- United States

- /

- Diversified Financial

- /

- NYSE:FIS

Fidelity National Information Services (NYSE:FIS) Powers ATLAS With Advanced Commercial Loan Solution

Reviewed by Simply Wall St

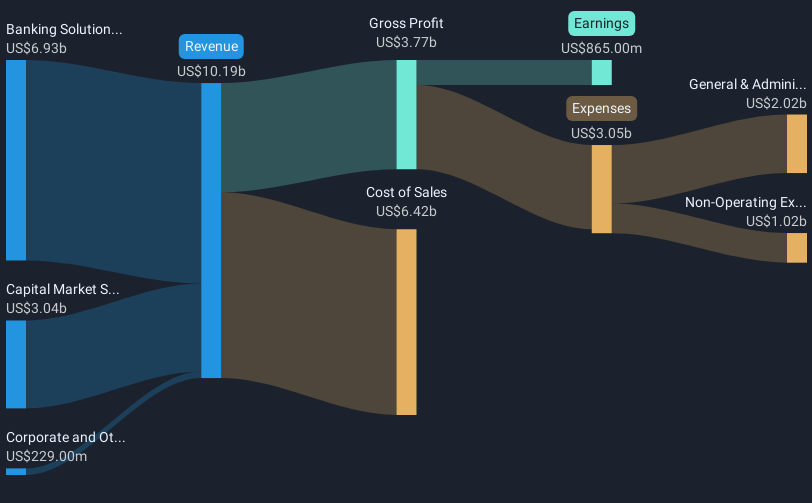

Fidelity National Information Services (NYSE:FIS) announced that ATLAS SP Partners had chosen its Commercial Loan Servicing solution to enhance loan lifecycle processing, an event that may have influenced the company's 15% price increase over the last quarter. This aligns with market trends reflecting a 13% rise over the past year, suggesting FIS's recent client agreements and product innovations, such as partnerships with MUFG Securities and Letskipp Ltd., supported investor confidence. The company's strategic buybacks and solid dividend declaration further bolstered shareholder returns, aligning with its positioning as a key player in technology solutions for lending.

The recent adoption of Fidelity National Information Services' (FIS) Commercial Loan Servicing solution by ATLAS SP Partners is likely to bolster the company's client roster, which may influence both revenue and earnings projections. This partnership aligns with FIS's focus on strengthening banking solutions and expanding into corporate markets, potentially driving further growth. Given the company's ongoing strategic acquisitions and divestitures, revenue and earnings forecasts might reflect increased opportunities and enhanced profit margins. Such developments could support analysts' expectations of annual revenue growth of 4.2% over the next three years, with earnings anticipated to reach US$2.1 billion by 2028. However, execution risks remain, particularly in integration and realization of projected synergies.

FIS shares have increased by a substantial amount over the past quarter, though it's essential to consider the company's total shareholder return of 7.36% over the last year. This performance, while positive, underperformed the US Diversified Financial industry's 22% rise during the same period. Despite recent price movements showing a discounted share price compared to the consensus target of US$87.38, FIS's long-term potential may be undervalued if it continues to enhance its banking and treasury capabilities. Analysts project a need for the company to trade at a price-to-earnings ratio (PE) of 23.6x based on 2028 earnings projections to justify the target price, compared to its current high PE of 46.1x, signaling a potentially significant valuation adjustment moving forward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIS

Fidelity National Information Services

Fidelity National Information Services, Inc.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives