- United States

- /

- Capital Markets

- /

- NYSE:EVR

Double-Digit Q2 Growth and European Expansion Could Be a Game Changer for Evercore (EVR)

Reviewed by Simply Wall St

- Evercore announced strong second quarter and first half 2025 results, with significant year-over-year growth in both revenue and net income, and also appointed Luigi de Vecchi to lead its continental European advisory operations.

- This leadership addition signals Evercore's expansion ambitions in Europe, supported by robust performance momentum highlighted in recent financial results.

- With the recent arrival of an experienced continental Europe chairman, we will explore how this international expansion impacts Evercore's investment narrative.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Evercore Investment Narrative Recap

To be a shareholder in Evercore today, you need to believe in the firm's ability to deliver long-term revenue growth by expanding its international advisory footprint while maintaining healthy margins, even as it contends with rising costs. The latest financial results confirm solid short-term performance and strong momentum, but the main near-term catalyst, sustained global M&A activity, remains subject to cyclical headwinds, and ongoing margin pressure from higher non-compensation expenses and talent investments poses the biggest risk. The recent news, though positive, does not fundamentally alter these key factors or shift the risk balance in the short run.

Among the latest announcements, Evercore’s ongoing share repurchase program stands out. Having completed the buyback of over 6.5 million shares (16.94% of outstanding shares) for nearly US$1 billion since February 2022, this action is most relevant as it may help offset dilution and signal management's confidence, but its impact is ultimately contingent on the firm sustaining revenue and earnings growth, which depend directly on deal activity, the core business catalyst.

Yet, investors should also keep an eye on whether Evercore’s growing fixed expenses, driven by new office launches and technology spending, expose the firm to...

Read the full narrative on Evercore (it's free!)

Evercore's narrative projects $5.0 billion revenue and $849.0 million earnings by 2028. This requires 17.4% yearly revenue growth and an increase of $410.2 million in earnings from $438.8 million today.

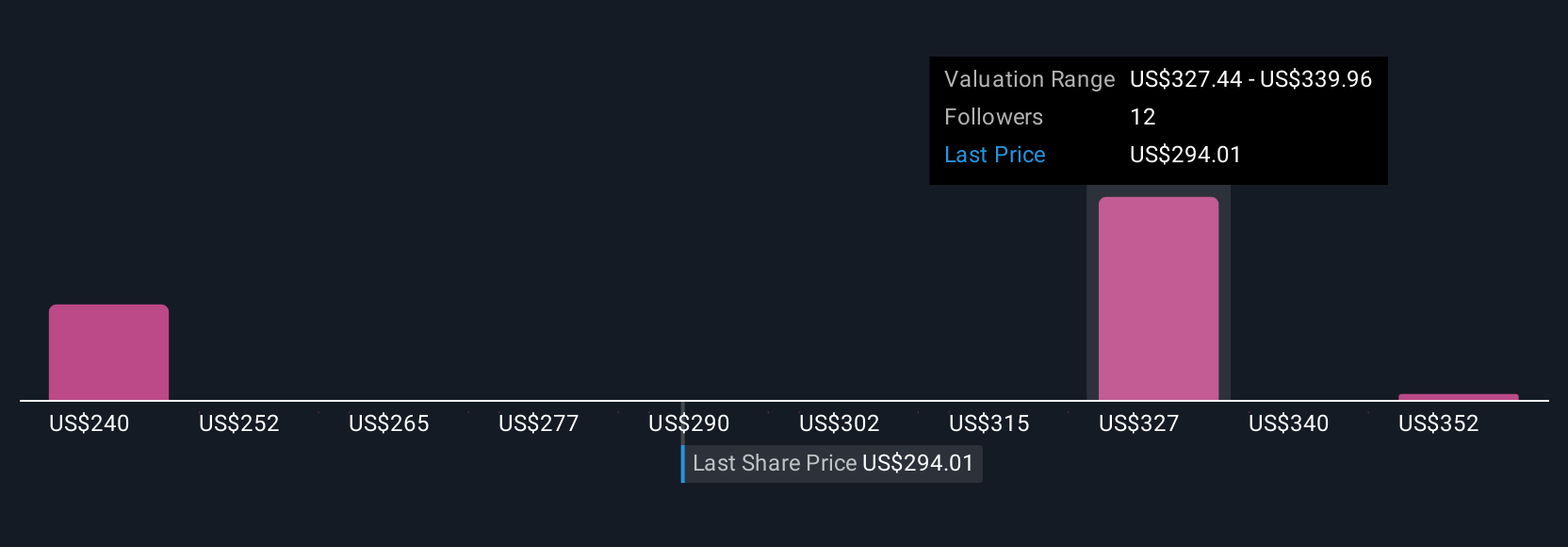

Uncover how Evercore's forecasts yield a $331.40 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range from US$262 to US$365 per share, illustrating the wide range across private investor opinions. Against this backdrop, many are weighing how Evercore’s rising non-compensation costs could impact future margins if market conditions soften, so explore these different viewpoints to see how your expectations align.

Explore 3 other fair value estimates on Evercore - why the stock might be worth as much as 18% more than the current price!

Build Your Own Evercore Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evercore research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Evercore research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evercore's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 21 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evercore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVR

Evercore

Operates as an independent investment banking firm in the Americas, Europe, Middle East, Africa, and Asia-Pacific.

High growth potential with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives