- United States

- /

- Diversified Financial

- /

- NYSE:FIS

Will Smart Basket’s Personalized Rewards and Multi-Payment Flexibility Transform FIS’s (FIS) Investment Narrative?

Reviewed by Sasha Jovanovic

- FIS recently announced Smart Basket, an upcoming checkout solution designed to use real-time, item-level adjudication to personalize rewards and payment methods, promising to streamline shopping for consumers and enable multi-payment flexibility, including healthcare accounts.

- This initiative highlights FIS’s ambition to differentiate its payments ecosystem by integrating real-time payments, loyalty, and spend filtering technologies, with the potential to drive deeper customer engagement and partner loyalty across the broader commerce and financial landscape.

- We'll explore how Smart Basket's focus on customized rewards and payment optimization could influence FIS's investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Fidelity National Information Services Investment Narrative Recap

To be a shareholder in Fidelity National Information Services (FIS), you need to believe the company can remain a central player in payments technology while defending its market share against rising fintech competition and ongoing integration hurdles. The recent Smart Basket announcement underscores FIS's push to create differentiated payments solutions and drive engagement, but it does not materially alter near-term catalysts or mitigate the most pressing risks such as margin pressure from disruptors and the complexity of integrating new products across a broad client base.

Among recent announcements, the launch of FIS Neural Treasury is most relevant alongside Smart Basket, as both initiatives showcase FIS’s commitment to delivering AI-driven automation in payments and treasury services, an area tied closely to its ability to stay competitive and win new clients as digital transformation accelerates.

However, investors should also be aware that despite technology investments, FIS’s heavy reliance on large financial clients leaves it vulnerable if those institutions begin shifting to other providers or new financial models...

Read the full narrative on Fidelity National Information Services (it's free!)

Fidelity National Information Services is projected to reach $11.7 billion in revenue and $2.4 billion in earnings by 2028. This outlook implies a 4.3% annual revenue growth rate and a substantial $2.24 billion increase in earnings from the current $158 million.

Uncover how Fidelity National Information Services' forecasts yield a $84.39 fair value, a 26% upside to its current price.

Exploring Other Perspectives

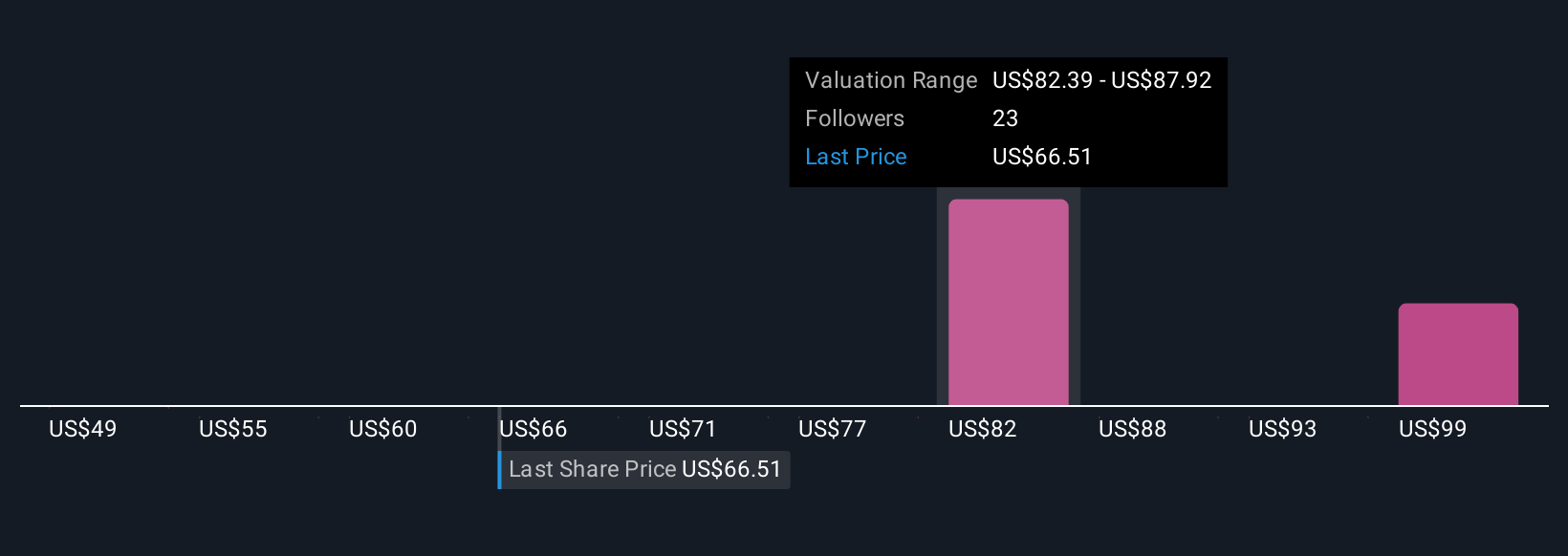

Three Simply Wall St Community fair value estimates for FIS range from US$49.20 to US$105.41, reflecting diverse views on future earnings growth. Many highlight the importance of accelerating digital solutions as a key factor shaping FIS’s longer-term performance, so consider the full spectrum of perspectives before forming your outlook.

Explore 3 other fair value estimates on Fidelity National Information Services - why the stock might be worth as much as 58% more than the current price!

Build Your Own Fidelity National Information Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fidelity National Information Services research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Fidelity National Information Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fidelity National Information Services' overall financial health at a glance.

No Opportunity In Fidelity National Information Services?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIS

Fidelity National Information Services

Fidelity National Information Services, Inc.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives