- United States

- /

- Capital Markets

- /

- NYSE:EVR

Evercore (EVR): Assessing Valuation After Strategic Leadership Addition Bolsters Capital Markets Advisory Team

Reviewed by Simply Wall St

Evercore (EVR) has brought Ovadiah Jacob on board as a senior managing director for its private capital markets and debt advisory group, focusing on ratings advisory. Jacob’s extensive background includes leadership roles at Goldman Sachs and Standard & Poor’s, which offers new depth to Evercore’s advisory team.

See our latest analysis for Evercore.

Momentum around Evercore has held strong in 2024, with the share price climbing 14.8% year-to-date and a robust 24.5% total shareholder return over the past year. While shares have pulled back 10.5% in the past month, the longer-term trend remains impressive, as evidenced by a staggering 235.8% total return for shareholders over the last three years. News like Jacob’s appointment reinforces Evercore’s long-term growth story and suggests that investors continue to view its leadership moves as supportive of future performance.

If Evercore’s strategic moves have you thinking bigger, now could be the ideal time to broaden your outlook and discover fast growing stocks with high insider ownership

Given Evercore’s steady growth, recent leadership additions, and strong past returns, the real question is whether the current valuation leaves room for further upside or if the market has already accounted for the company’s future potential.

Most Popular Narrative: 16.2% Undervalued

With Evercore shares last closing at $317.07, the most popular narrative points to a fair value estimate of $378.29, suggesting notable upside potential. The narrative’s numbers reflect a strong case for future growth given the current market environment and ongoing expansion.

The ongoing globalization of capital markets and an accelerating trend in cross-border M&A activity are providing an increasingly fertile environment for independent, conflict-free advisors like Evercore. The firm's continued expansion into key international markets, as evidenced by new offices and hiring in EMEA (France, Spain, Italy, Dubai, UK), positions it to capture an increasing share of growing advisory fee pools and drive top-line revenue over the long term.

What’s behind this bullish outlook? The narrative’s foundation is a leap in both earnings and revenue over the next few years, as well as bolder profit expectations and ambitious international targets. One powerful assumption could tip the fair value even higher. Are you willing to uncover which?

Result: Fair Value of $378.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and Evercore’s exposure to cyclical M&A trends mean that any market slowdown could quickly challenge these bullish expectations.

Find out about the key risks to this Evercore narrative.

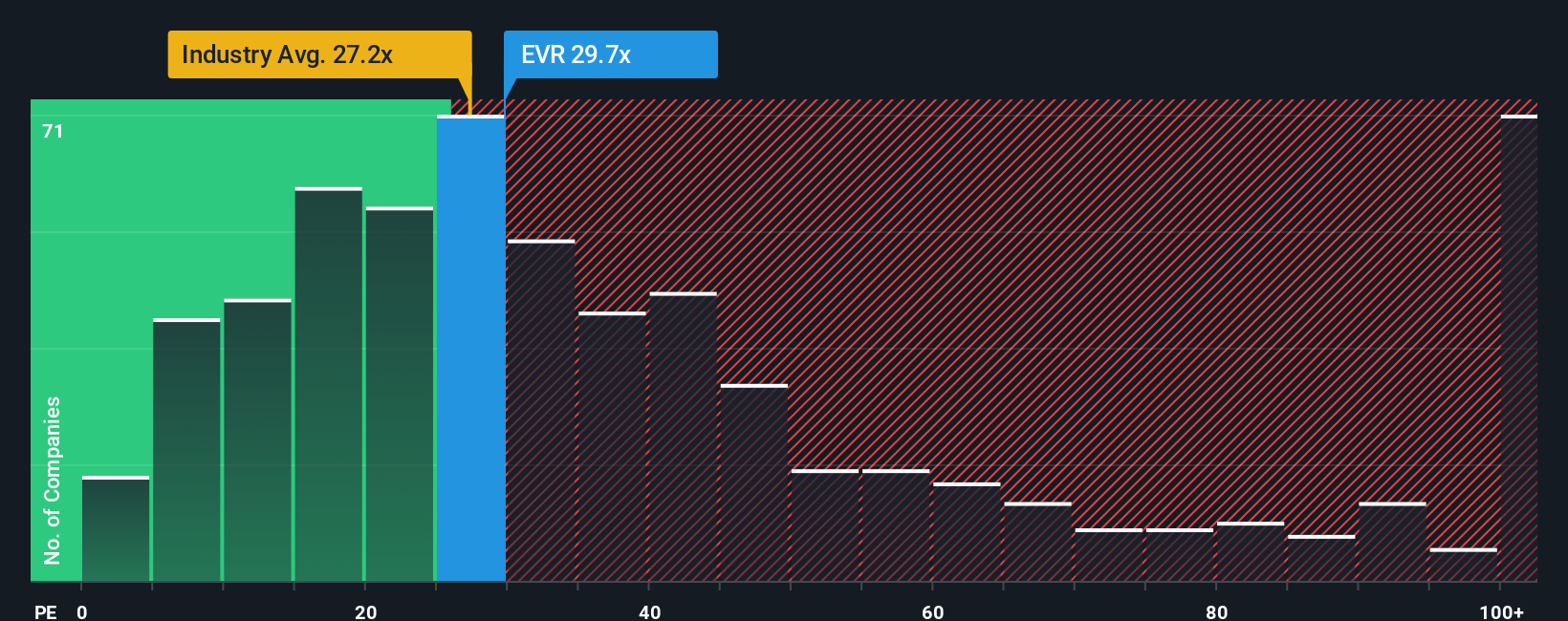

Another View: Looking at Valuation Multiples

While the main narrative points to solid upside, a closer look at Evercore’s price-to-earnings ratio offers a different angle. The shares trade at 26.5 times earnings, which is higher than both the industry average (26x) and the fair ratio of 17.4x. This signals the stock could be expensive if growth falters. But will high returns on equity and earnings momentum justify the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Evercore Narrative

If you’re not convinced by the current narrative or prefer digging into the details yourself, you can piece together your own Evercore story in just a few minutes. Do it your way

A great starting point for your Evercore research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock opportunities others might overlook by checking out handpicked investment themes right now. Don’t wait, as these market shifts could move fast!

- Capture steady income streams by targeting companies with solid yields through these 17 dividend stocks with yields > 3% and create a portfolio built on reliable cash returns.

- Tap into the AI boom and see which promising market leaders you could add by jumping into these 26 AI penny stocks before the next major breakout.

- Stay ahead of value seekers by reviewing these 877 undervalued stocks based on cash flows, which highlights the best potential for price appreciation based on strong underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evercore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVR

Evercore

Operates as an independent investment banking firm in the Americas, Europe, Middle East, Africa, and Asia-Pacific.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives