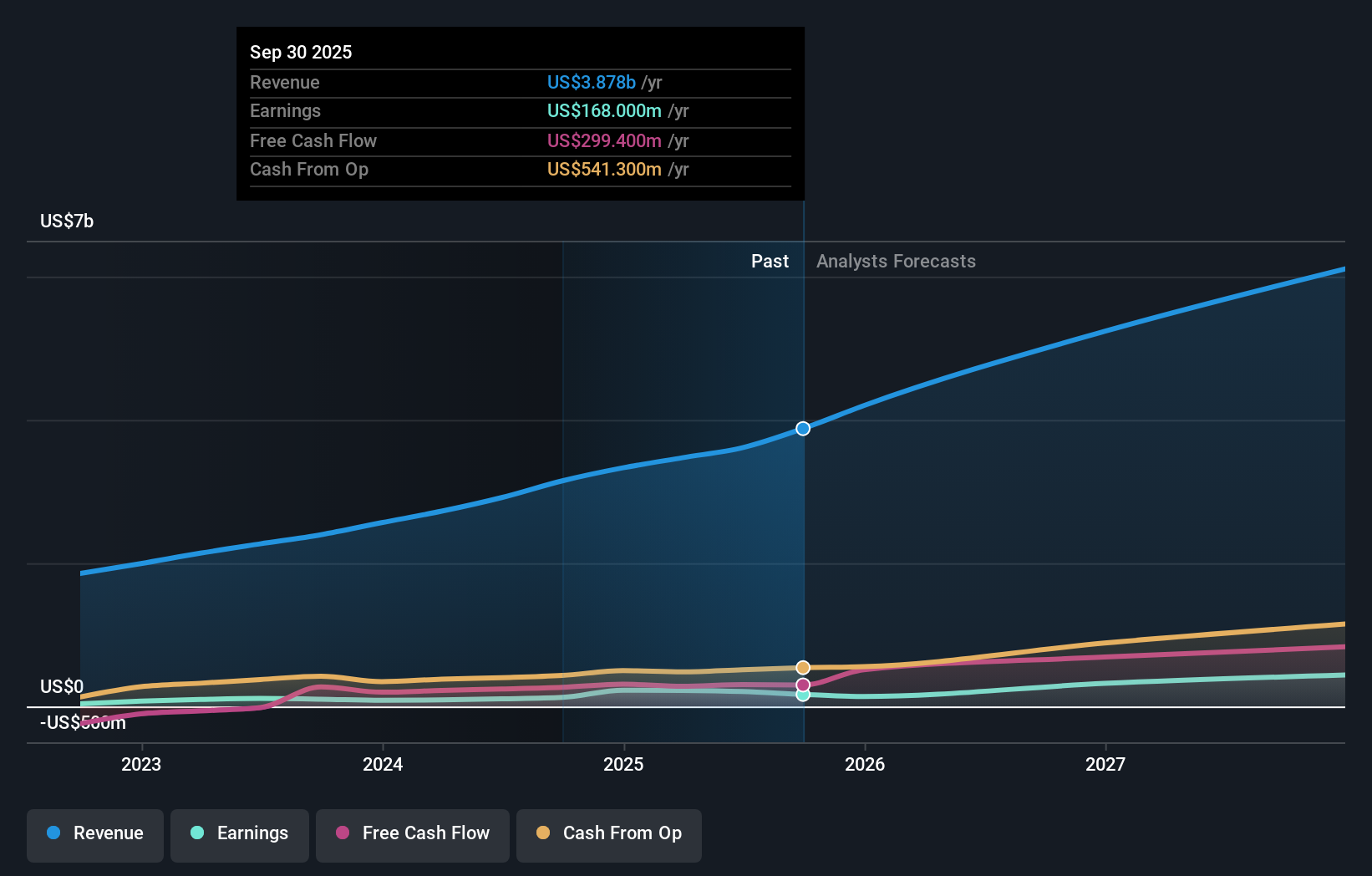

Shift4 Payments' narrative projects $7.0 billion revenue and $613.9 million earnings by 2028. This requires 24.8% yearly revenue growth and about a $406 million earnings increase from $207.7 million today.

Uncover how Shift4 Payments' forecasts yield a $95.86 fair value, a 47% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community currently value Shift4 between US$47.02 and US$105.99 per share, highlighting very different views on its potential. When you set those opinions against the company’s reliance on debt funded acquisitions and complex capital structure, it becomes even more important to compare several perspectives before deciding how comfortable you are with the balance of growth and risk.

Explore 5 other fair value estimates on Shift4 Payments - why the stock might be worth 28% less than the current price!

Build Your Own Shift4 Payments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shift4 Payments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Shift4 Payments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shift4 Payments' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 10 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FOUR

Shift4 Payments

Engages in the provision of software and payment processing solutions in the United States and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion