- United States

- /

- Diversified Financial

- /

- NYSE:CODI

Compass Diversified (NYSE:CODI) Has Announced A Dividend Of US$0.36

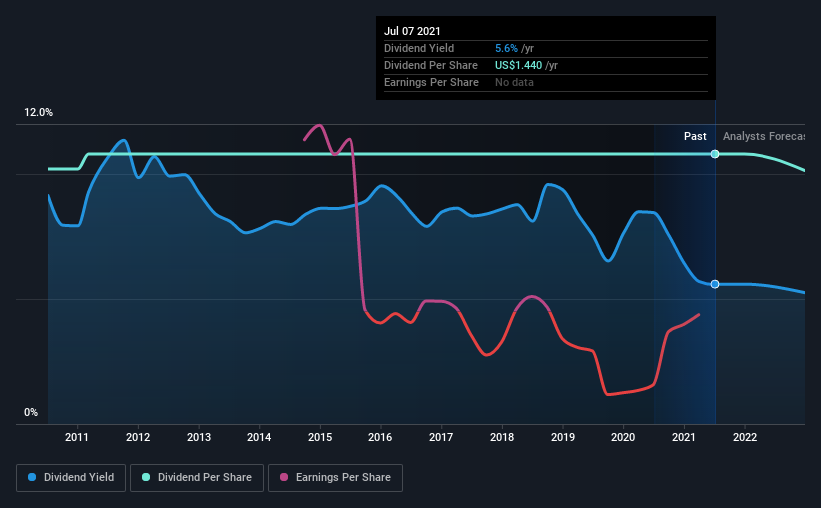

The board of Compass Diversified (NYSE:CODI) has announced that it will pay a dividend on the 22nd of July, with investors receiving US$0.36 per share. This means the annual payment is 5.6% of the current stock price, which is above the average for the industry.

Check out our latest analysis for Compass Diversified

Compass Diversified Might Find It Hard To Continue The Dividend

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Even while not generating a profit, Compass Diversified is paying out most of its free cash flows as a dividend. Paying a dividend while unprofitable is generally considered an aggressive policy, and with limited funds retained for reinvestment, growth may be slow.

Recent, EPS has fallen by 34.6%, so this could continue over the next year. This will push the company into unprofitability, which means the managers will have to choose between suspending the dividend, or paying it out of cash reserves.

Compass Diversified Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. The first annual payment during the last 10 years was US$1.36 in 2011, and the most recent fiscal year payment was US$1.44. Its dividends have grown at less than 1% per annum over this time frame. While the consistency in the dividend payments is impressive, we think the relatively slow rate of growth is less attractive.

The Dividend Has Limited Growth Potential

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Let's not jump to conclusions as things might not be as good as they appear on the surface. Over the past five years, it looks as though Compass Diversified's EPS has declined at around 35% a year. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

The Dividend Could Prove To Be Unreliable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. We don't think Compass Diversified is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. To that end, Compass Diversified has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you’re looking to trade Compass Diversified, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:CODI

Compass Diversified

A private equity firm specializing in add on acquisitions, buyouts, industry consolidation, recapitalization, late stage, and middle market investments.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives