- United States

- /

- Capital Markets

- /

- NYSE:CNS

Cohen & Steers (CNS): Valuation in Focus After Q3 Earnings Beat and Strong Net Inflows

Reviewed by Kshitija Bhandaru

Cohen & Steers (NYSE:CNS) drew attention after releasing third quarter results that beat expectations for both revenue and profit. Shares jumped as investors responded to stronger than expected figures and multiyear high net inflows.

See our latest analysis for Cohen & Steers.

Despite today’s jump, Cohen & Steers’ 1-day share price return of 5.8% reflects a welcome change in momentum after a challenging start to the year. Over the past twelve months, the stock’s total shareholder return was -32.7%. Looking longer term, the three- and five-year total returns stand at 33% and 44% respectively, highlighting its ability to deliver for patient investors during stronger market cycles.

If strong quarterly results have you eyeing broader opportunities, this could be the moment to discover fast growing stocks with high insider ownership.

Yet with shares rebounding sharply and the latest results now public, investors face a key question: Is this recent strength a sign that Cohen & Steers is undervalued, or has the market already priced in the good news?

Most Popular Narrative: 3.8% Undervalued

With Cohen & Steers closing at $69.62, the consensus fair value according to the most followed narrative sits modestly higher, implying a slight upside for the stock. Recent analyst revisions and sector optimism are shaping perspectives on whether shares are poised to move higher from here.

Strategic expansion into active ETFs and broader product diversification (including the launch of integrated listed/private real estate strategies) is expected to attract new investor segments and improve client retention. These efforts aim to support future AUM growth and revenue stability.

Want to see the bold growth assumptions hiding behind this price target? The narrative hints at a strategy shift and ambitious projections. What are analysts betting on for the years ahead? Uncover which future earnings and profitability leaps fuel their fair value math.

Result: Fair Value of $72.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent outflows from institutional clients or rising operating costs could quickly undermine these optimistic forecasts and disrupt the growth narrative for Cohen & Steers.

Find out about the key risks to this Cohen & Steers narrative.

Another View: What About Market Comparisons?

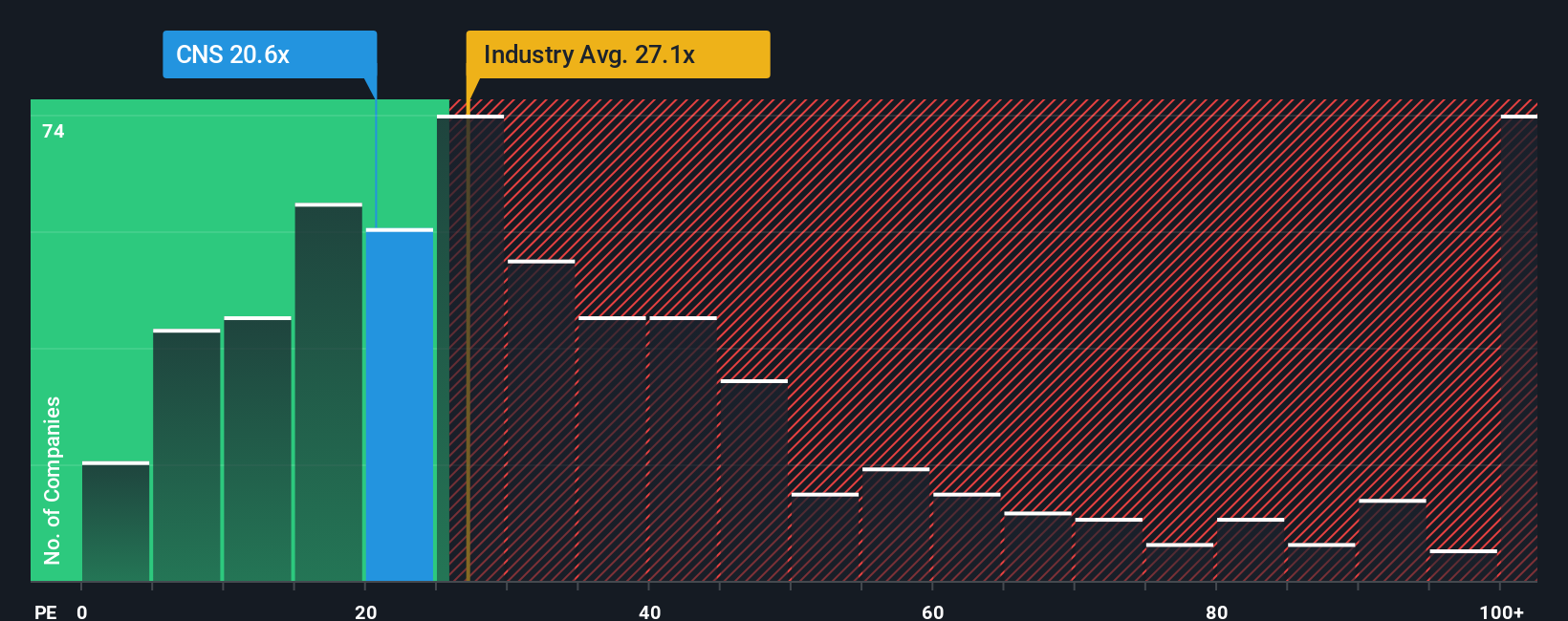

While the consensus says Cohen & Steers is modestly undervalued, a closer look at the price-to-earnings ratio raises questions. At 21.6x, it is cheaper than the industry average of 25.4x, but pricier than the peer average of 11.9x and the fair ratio of 16x. This spread suggests the stock sits in a valuation “grey zone” — it is not obviously a bargain, nor vastly overpriced. Does this gap deliver opportunity, or signal risk if sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cohen & Steers Narrative

If you want to dive deeper or take a different view, all the key numbers are at your fingertips. Explore the figures and craft your own perspective in under three minutes. Do it your way

A great starting point for your Cohen & Steers research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Expand your portfolio with opportunities others might miss by checking out handpicked stocks and themes. Explore these timely ideas before the next market move.

- Spot companies making waves in artificial intelligence by reviewing these 24 AI penny stocks and stay ahead as innovations transform global markets.

- Capture inflation-beating income from these 18 dividend stocks with yields > 3% delivering yields above 3% to shareholders seeking consistent returns.

- Ride the momentum behind tomorrow’s technology with a close look at these 26 quantum computing stocks, highlighting businesses shaping advances in quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNS

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives