- United States

- /

- Capital Markets

- /

- NYSE:FDS

How Should Investors Feel About FactSet Research Systems Inc.'s (NYSE:FDS) CEO Pay?

Phil Snow became the CEO of FactSet Research Systems Inc. (NYSE:FDS) in 2015. First, this article will compare CEO compensation with compensation at other large companies. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for FactSet Research Systems

How Does Phil Snow's Compensation Compare With Similar Sized Companies?

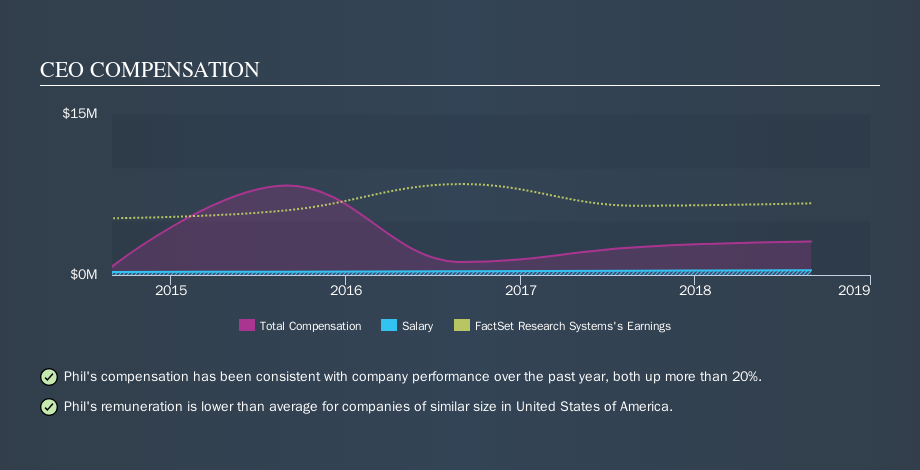

Our data indicates that FactSet Research Systems Inc. is worth US$11b, and total annual CEO compensation was reported as US$3.1m for the year to August 2018. While we always look at total compensation first, we note that the salary component is less, at US$446k. Importantly, there may be performance hurdles relating to the non-salary component of the total compensation. When we examined a group of companies with market caps over US$8.0b, we found that their median CEO total compensation was US$11m. There aren't very many mega-cap companies, so we had to take a wide range to get a meaningful comparison figure.

A first glance this seems like a real positive for shareholders, since Phil Snow is paid less than the average total compensation paid by other large companies. While this is a good thing, you'll need to understand the business better before you can form an opinion.

You can see, below, how CEO compensation at FactSet Research Systems has changed over time.

Is FactSet Research Systems Inc. Growing?

FactSet Research Systems Inc. saw earnings per share stay pretty flat over the last three years, albeit with a slight decrease, according to the line of best fit. In the last year, its revenue is up 6.5%.

The lack of earnings per share growth in the last three years is unimpressive. The modest increase in revenue in the last year isn't enough to make me overlook the disappointing change in earnings per share. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO.

Has FactSet Research Systems Inc. Been A Good Investment?

Boasting a total shareholder return of 62% over three years, FactSet Research Systems Inc. has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

It appears that FactSet Research Systems Inc. remunerates its CEO below most large companies.

Phil Snow is paid less than CEOs of other large companies. While the company isn't growing on our analysis, shareholder returns have been good in recent years. So, while it would be nice to have EPS growth, on our analysis the CEO compensation is not an issue. If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at FactSet Research Systems.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:FDS

FactSet Research Systems

Operates as a financial digital platform and enterprise solutions provider for the investment community worldwide.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives