- United States

- /

- Mortgage REITs

- /

- NYSE:BXMT

A Closer Look at Blackstone Mortgage Trust (BXMT) Valuation Following Recent Share Price Dip

Reviewed by Simply Wall St

Blackstone Mortgage Trust (BXMT) shares edged up slightly following a period of muted trading, as investors continue to digest the company's recent performance. Over the past month, the stock has slipped by about 4%, which highlights some market caution.

See our latest analysis for Blackstone Mortgage Trust.

While Blackstone Mortgage Trust’s share price has faced some pressure recently, its year-to-date price return is still in positive territory, and the 1-year total shareholder return sits at 6.3%. This suggests that even with recent volatility, long-term holders have seen steady gains and the market remains attentive to potential shifts in growth or risk perception.

If you’re looking for other opportunities with forward momentum, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a modest discount to analyst targets and steady returns over time, the key question now is whether Blackstone Mortgage Trust is undervalued or if the market already reflects its growth prospects.

Most Popular Narrative: 10% Undervalued

Blackstone Mortgage Trust's most widely followed narrative sets its fair value at $20.50 per share, around 10% above the last close of $18.37. This positions BXMT as a potential value pick if those future projections are achieved and sharpens the focus on the strategic moves driving the forecast.

The company is focusing on portfolio turnover through repayments and redeployment into high-quality new credit opportunities, which is expected to enhance future earnings by improving the overall credit composition and potentially increasing revenue from new investments.

Curious what’s fueling the bold fair value? The most popular narrative factors in high-octane profit growth and margin expansion, along with a shrinking share base. Discover which powerful financial assumptions and strategic pivots could push BXMT to that higher valuation. All the details are revealed inside the full narrative.

Result: Fair Value of $20.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are notable risks, such as delays in resolving impaired loans and market volatility, that could challenge Blackstone Mortgage Trust’s positive outlook.

Find out about the key risks to this Blackstone Mortgage Trust narrative.

Another View: What Multiples Say

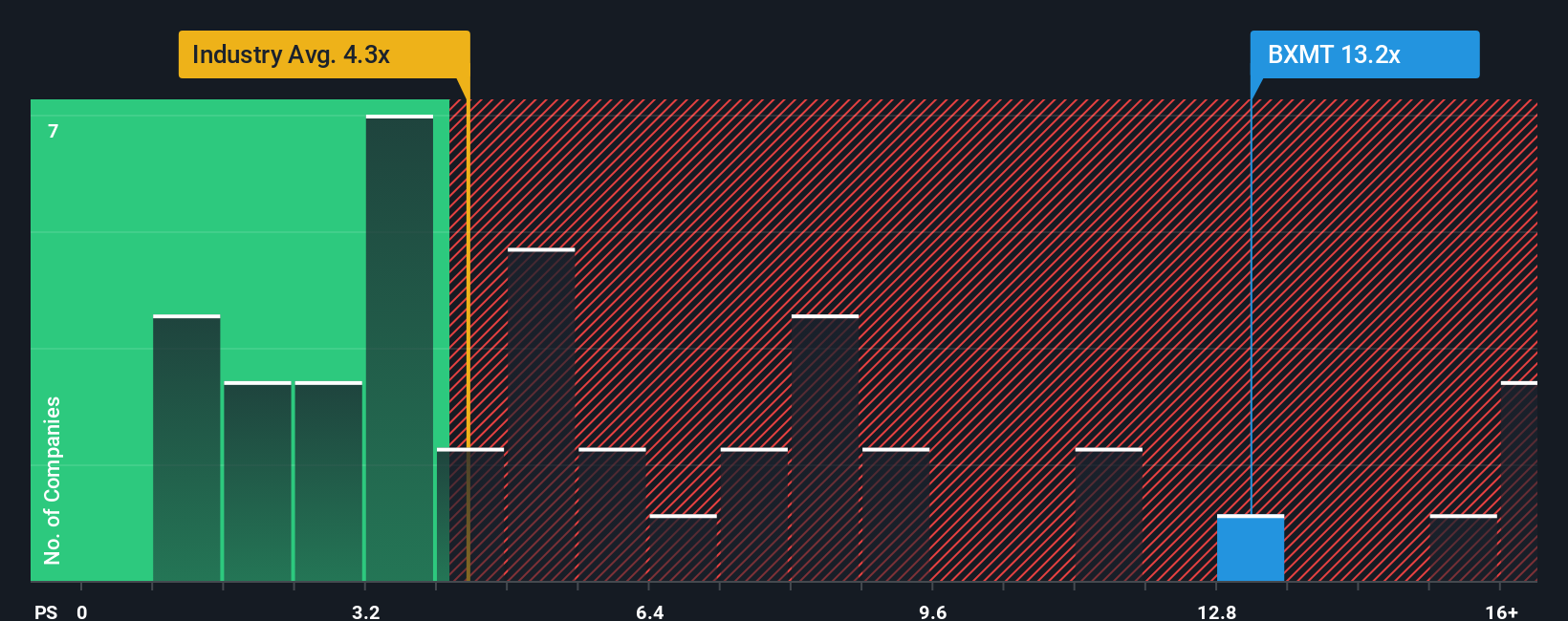

Looking at the price-to-sales ratio, Blackstone Mortgage Trust trades at 13.2 times sales. That is much higher than both the US Mortgage REITs industry average of 4.3 and the peer average of 9.4. It also sits well above the fair ratio of 3.9. This sizable gap suggests the market may be factoring in more optimism than fundamentals currently reflect, raising key questions about potential valuation risk or whether a catch-up is on the horizon.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Blackstone Mortgage Trust Narrative

If you want to dig into the numbers yourself or have your own perspective on BXMT’s outlook, you can craft your own view in just a few minutes. Do it your way.

A great starting point for your Blackstone Mortgage Trust research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your next move and seize market opportunities that others might miss. The right strategy can multiply your results, but only if you take action now.

- Capitalize on the explosive rise of artificial intelligence by targeting potential market shakers among these 26 AI penny stocks who are positioned for breakout growth.

- Secure your portfolio with steady income by tapping into these 17 dividend stocks with yields > 3% featuring resilient businesses that offer yields above 3%.

- Ride the momentum of undervalued winners by scanning these 874 undervalued stocks based on cash flows and uncovering stocks with strong cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone Mortgage Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BXMT

Blackstone Mortgage Trust

A real estate finance company, originates senior loans collateralized by commercial properties in North America, Europe, and Australia.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives