- United States

- /

- Diversified Financial

- /

- NYSE:FI

Leadership Transitions at Fiserv (NYSE:FI) as Michael Lyons Becomes New CEO

Reviewed by Simply Wall St

Fiserv (NYSE:FI) recently announced several executive changes, with Michael P. Lyons stepping in as the new CEO following Frank J. Bisignano's resignation. Despite these shifts, the company's share price remained relatively flat over the past week. This stability occurred amidst broader market trends where major indices had mixed performances, with the Dow Jones and S&P 500 experiencing slight gains. Meanwhile, anticipations of the Federal Reserve's upcoming interest rate decision and ongoing U.S.-China trade discussions influenced general investor sentiment. The executive transitions at Fiserv added context to a week of stable movements in the company's share price.

Be aware that Fiserv is showing 2 risks in our investment analysis.

The recent executive changes at Fiserv, with Michael P. Lyons taking over as CEO, are unlikely to cause significant immediate shifts in the company's strategic direction or financial forecasts. Over the past three years, Fiserv's total shareholder return, including dividends, reached 99.34%, reflecting its long-term resilience and attractiveness to investors. However, the one-year total return exceeded the US Diversified Financial industry benchmark, which returned 19.6% over the same period. This superior performance underscores Fiserv's ability to deliver value despite market fluctuations.

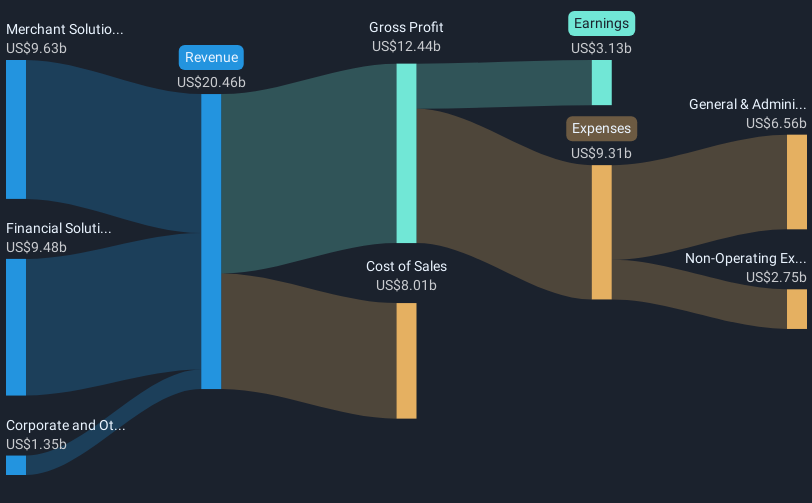

The market's focus will likely shift towards the effectiveness of Lyons in executing the company's ongoing international expansion and acquisitions, such as the integration of Payfare in Canada. These initiatives are pivotal to Fiserv's revenue growth, projected to grow by 6% annually. Moreover, earnings are anticipated to expand by 16.4%, driving expectations for a robust financial trajectory. However, any missteps in these strategic moves could impact revenue and earnings forecasts.

At US$185.29, Fiserv's share price remains below the consensus analyst target of US$226.66, representing an 18.3% potential upside. This discrepancy indicates that investor sentiment might be cautious, given the company's relatively high price-to-earnings ratio compared to its industry. While the current news hasn't substantially shifted share prices, investors should monitor how these leadership transitions and strategic initiatives affect Fiserv’s financial health and alignment with analysts' expectations.

Understand Fiserv's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FI

Fiserv

Provides payments and financial services technology solutions in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives