- United States

- /

- Diversified Financial

- /

- NYSE:FIS

A Fresh Look at FIS’s Valuation After Launching New Automated Financial Platforms

Reviewed by Simply Wall St

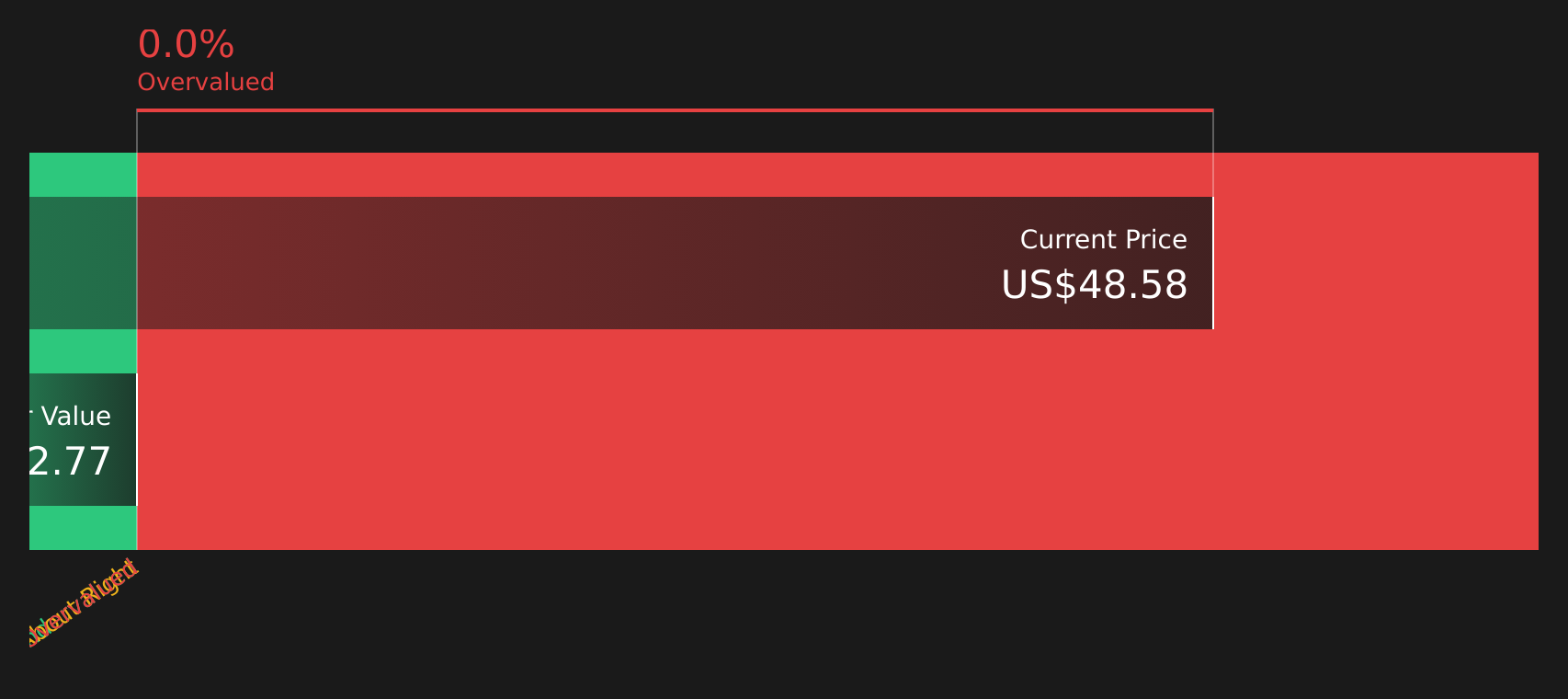

Most Popular Narrative: 16.2% Undervalued

According to community narrative, Fidelity National Information Services is considered significantly undervalued based on robust growth expectations, margin improvement, and digital payments momentum. Analysts believe the company’s future earnings, operational streamlining, and global reach could drive meaningful upside from current prices.

"Increasing client demand for cloud-based and AI-powered fintech solutions, such as the launch of TreasuryGPT and Banker Assist, is allowing FIS to upsell higher-value, 'stickier' products to financial institutions modernizing their operations. This should support long-term revenue expansion and improved net margins."

Curious what’s fueling this bullish view? The narrative points to a leap in profitability, a future-oriented profit multiple, and sector-defining digital innovation. This is not your typical value case. Explore the full narrative to discover what kind of earnings improvements and growth assumptions are shaping this stock’s potential price.

Result: Fair Value of $85.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rapid fintech disruption and challenges from integrating acquisitions could threaten FIS's earnings growth and put pressure on future margins, potentially undermining bullish expectations.

Find out about the key risks to this Fidelity National Information Services narrative.Another View: Valuing FIS from a Different Angle

Not everyone sees the same opportunity. Looking at FIS through the lens of our DCF model instead of market-based ratios, the stock is evaluated as undervalued. However, is it really that simple?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Fidelity National Information Services Narrative

If you see things differently or want to dive deeper on your own terms, you can easily craft your own narrative in just a few minutes. So why not do it your way?

A great starting point for your Fidelity National Information Services research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Angles?

Do not let your next great opportunity pass by. Broaden your horizon and gain an edge with our powerful Screener tools, designed to highlight potential in today’s market. Sharpen your investment strategy and stay ahead of trends with ideas tailored to different interests.

- Tap into future growth by spotting healthcare leaders transforming patient care with the latest breakthroughs in artificial intelligence. Use the healthcare AI stocks tool: healthcare AI stocks.

- Uncover quality picks for your income portfolio by targeting companies with consistent yields above 3 percent. Find them through our high-yield dividend finder: dividend stocks with yields > 3%.

- Seize undervalued gems by searching for stocks flagged as being priced below their intrinsic value using our cash flow opportunity screener: undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIS

Fidelity National Information Services

Fidelity National Information Services, Inc.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives