- United States

- /

- Diversified Financial

- /

- NYSE:CPAY

How Corpay's (CPAY) Faster Payments Integration Could Shape Its International Growth Ambitions

Reviewed by Sasha Jovanovic

- Corpay, Inc. recently announced that its Cross-Border business has joined the United Kingdom's Faster Payment Service (FPS), following a separate announcement of an expanded collaboration with Mastercard to enable near real-time payments in 22 additional international markets.

- These moves enhance Corpay's global payments reach and speed, while also strengthening its multi-currency capabilities and client offerings for businesses operating in GBP and across borders.

- We'll explore how Corpay's direct FPS integration may further support its long-term growth narrative and international expansion goals.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Corpay Investment Narrative Recap

To be a Corpay shareholder, you need to believe in its continued global payments expansion, especially its ability to capitalize on the growth of cross-border business through innovations like near-instant settlements. The recent UK Faster Payment Service (FPS) integration strengthens Corpay’s payments infrastructure, supporting its ambition to boost transaction volumes and margins, but this news is unlikely to materially shift short-term earnings drivers or offset challenges from rising competition and compliance costs.

Among recent developments, the expanded partnership with Mastercard stands out as most relevant: it broadens Corpay’s real-time payments reach to 22 new markets, directly aligning with catalysts for international growth and deeper customer engagement. Both the FPS link and Mastercard collaboration reinforce Corpay’s move toward faster, more seamless cross-border payments, the centerpiece of its investment appeal right now. Yet, despite these advances, investors should keep an eye on...

Read the full narrative on Corpay (it's free!)

Corpay's narrative projects $5.7 billion revenue and $1.8 billion earnings by 2028. This requires 10.9% yearly revenue growth and an $0.8 billion earnings increase from $1.0 billion currently.

Uncover how Corpay's forecasts yield a $379.36 fair value, a 30% upside to its current price.

Exploring Other Perspectives

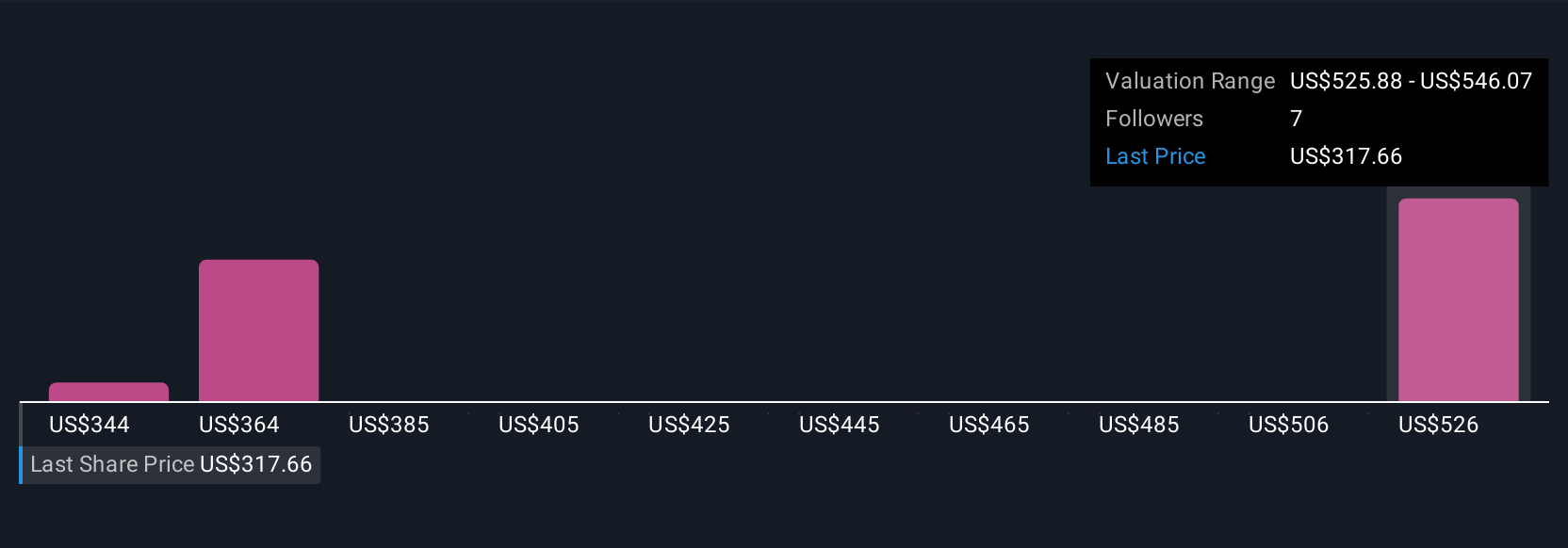

Three members of the Simply Wall St Community estimate Corpay’s fair value from US$344.17 up to US$549.19. While opinions vary widely, accelerating adoption of new payment ecosystems remains a key watchpoint for anyone following the stock’s growth trajectory.

Explore 3 other fair value estimates on Corpay - why the stock might be worth as much as 88% more than the current price!

Build Your Own Corpay Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Corpay research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Corpay research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Corpay's overall financial health at a glance.

No Opportunity In Corpay?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPAY

Corpay

Operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026