- United States

- /

- Mortgage REITs

- /

- NYSE:BXMT

Blackstone Mortgage Trust's (NYSE:BXMT) Stock Price Has Reduced 29% In The Past Year

While it may not be enough for some shareholders, we think it is good to see the Blackstone Mortgage Trust, Inc. (NYSE:BXMT) share price up 15% in a single quarter. But in truth the last year hasn't been good for the share price. The cold reality is that the stock has dropped 29% in one year, under-performing the market.

View our latest analysis for Blackstone Mortgage Trust

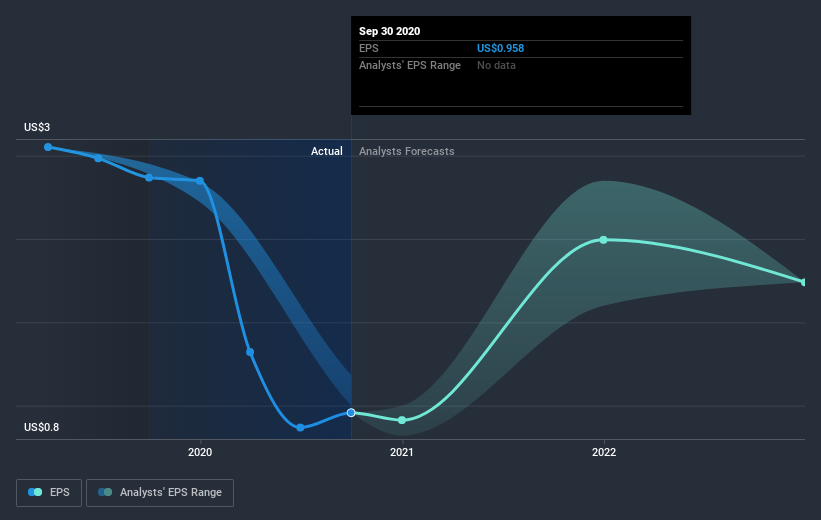

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately Blackstone Mortgage Trust reported an EPS drop of 60% for the last year. The share price fall of 29% isn't as bad as the reduction in earnings per share. It may have been that the weak EPS was not as bad as some had feared.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Blackstone Mortgage Trust's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Blackstone Mortgage Trust the TSR over the last year was -21%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Blackstone Mortgage Trust shareholders are down 21% for the year (even including dividends), but the market itself is up 27%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 12% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Blackstone Mortgage Trust (at least 2 which are a bit concerning) , and understanding them should be part of your investment process.

Of course Blackstone Mortgage Trust may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Blackstone Mortgage Trust, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Blackstone Mortgage Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:BXMT

Blackstone Mortgage Trust

A real estate finance company, originates senior loans collateralized by commercial properties in North America, Europe, and Australia.

High growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives