- United States

- /

- Consumer Finance

- /

- NYSE:ENVA

How Enova's Revenue Growth and Facility Update Have Changed Its Investment Story (ENVA)

Reviewed by Sasha Jovanovic

- In the past week, Enova International reported third-quarter revenue growth of 16% and a 29% annual increase in small business lending, while also amending its receivables facility to extend the maturity and enhance flexibility. The company further saw its CEO exercise stock options and attract considerable interest from investors and online forums, reflecting optimism around recent developments.

- A unique aspect of the announcement is Enova’s proactive approach to financial operations, including the extension of its revolving receivables facility, which is expected to improve the company’s liquidity management and operational flexibility.

- We’ll now examine how Enova’s robust small business lending and financial facility update reshape its broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Enova International Investment Narrative Recap

To be a shareholder in Enova International, you need to believe that ongoing digital adoption and the shift toward nonbank lenders will continue to drive demand for its small business and consumer lending platforms. The recent update, reporting strong third-quarter revenue growth and expanding its small business loan book, reinforces the company’s short-term growth catalyst. At the same time, risks from shifting regulation and consumer sentiment toward high-cost lending remain front of mind, and recent news does not materially change these concerns.

The amendment to Enova’s revolving receivables facility, which extends maturity and improves liquidity management, stands out as most directly relevant to the investor outlook. This move has the potential to support future lending expansion, addressing some concerns about funding stability and operational flexibility that can impact performance during volatile market cycles.

However, investors should be aware of the ongoing risk from potential regulatory tightening and changes in consumer preferences…

Read the full narrative on Enova International (it's free!)

Enova International's narrative projects $5.7 billion in revenue and $426.8 million in earnings by 2028. This requires 60.7% annual revenue growth and a $170.6 million increase in earnings from the current $256.2 million.

Uncover how Enova International's forecasts yield a $140.62 fair value, a 7% upside to its current price.

Exploring Other Perspectives

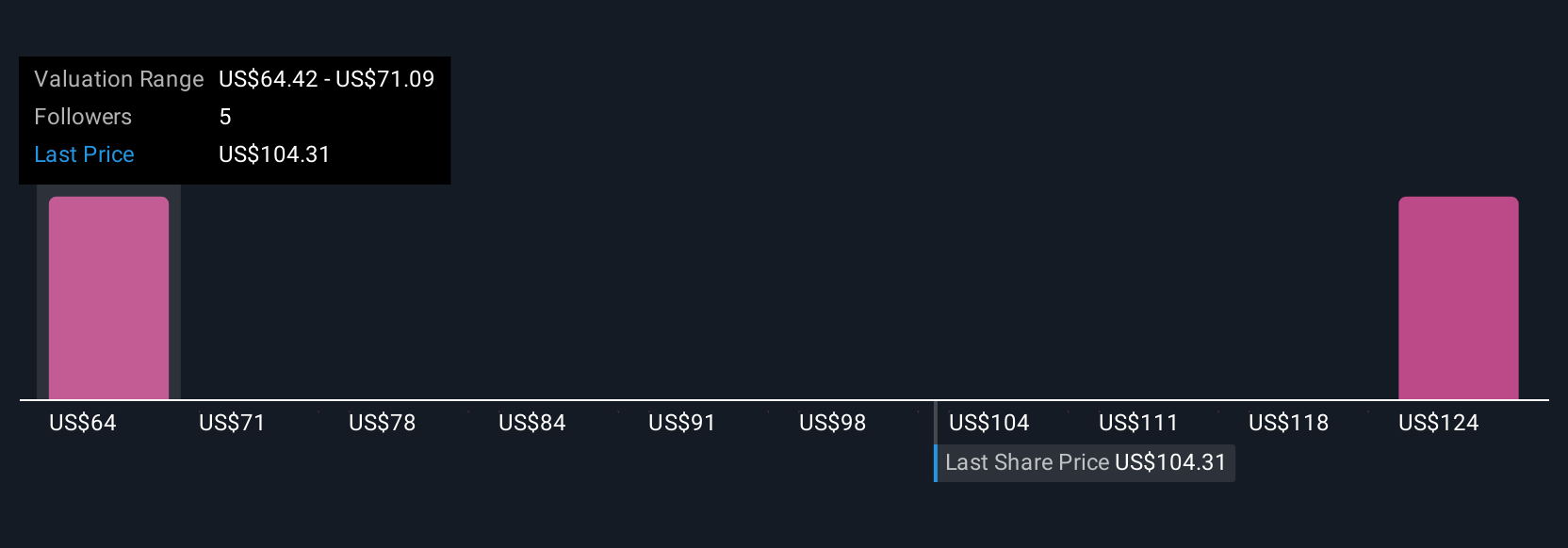

Simply Wall St Community members published four fair value estimates for Enova International ranging from US$64.42 to US$467.73 per share. As digital lending demand drives Enova’s recent growth, opinions vary widely, consider the breadth of views before forming your own outlook.

Explore 4 other fair value estimates on Enova International - why the stock might be worth less than half the current price!

Build Your Own Enova International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enova International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Enova International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enova International's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enova International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ENVA

Enova International

A technology and analytics company, provides online financial services in the United States, Brazil, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026