- United States

- /

- Capital Markets

- /

- NYSE:FDS

Is FactSet Research Systems a Bargain After 39% Drop in 2025?

Reviewed by Bailey Pemberton

If you’ve been watching FactSet Research Systems recently and wondering if now’s the right time to make a move, you’re not alone. There’s a lot to unpack with this stock, especially as its story shifts from steady achiever to a more complex proposition for investors. Over the past week, shares have seen a mild uptick of 2.1%, but zoom out and it’s a different picture. Year to date, FactSet’s stock has tumbled by 39.2%, and it’s still sitting 36.9% lower than where it was a year ago. That kind of retreat understandably gets people asking whether this is finally a bargain, or if there’s more pain ahead.

Some of this weakness can be traced back to shifting investor appetites for financial data and analytics providers, especially as questions have cropped up around how FactSet will continue differentiating itself in a crowded landscape. Recent product rollouts and partnerships are encouraging, signaling the company isn’t standing still. Still, longer-term holders are understandably focusing on growth potential, innovation, and how Wall Street is recalibrating its risk outlook for the sector.

So how does FactSet measure up on value? Our current assessment gives it a valuation score of 3 out of 6, a sign it’s undervalued on half of the tests we use, but not a slam-dunk value pick just yet. Of course, we know that a simple checklist only scratches the surface. In the next section, let’s take a closer look at the valuation methods themselves, and at the end, I’ll share an even sharper lens to help you understand FactSet’s true worth.

Why FactSet Research Systems is lagging behind its peers

Approach 1: FactSet Research Systems Excess Returns Analysis

The Excess Returns model assesses how much value a company creates above and beyond the required return for its equity investors. It focuses on Return on Equity and how efficiently a business puts its capital to work, rewarding companies that consistently generate profits exceeding their cost of equity.

For FactSet Research Systems, several key data points stand out according to this approach:

- Book Value: $57.91 per share

- Stable EPS: $19.84 per share (Source: Weighted future Return on Equity estimates from 4 analysts.)

- Cost of Equity: $5.93 per share

- Excess Return: $13.91 per share

- Average Return on Equity: 28.15%

- Stable Book Value: $70.49 per share (Source: Weighted future Book Value estimates from 6 analysts.)

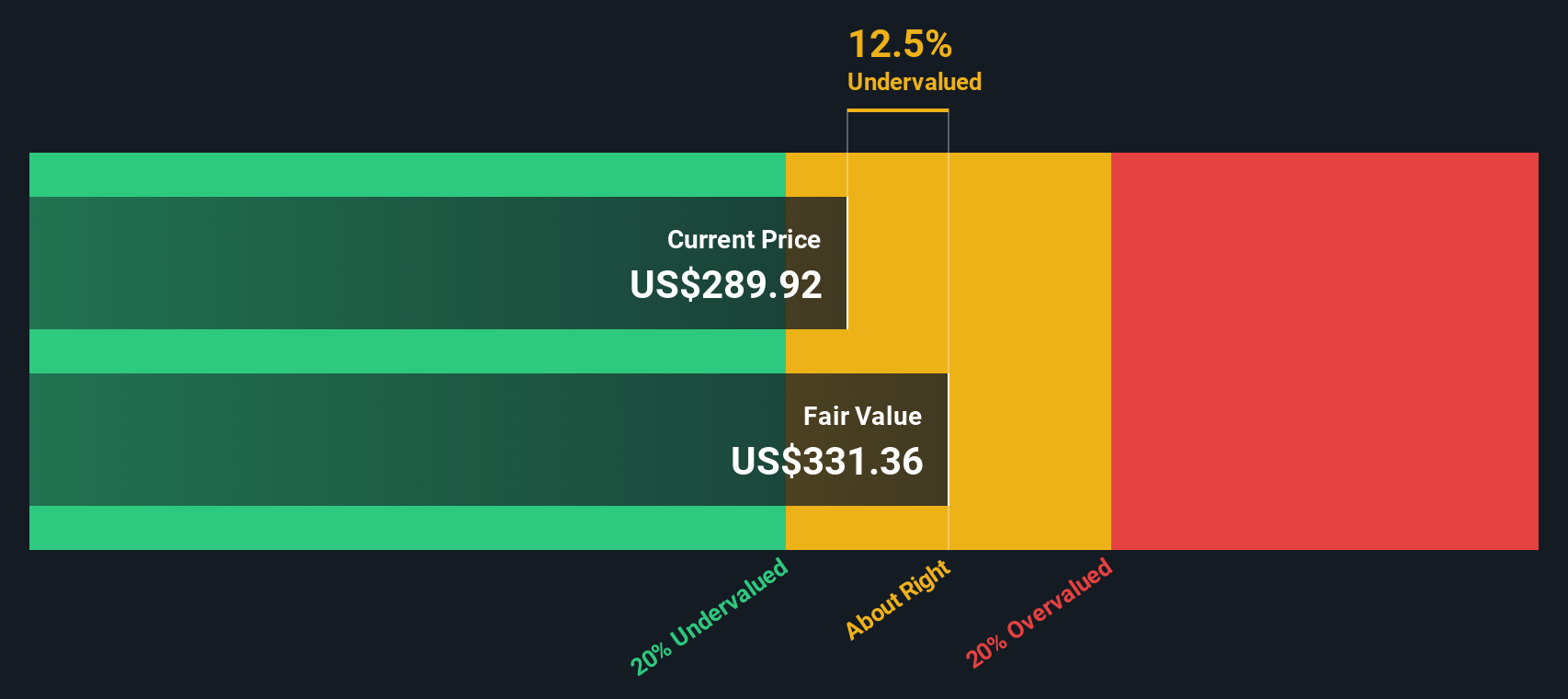

This model estimates FactSet's intrinsic value at $331.36 per share. Compared to the recent share price, this reflects a 12.5% discount, meaning the stock is currently trading below what the model suggests it is worth. For long-term investors, this undervaluation indicates a potential opportunity, especially when combined with FactSet's ability to consistently generate strong returns on its equity base.

Result: UNDERVALUED

Our Excess Returns analysis suggests FactSet Research Systems is undervalued by 12.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: FactSet Research Systems Price vs Earnings

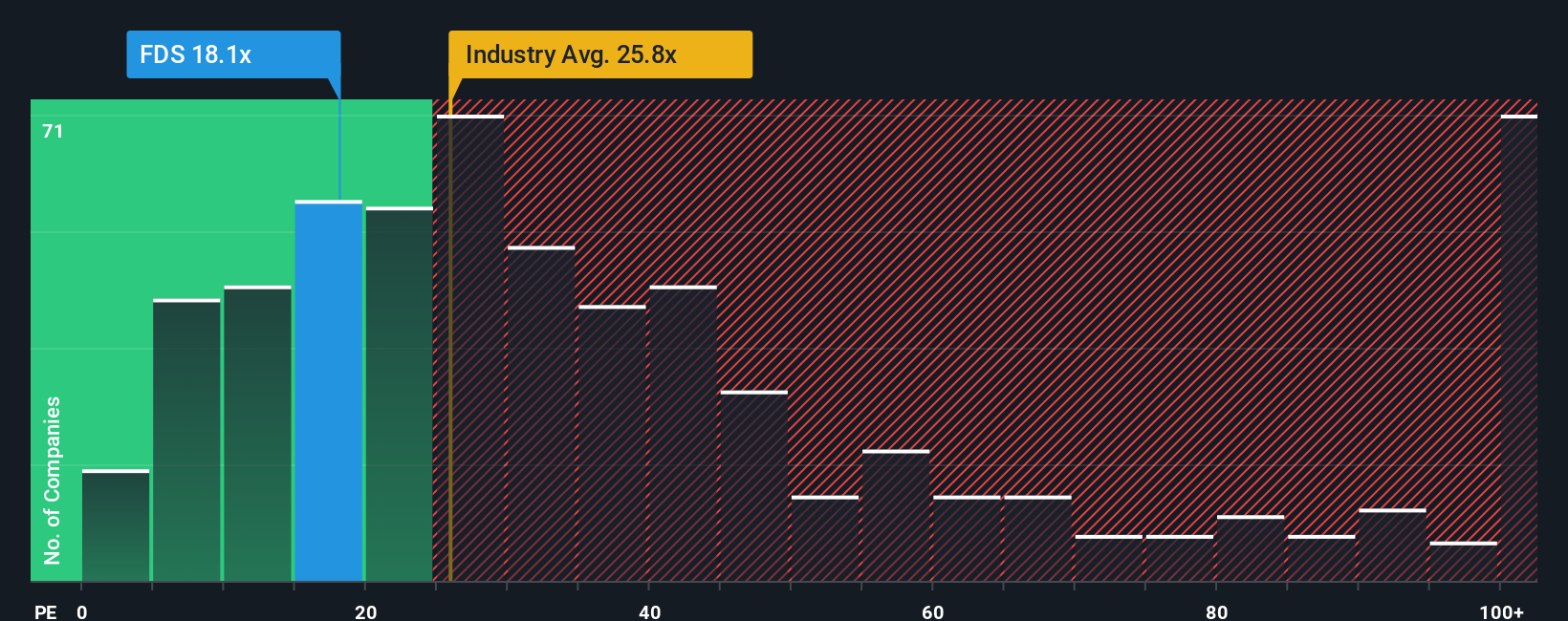

For profitable companies like FactSet Research Systems, the Price-to-Earnings (PE) ratio is a favored way to assess valuation because it connects the share price directly to the company’s actual profits. A PE ratio gives instant context on how much investors are willing to pay for each dollar of earnings, making it especially useful for well-established, consistently profitable firms.

While a company’s PE ratio often gets compared to industry averages or direct peers, it’s important to remember that “normal” or “fair” values shift based on growth expectations and perceived risks. Faster earnings growth or a stable risk profile often commands a higher PE, while slower growth or more uncertainty can mean a lower ratio is warranted.

FactSet trades at a PE of 18.2x, noticeably lower than the Capital Markets industry average of 25.9x and peer average of 30.4x. However, Simply Wall St’s Fair Ratio digs even deeper. By factoring in not just industry and profits, but also unique elements like margin strength, future growth forecasts, company size, and specific risks, the Fair Ratio offers a more tailored benchmark. For FactSet, this figure is 15.1x. This approach sidesteps the one-size-fits-all flaws of simple peer or industry comparisons and focuses on a level that makes sense for this specific business.

Comparing FactSet’s actual PE of 18.2x with its Fair Ratio of 15.1x, the stock looks slightly expensive relative to its fundamentals and outlook, but not dramatically so.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your FactSet Research Systems Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your personal investment story for a company, connecting your perspective such as what you believe about FactSet’s future growth, earnings, and margins to a financial forecast and then to a fair value for the stock.

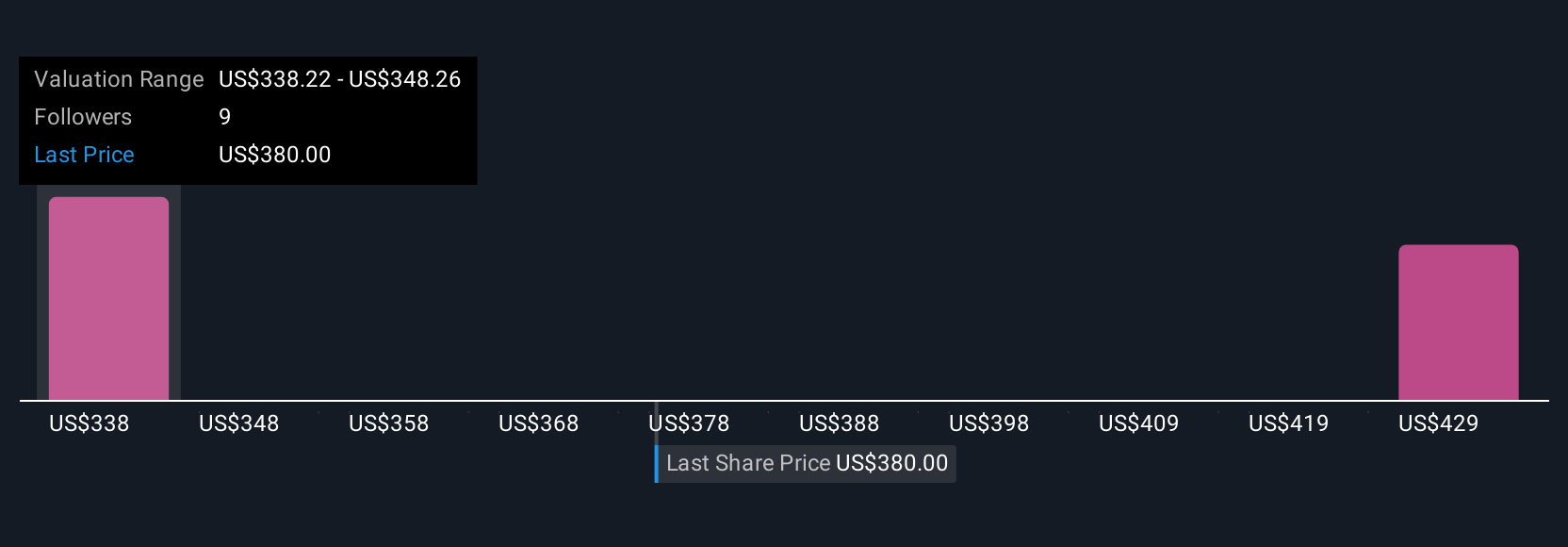

This approach helps bring the numbers to life by letting you test your assumptions, see what must be true to justify a share price, and compare your outlook against the consensus or other investors. Narratives are a popular feature on Simply Wall St’s Community page, where millions of investors share and update their views as new news or earnings arrive, giving you a real-time, dynamic understanding of the company’s outlook.

With Narratives, you can decide to buy or sell based on your calculated Fair Value versus the current Price, and see how your view stacks up next to a range of market perspectives. For example, within the FactSet Research Systems community, some users see tremendous upside, targeting as high as $500 based on strong GenAI adoption and operational gains, while others estimate much lower, at $355, due to ongoing margin pressures and increased investment costs.

Do you think there's more to the story for FactSet Research Systems? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDS

FactSet Research Systems

Operates as a financial digital platform and enterprise solutions provider for the investment community worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives