- United States

- /

- Capital Markets

- /

- NYSE:FDS

A look at FactSet Research Systems (FDS) valuation after a recent rebound in its share price

Reviewed by Simply Wall St

FactSet Research Systems (FDS) has quietly outperformed the market over the past month, even as the stock remains sharply lower this year, inviting a closer look at what investors might be pricing in.

See our latest analysis for FactSet Research Systems.

The recent bounce, including an 11.29% 1 month share price return off a deep year to date slide of 39.01 percent, suggests sentiment is stabilising even though the 1 year total shareholder return remains sharply negative.

If this shift in momentum has you reassessing your watchlist, it could be a good moment to discover high growth tech and AI stocks that sit at the intersection of finance and technology.

With earnings still growing and the share price lagging, investors now face a crucial question: is FactSet trading at a meaningful discount to its fundamentals, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 13.5% Undervalued

With FactSet shares last closing at $290.63 against a narrative fair value of $335.94, the valuation case leans positive and hinges on execution.

FactSet is integrating new acquisitions like Irwin and LiquidityBook, adding immediate cross-sell opportunities and expanding services across buy-side and banking workflows, which will support revenue growth. The launch of new GenAI products, including Pitch Creator and conversational API, is expected to provide additional services that drive adoption and increase ASV growth, positively impacting future revenue.

Curious how steady mid single digit revenue growth, rising margins and a richer earnings multiple all fit together into that upside case? Dig into the full narrative to see the specific assumptions driving this fair value view.

Result: Fair Value of $335.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing price increases and rising technology expenses could constrain revenue growth and margins, challenging the optimistic earnings and valuation assumptions embedded in this narrative.

Find out about the key risks to this FactSet Research Systems narrative.

Another Angle on Valuation

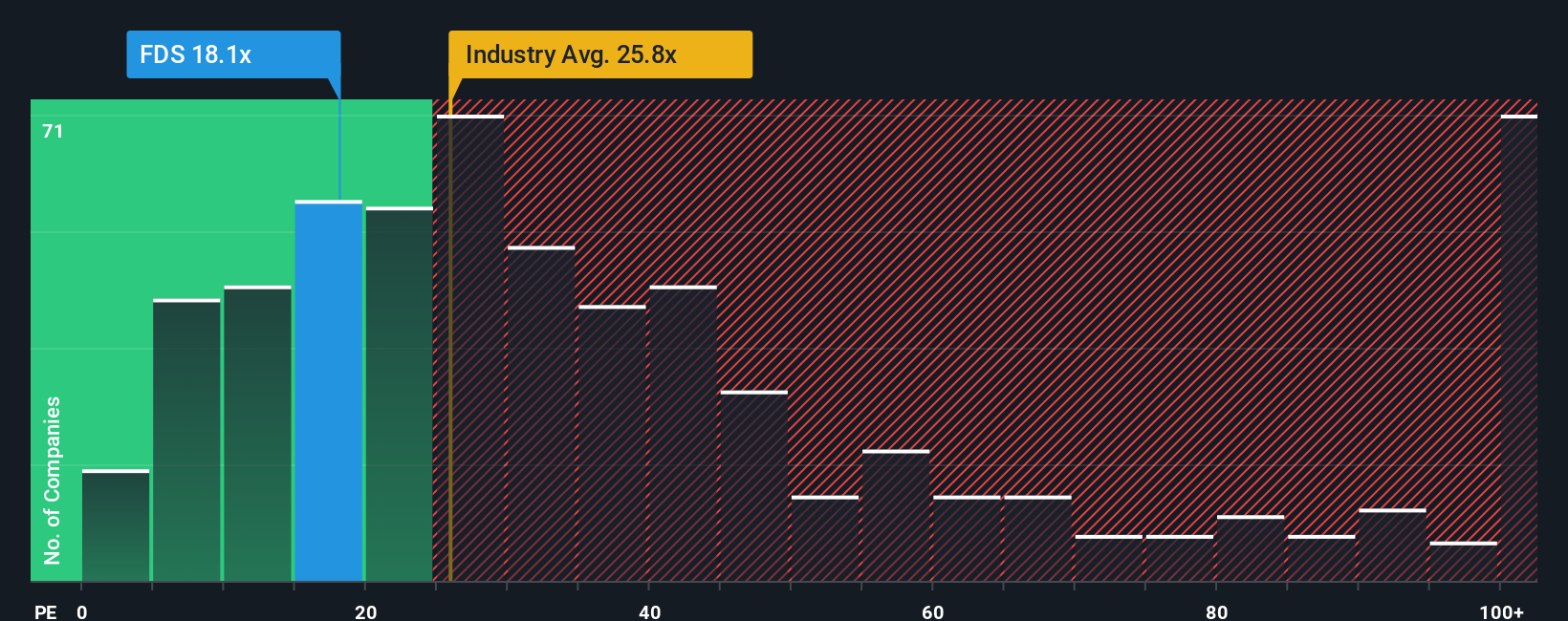

On earnings, the picture is less forgiving. FactSet trades at 17.5 times earnings versus a fair ratio of 14.1 times, even as the US capital markets group averages 24 times. That premium to its own fundamentals hints at valuation risk if growth disappoints from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FactSet Research Systems Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a customised view in just minutes, Do it your way.

A great starting point for your FactSet Research Systems research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, take a few moments to line up your next potential winners with targeted stock ideas that could sharpen your edge and widen your opportunity set.

- Capture potential bargains by screening for companies trading below intrinsic value through these 908 undervalued stocks based on cash flows, grounded in discounted cash flow fundamentals.

- Capitalize on powerful tech tailwinds by scanning these 26 AI penny stocks, shaping the future of automation, data analytics, and intelligent software platforms.

- Strengthen your income stream by reviewing these 15 dividend stocks with yields > 3% that pair attractive yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDS

FactSet Research Systems

Operates as a financial digital platform and enterprise solutions provider for the investment community.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026