- United States

- /

- Capital Markets

- /

- NYSE:CNS

A Fresh Look at Cohen & Steers (CNS) Valuation Following New Insurance-Linked Securities Joint Venture

Reviewed by Kshitija Bhandaru

Cohen & Steers (NYSE:CNS) has teamed up with Augment Risk to launch a new casualty insurance-linked securities joint venture. By combining broking expertise with investment experience, the partnership aims to streamline access to reinsurance capacity for clients.

See our latest analysis for Cohen & Steers.

Cohen & Steers’ collaboration with Augment Risk comes at an interesting point. While the latest news signals a push toward innovation in reinsurance, investors have seen overall momentum stall. The 1-year total shareholder return is down slightly at -0.28%. The 3- and 5-year total returns of 20% and 32.8% indicate that longer-term holders have still come out ahead, but recent share price returns suggest growth optimism has cooled for now.

If you’re curious about what else is moving in the financial sector, it might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares currently below analyst price targets and longer-term returns outpacing recent dips, the question now is whether Cohen & Steers is trading at a bargain or if the market already reflects its future prospects.

Most Popular Narrative: 11.7% Undervalued

According to the most widely followed narrative, Cohen & Steers' estimated fair value sits well above its last close of $65.64. With consensus analyst projections pricing in further upside, the stage is set for a potential re-rating as growth unfolds.

Strategic expansion into active ETFs and broader product diversification (including the launch of integrated listed/private real estate strategies) is expected to attract new investor segments and improve client retention, supporting future AUM growth and revenue stability. Ongoing investments in global distribution, particularly in Asia-Pacific and Europe, and recent foreign office upgrades are expected to drive international client inflows and scale, with potential for margin expansion as global business grows.

Want to know the real engine behind this valuation? This narrative hinges on aggressive product expansion, international scale, and the belief that earnings power will outpace current market expectations. Take a closer look to see what quantitative leaps are expected to justify the upside. Could these strategic shifts be the turning point? The numbers may surprise you.

Result: Fair Value of $74.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent client outflows or higher costs from global expansion could challenge the growth outlook and put pressure on profitability for Cohen & Steers.

Find out about the key risks to this Cohen & Steers narrative.

Another View: Multiples Raise a Caution

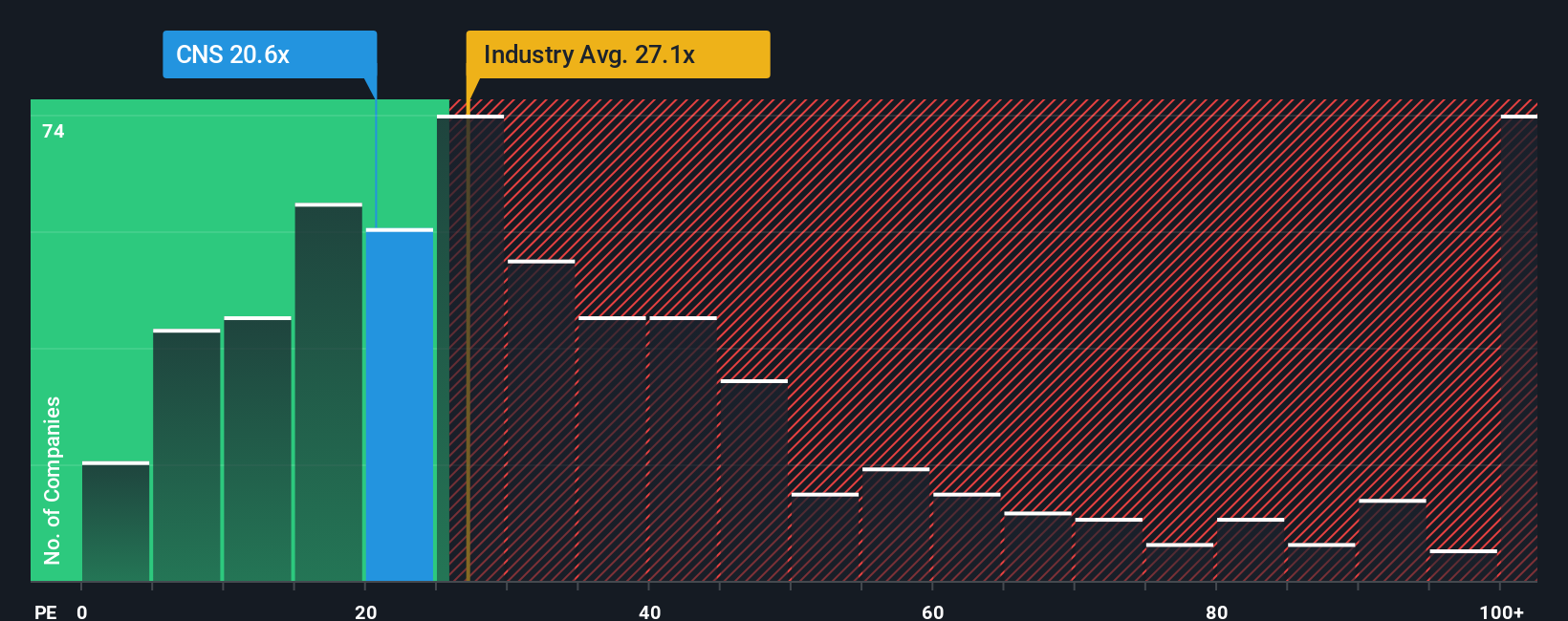

Taking a look through the lens of earnings multiples, Cohen & Steers currently trades at a price-to-earnings ratio of 20.6x. This is below the broader US Capital Markets industry average of 27.1x, but noticeably above the peer average of 11.9x and also above its own fair ratio of 16.6x. Despite recent earnings strength, this gap suggests investors may be paying a premium versus comparable companies, which could increase downside risk if growth stalls. Will the market reward this pricing, or could a reversion narrow the gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cohen & Steers Narrative

If you see things differently or want to test your own investment thesis, it’s easy to build your perspective on Cohen & Steers in just a few minutes, so Do it your way.

A great starting point for your Cohen & Steers research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit their options. Uncover fresh opportunities today with tools uniquely tailored to your goals and see how easily you can upgrade your portfolio.

- Tap into tomorrow’s market leaders when you scan through these 896 undervalued stocks based on cash flows, which analysts believe are trading below their true worth.

- Accelerate your growth plans by checking out these 19 dividend stocks with yields > 3%, offering robust yields for those seeking consistent income on top of capital gains.

- Catch the early wave of potential breakout companies by scouring these 24 AI penny stocks, which are harnessing real-world artificial intelligence in innovative ways.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNS

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives