- United States

- /

- Consumer Finance

- /

- NYSE:COF

Capital One (COF): Assessing Valuation Following Recent Share Price Volatility

Reviewed by Simply Wall St

Capital One Financial (COF) shares have gradually bounced back over the past week, rising about 3% as investors keep a close eye on its performance metrics and overall financial health. Even with recent volatility, the stock’s year-to-date gain stands at 16%.

See our latest analysis for Capital One Financial.

After charging higher earlier in the year, Capital One Financial’s share price has cooled in recent weeks, pulling back more than 7% over the past month. Still, with a year-to-date share price return of 16% and a robust total shareholder return of nearly 10% over the last year, momentum is holding up fairly well, especially considering a striking 166% in total returns over five years. Investors seem to be weighing the company’s longer-term growth prospects as they digest shifting risk perceptions in the sector.

If you’re reassessing your watchlist after this recent volatility, now’s a smart time to broaden your search and discover fast growing stocks with high insider ownership

But with shares trading roughly 25% below analyst targets and annual revenue and net income both showing strong growth, is Capital One Financial undervalued, or does the current price already reflect its future upside?

Most Popular Narrative: 20.1% Undervalued

Capital One Financial’s most widely tracked narrative pins its fair value well above the recent close, suggesting room for further upside if current growth projections materialize. There is strong alignment between price and future expectations, but the detailed reasoning behind this view is worth a closer look.

The combination with Discover positions Capital One to leverage proprietary payments network infrastructure. This enables it to migrate Capital One debit and some credit card volume to the unregulated Discover network. This transition is expected to generate substantial incremental fee income and interchange revenue over time as scale, acceptance, and brand investments are realized.

Want a peek behind the analysts’ optimism? One bold forecast stands out, relying on aggressive leaps in both future earnings and revenue, powered by strategic mergers and a shift in how Capital One makes money. Curious which growth drivers are causing such a big valuation gap? Explore how this narrative connects industry shifts with ambitious projections.

Result: Fair Value of $260.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, costly integration of Discover or slower than hoped revenue gains could quickly challenge optimistic forecasts and diminish Capital One's perceived upside.

Find out about the key risks to this Capital One Financial narrative.

Another View: Look at the Market Ratios

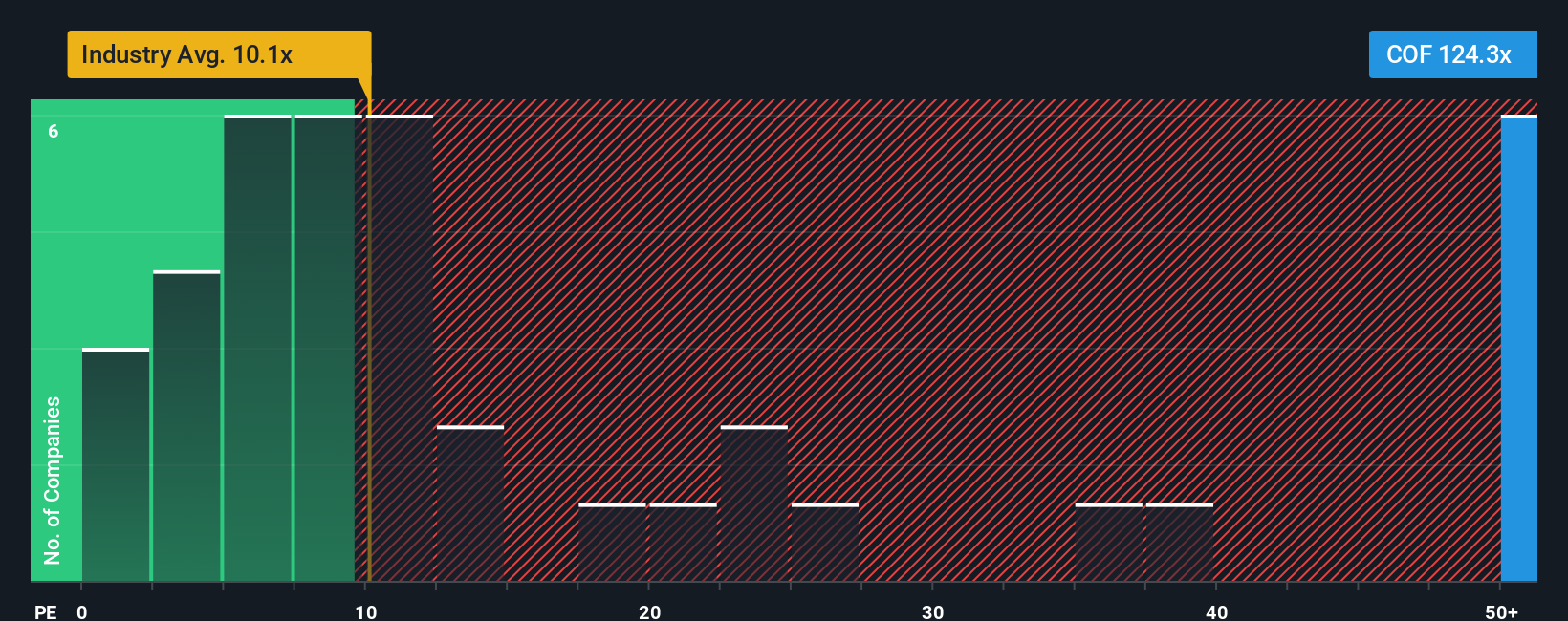

Not everyone values Capital One Financial through discounted cash flows. If you stack its price-to-earnings ratio of 114.8x against the Consumer Finance industry average of 9.7x and a peer average of 25.3x, it's clear the stock trades at a substantial premium. Even compared to its fair ratio of 34.4x, the gap is significant, raising questions about what investors are really paying for. Could this premium be justified by future growth, or is it a risk if market expectations change?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capital One Financial Narrative

If you have a different perspective or want to dig deeper into the numbers, you can craft your own take in just a few minutes. Do it your way

A great starting point for your Capital One Financial research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Smart investors stay ahead by tracking fresh opportunities. If you only focus on established names, you could miss tomorrow’s biggest growth drivers or hidden gems.

- Unlock potential with these 917 undervalued stocks based on cash flows that the market may be overlooking. This can give you a head start on value plays before the crowd notices.

- Tap into market shifts by targeting yield and steady income through these 15 dividend stocks with yields > 3%, so your portfolio keeps working for you even in uncertain times.

- Fuel your curiosity for tech breakthroughs by checking out these 26 AI penny stocks, which are reshaping industries with artificial intelligence and innovation that is changing the investing landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COF

Capital One Financial

Operates as the financial services holding company for the Capital One, National Association, which engages in the provision of various financial products and services in the United States, Canada, and the United Kingdom.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives