- United States

- /

- Diversified Financial

- /

- NYSE:FI

Fiserv (FI): Assessing Valuation as North Dakota’s First State-Backed Stablecoin Launches

Reviewed by Simply Wall St

Fiserv (FI) is making headlines after teaming up with the Bank of North Dakota to introduce the Roughrider coin, representing the state’s first move into stablecoin territory. This partnership highlights Fiserv’s effort to position itself at the center of digital currency adoption for local banks and merchants.

See our latest analysis for Fiserv.

This debut of North Dakota’s first state-backed stablecoin comes as Fiserv’s share price has seen some pressure this year, with a 1-year total shareholder return of -36.9% and a year-to-date share price decline of nearly 39%. While recent news could help sentiment stabilize, momentum remains muted in the short term as investors weigh the company’s shifting risk profile and long-term digital strategy.

If you’re curious about where the next industry movers might be found, now is a perfect time to broaden your search and discover fast growing stocks with high insider ownership

With Fiserv shares trading at a notable discount to analyst price targets amid solid revenue and net income growth, the key question now is whether there is real value on offer or if the market has fully priced in future upside.

Most Popular Narrative: 29% Undervalued

Fiserv’s most widely followed valuation narrative places its fair value at $178.38, which is notably above the last close of $126.07. This suggests that, in the eyes of those tracking the company’s long-term growth drivers and digital strategy, the market may be underappreciating future upside.

Fiserv is positioned to benefit from the continued global shift toward digital payments. This is evidenced by international expansion of its Clover platform into new geographies, including Brazil, Mexico, Australia, Singapore, and Europe. The company has also established significant partnerships such as TD Bank Canada. These initiatives are expected to drive accelerated revenue growth and higher long-term earnings by increasing payment processing volumes and expanding addressable markets.

Curious what fuels that bullish narrative? The mathematical backbone includes ambitious calls for rapid profit margins and analyst projections that may surprise you. Want to know if global expansion and software innovation justify such a premium? Dive deeper and discover why some believe Fiserv could be dramatically mispriced at current levels.

Result: Fair Value of $178.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in new product launches and persistent competitive pressure could undermine Fiserv’s recovery story, especially if recent guidance cuts turn out to be ongoing trends.

Find out about the key risks to this Fiserv narrative.

Another View: What Do Market Multiples Tell Us?

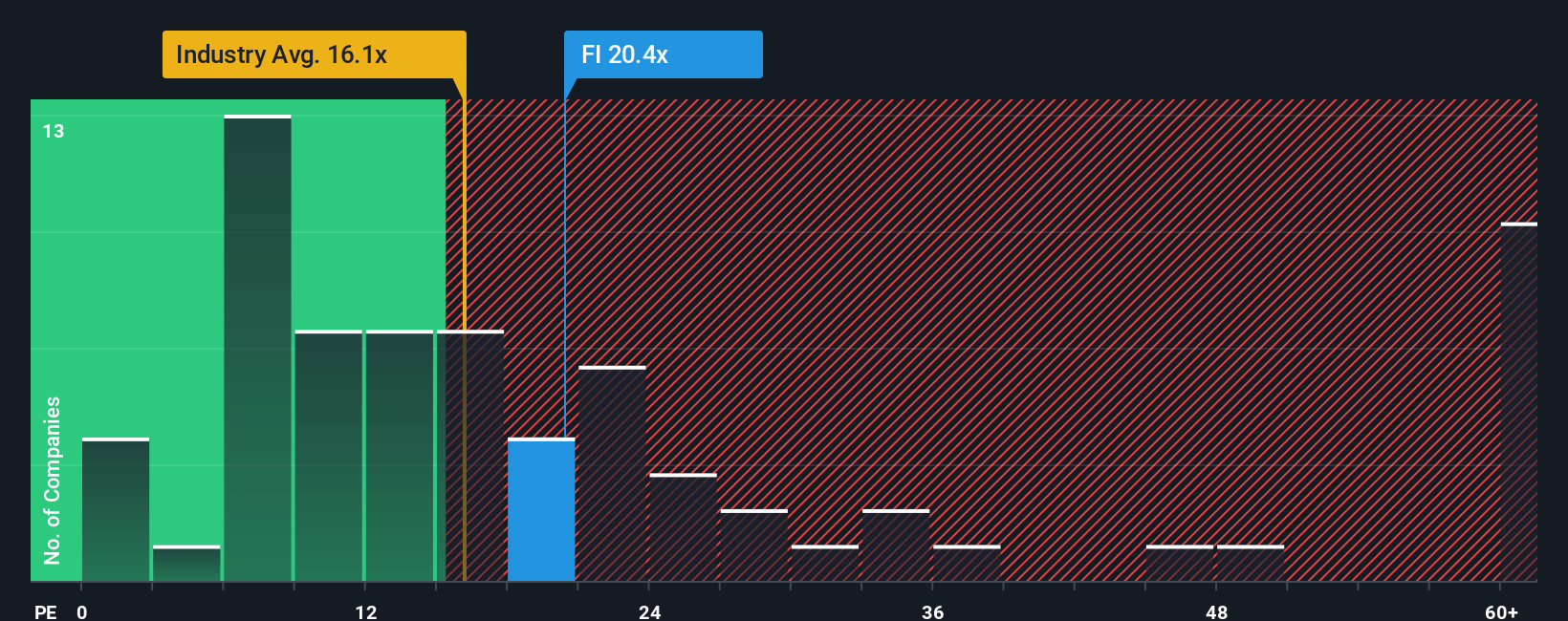

Looking beyond the fair value estimate, Fiserv’s valuation based on price-to-earnings sits at 20.3 times earnings. This is notably above the US Diversified Financial industry average of 16.5, and even pricier than its closest peers. Yet, the fair ratio for the stock is calculated at 21.1, a mark the market could drift toward if sentiment shifts. Does this premium signal lingering risk, or untapped opportunity for patient investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fiserv Narrative

If you see things differently or want a deeper look at the data, it takes less than three minutes to shape your own perspective, so why not Do it your way

A great starting point for your Fiserv research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why limit yourself to just one opportunity? Leverage Simply Wall Street’s powerful screener tools now to find stocks with explosive potential before everyone else does.

- Capture impressive yields and consistent payouts when you browse these 17 dividend stocks with yields > 3% offering strong income streams and robust fundamentals.

- Get ahead of the curve by targeting revolutionary breakthroughs shaping healthcare’s future. Jump into these 33 healthcare AI stocks accelerating innovation in diagnostics, patient care, and medical technology.

- Seize value others are missing by zeroing in on these 876 undervalued stocks based on cash flows that trade at a discount despite significant upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FI

Fiserv

Provides payments and financial services technology solutions in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives