- United States

- /

- Diversified Financial

- /

- NYSE:FIS

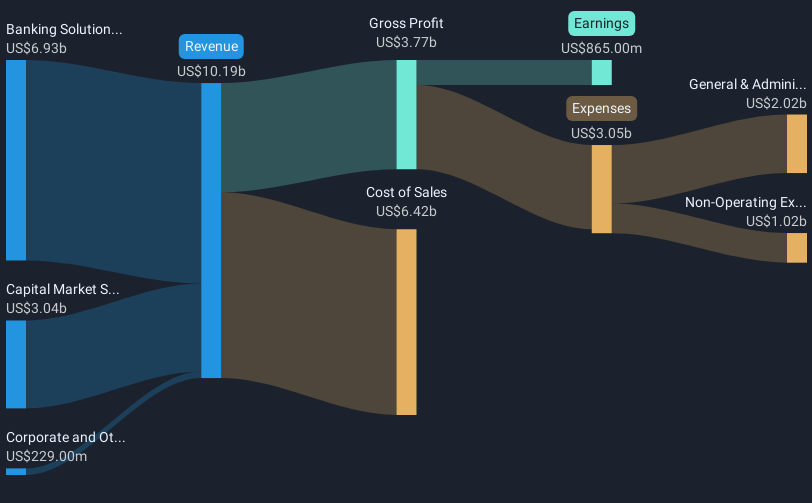

Fidelity National Information Services (NYSE:FIS) Reports Q1 Earnings US$77 Million Amid New Revenue Guidance

Reviewed by Simply Wall St

Fidelity National Information Services (NYSE:FIS) recently experienced a 12% share price increase over the last month, despite reporting a significant drop in net income for Q1 2025. The company's earnings report revealed an increase in sales, alongside the introduction of optimistic revenue targets for the upcoming quarters. These strategic outlooks, coupled with the latest dividend affirmation and innovative product launches, such as the Money Movement Hub, likely added weight to this price movement. However, this significant jump occurred amid a broader market that has been climbing steadily, with the Dow Jones and S&P 500 also gaining ground.

The recent developments at Fidelity National Information Services could bolster its narrative of positioning itself as a leader in digital payments and lending. The introduction of innovative products like the Money Movement Hub and optimistic future revenue targets are aligned with the company's focus on high-margin recurring streams and strategic partnerships. As these initiatives unfold, they are anticipated to positively impact future revenue and earnings forecasts, supporting analysts' assumptions of a 4.7% annual revenue growth over the next three years. Despite high competition and potential implementation challenges, the reaffirmation of dividends shows commitment to shareholder returns, potentially improving investor confidence.

Over the longer-term, FIS shares posted a total return of 13.29% last year. This demonstrates a notable improvement compared to the immediate past where the one-year performance outpaced the broader US market, which yielded a 9.3% return. However, compared to the US Diversified Financial industry, where returns reached 23.5% over the past year, the performance was less competitive. Nevertheless, the recent share price rise of 12% in April positions the company well relative to its consensus price target of US$87.28, which is 9.9% higher than the current share price of US$78.63. This indicates some room for appreciation, pending successful execution of its initiatives and favorable market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Fidelity National Information Services, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIS

Fidelity National Information Services

Fidelity National Information Services, Inc.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives