- United States

- /

- Diversified Financial

- /

- NYSE:ESNT

Is There an Opportunity in Essent Group Shares After Recent Market Volatility?

Reviewed by Bailey Pemberton

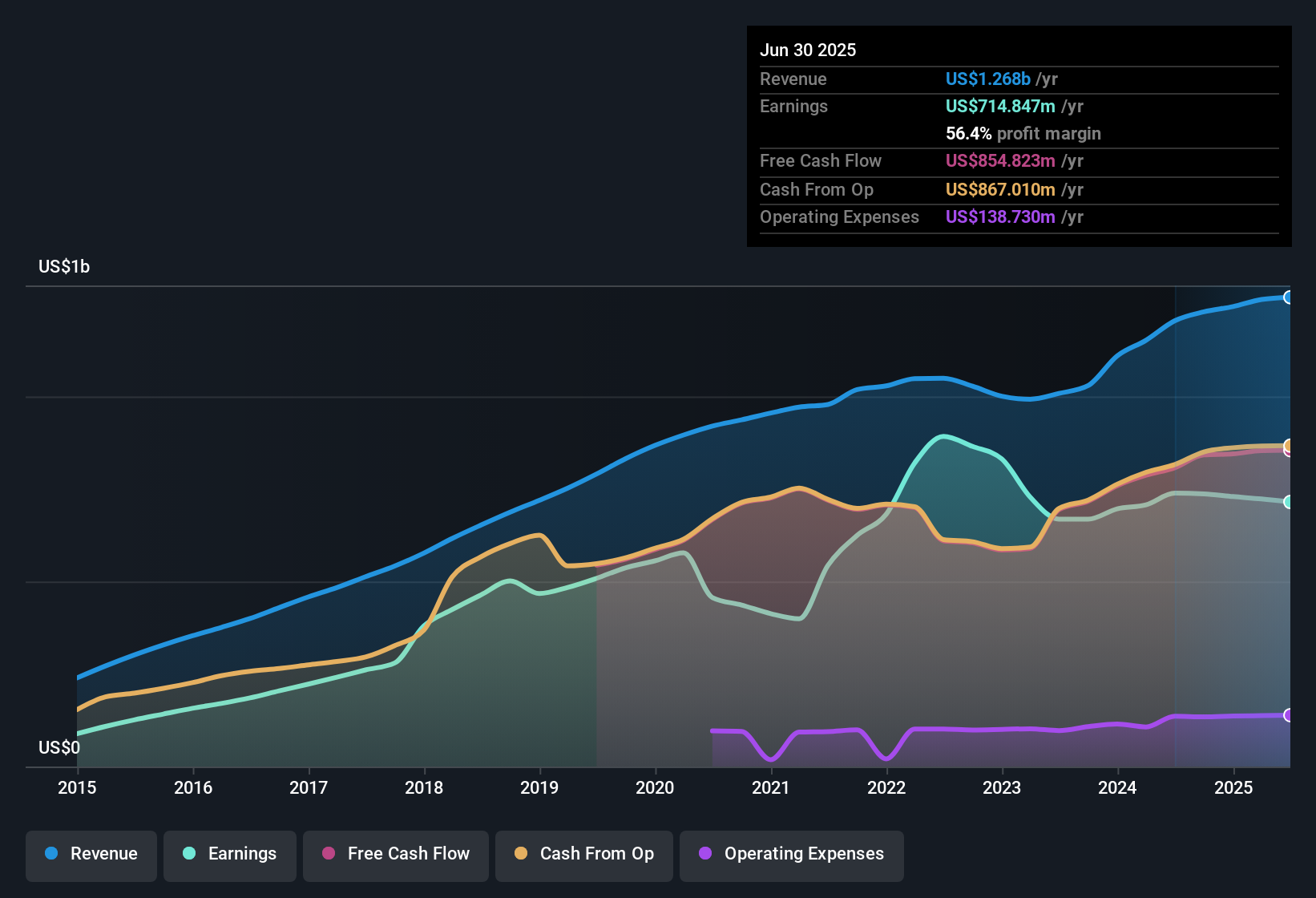

If you own shares of Essent Group or are weighing whether it deserves a spot in your portfolio, it might feel like you are at a crossroads. After a strong start to the year, with the stock up 12.6% year-to-date, there has been a slight pullback over the past month and week, down 4.0% and 3.9%, respectively. And yet, if you zoom out and look at the bigger picture, the company has rewarded long-term holders: in the past three years, shares have gained 85.4%, and over five years, they are up 54.4%. It is only in the past year where Essent’s price has barely nudged, slipping just 0.2%.

Some of this recent volatility could be tied to changing market conditions affecting mortgage insurance players. Investors have been recalibrating their risk outlooks as the broader environment shifts, but long-term optimism in Essent’s underlying business seems to persist.

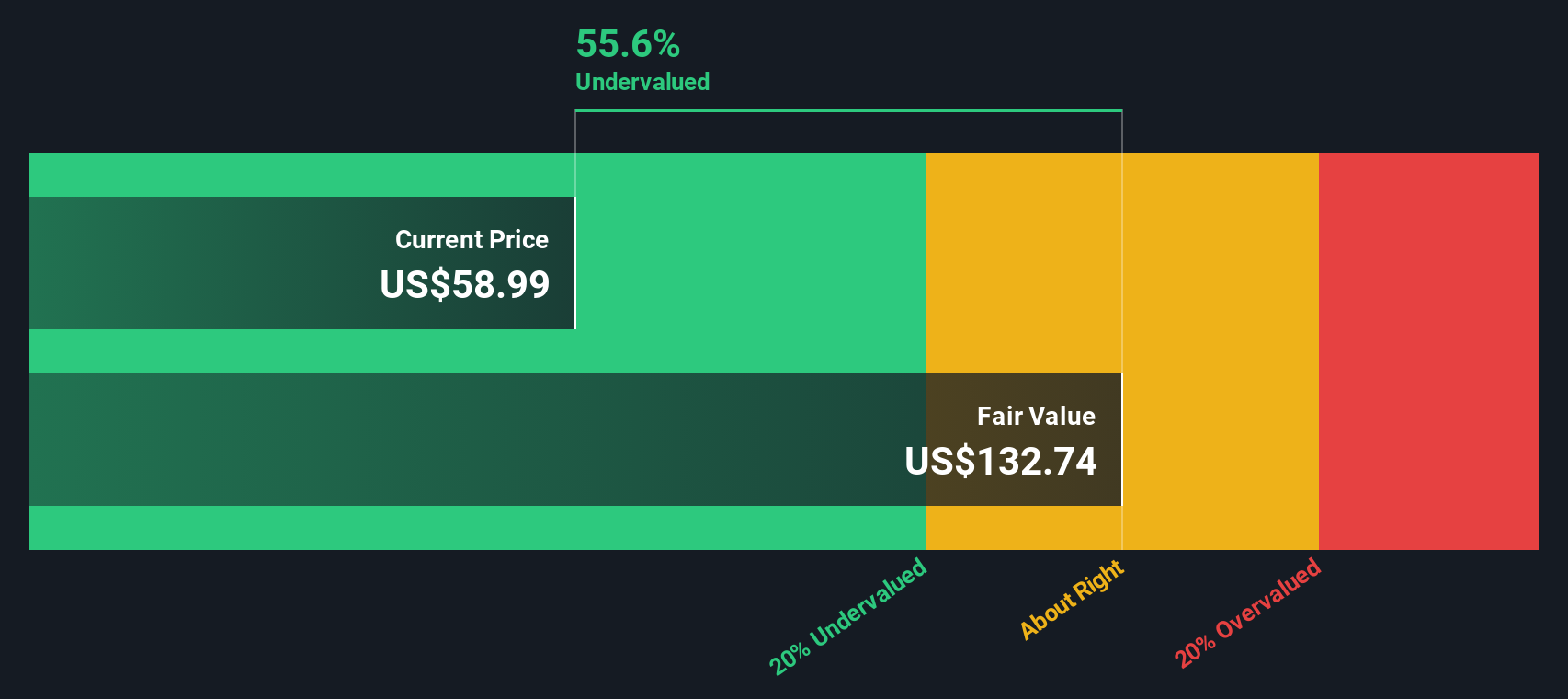

But what about the stock’s value right now? Is Essent Group still a buy after such a run, or are you late to the party? Here is where things get interesting. When we run the company through a series of six tried-and-true valuation checks, covering everything from price-to-earnings ratios to cash flow multiples, Essent Group is undervalued in five out of six areas, giving it a stellar value score of 5.

Let’s break down how each of these valuation methods stacks up, and stick around because I will also share one approach savvy investors use to get an even clearer read on Essent’s real value.

Why Essent Group is lagging behind its peers

Approach 1: Essent Group Excess Returns Analysis

The Excess Returns valuation model estimates a company's fair value by looking at how much return it generates on its invested capital beyond the cost of equity. This approach is especially helpful for financial firms like Essent Group, where consistent profitability and capital efficiency matter most.

For Essent Group, the data tells a compelling story. The company’s Book Value stands at $56.98 per share, with a Stable EPS (earnings per share) of $8.00, according to forecasts from five analysts. The estimated Cost of Equity is $5.04 per share. This means Essent generates an Excess Return of $2.96 per share. Over the long run, Essent’s stable Book Value is projected to increase to $66.77 per share, supported by a healthy average Return on Equity of 11.98% (with three analysts backing this future book value estimate).

Based on these projections, the Excess Returns model calculates an intrinsic value that is 53.9% above the current share price. This suggests that Essent Group is significantly undervalued when compared to what its future capital returns could justify.

Result: UNDERVALUED

Our Excess Returns analysis suggests Essent Group is undervalued by 53.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

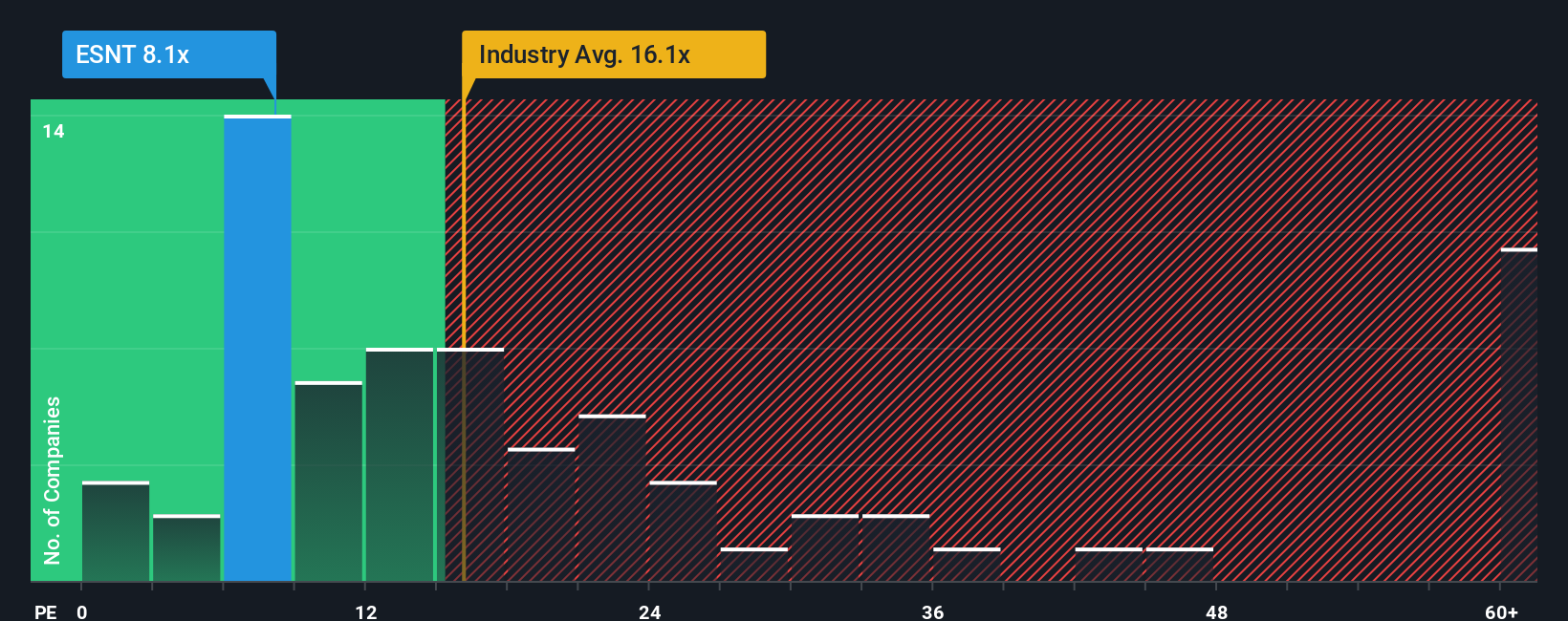

Approach 2: Essent Group Price vs Earnings

The price-to-earnings (PE) ratio is a classic valuation tool for profitable companies like Essent Group. It quickly shows how much investors are willing to pay for each dollar of earnings. For steady and consistently profitable businesses, PE ratios provide a valuable yardstick because they connect stock price directly to the underlying profits.

Interpreting a PE ratio depends on growth prospects and perceived risk. Companies expected to grow quickly or with lower risks typically command higher PE ratios. Slower-growing or riskier firms tend to trade at lower multiples. With that in mind, Essent Group currently trades at a PE of 8.45x, notably below both the Diversified Financial industry average of 16.47x and the 10.2x average among its peers. This suggests the market is assigning a discount compared to both the broader sector and direct competitors.

To refine the analysis, Simply Wall St provides a proprietary “Fair Ratio” for PE, set here at 13.08x. Unlike standard comparisons, the Fair Ratio accounts for Essent’s specific mix of earnings growth, profit margins, risk profile, market capitalization, and its industry environment. This delivers a much more tailored benchmark than simply looking at peers or the industry average.

With Essent’s actual 8.45x PE well below the Fair Ratio of 13.08x, this points to Essent Group stock being undervalued based on its underlying fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Essent Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply the story or perspective you have about a company, connecting your outlook for its future revenue, earnings, and profit margins to your assumptions of what the stock is worth. Narratives combine your research and market insights into a single forecast and translate that story into a fair value, making it easy to see how your thinking maps onto potential returns.

On the Community page at Simply Wall St, Narratives enable millions of investors to visualize their own and others’ perspectives, compare them to professional consensus, and see at a glance whether the current share price reflects opportunity or risk. Because Narratives are dynamically updated with new data and events (like earnings reports or news releases), your outlook always stays relevant. For example, some optimistic investors believe Essent Group’s technology and homeownership growth will drive future value as high as $70, while more cautious views focus on potential headwinds with fair value estimates around $59. Narratives make it easy to weigh all these viewpoints and decide when to buy, hold, or sell based on your conviction and the latest facts.

Do you think there's more to the story for Essent Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Essent Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESNT

Essent Group

Through its subsidiaries, provides private mortgage insurance and reinsurance for mortgages secured by residential properties located in the United States.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives