- United States

- /

- Diversified Financial

- /

- NYSE:EVTC

EVERTEC (EVTC): Is the Market Overlooking Value After Recent Share Price Decline?

Reviewed by Kshitija Bhandaru

EVERTEC (EVTC) has caught market watchers’ attention lately, with shares showing a drop of around 13% over the past three months. Investors are weighing recent performance numbers and looking for clues on where the stock could head next.

See our latest analysis for EVERTEC.

Zooming out, EVERTEC’s share price has gradually slipped over the year, with momentum generally fading despite a few periods of renewed interest. The 1-year total shareholder return of -4.3% highlights that longer-term investors have also seen value drift. Earnings growth remains in the background as a potential catalyst for sentiment to shift.

If you’re wondering where else value or momentum might be shifting, now is a smart time to discover fast growing stocks with high insider ownership.

With EVERTEC’s share price lagging despite solid earnings growth and trading at a notable discount to analyst targets, the question for investors is clear: is this a bargain entry, or has the market already accounted for future gains?

Most Popular Narrative: 15.6% Undervalued

EVERTEC closed at $32.56. The most popular narrative values the company closer to $38.60, pointing to a notable gap between narrative fair value and market pricing. This difference spotlights what analysts view as significant upside potential and sets up a closer look at the catalysts driving these projections.

The company is experiencing robust transaction and sales volume growth across Latin America, aided by accelerated adoption of digital payments, especially contactless and mobile, among businesses of all sizes. This points to strong revenue and earnings expansion as these underpenetrated markets mature.

Want to uncover which critical growth levers are behind this bullish view? The story involves powerful tech upgrades, margin optimism, and ambitious regional expansion. Craving the full details and what really drives that fair value projection? Read the full narrative for the forecast that could change your outlook.

Result: Fair Value of $38.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on key customers and exposure to currency shifts could quickly undercut EVERTEC's current growth trajectory if conditions worsen.

Find out about the key risks to this EVERTEC narrative.

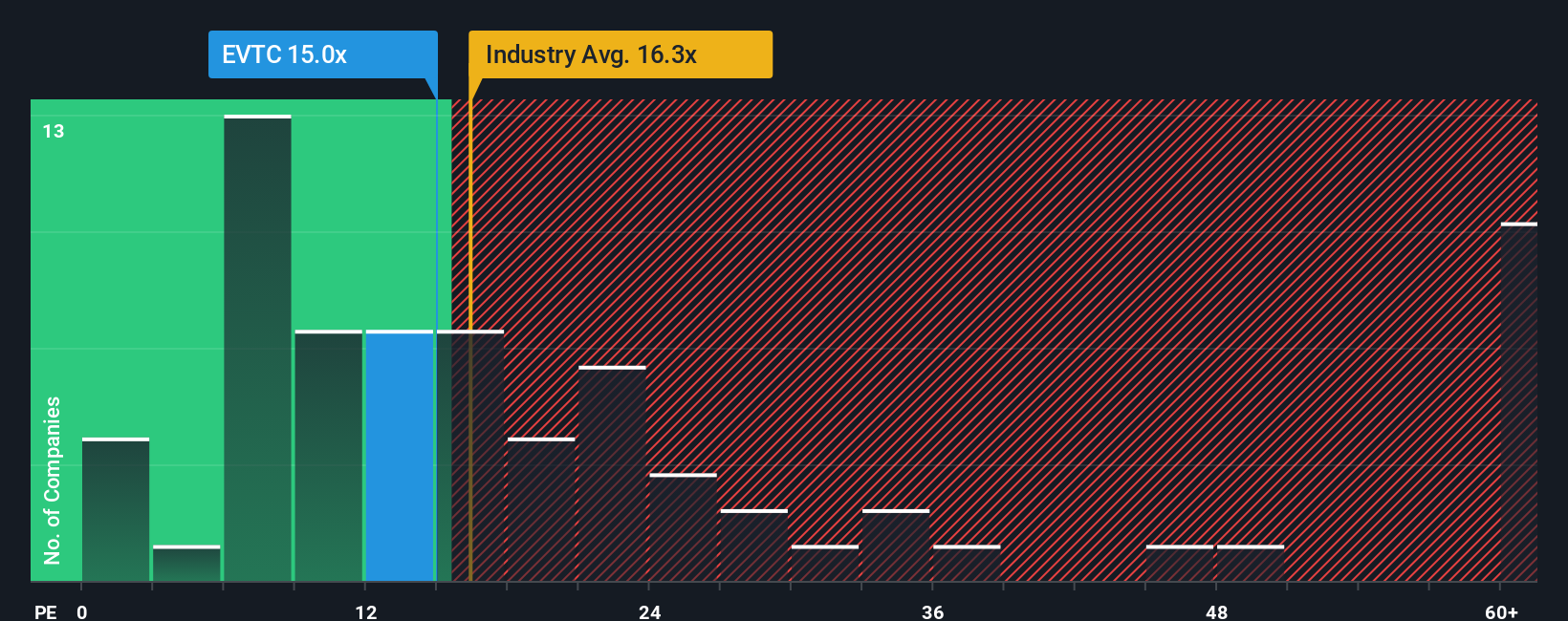

Another View: Multiples Tell a Cautious Story

Stepping away from fair value estimates, let’s look at valuation multiples for a reality check. EVERTEC trades on a price-to-earnings ratio of 15.1x, which is lower than the US Diversified Financial industry average of 16.5x. However, it is higher than its peer average of 13.6x and above its own fair ratio of 14.1x. This creates mixed signals for investors, showing relative value to the broader industry but a premium compared to peers and what the market could drift toward. Are the risks already baked in, or could the market re-rate the stock lower?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EVERTEC Narrative

If you see things differently or want to dig deeper on your own terms, you can build an alternative perspective in just a few minutes. Do it your way.

A great starting point for your EVERTEC research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stop second-guessing your next move and put your watchlist on the fast track by targeting stocks making waves in sectors with explosive upside.

- Maximize your income potential by scanning these 19 dividend stocks with yields > 3%, which features attractive yields over 3% and proven payout histories.

- Discover cutting-edge companies set to transform medicine and patient care by checking out these 31 healthcare AI stocks, focused on artificial intelligence for diagnostics and treatments.

- Take advantage of disruptive trends and volatility by targeting these 78 cryptocurrency and blockchain stocks, highlighting opportunities in blockchain and digital finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EVERTEC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVTC

EVERTEC

Provides transaction processing and financial technology services in Latin America, Puerto Rico, and the Caribbean.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives