- United States

- /

- Capital Markets

- /

- NYSE:BX

Blackstone (NYSE:BX) Reportedly In Talks To Acquire TXNM Energy's Utility Business

Reviewed by Simply Wall St

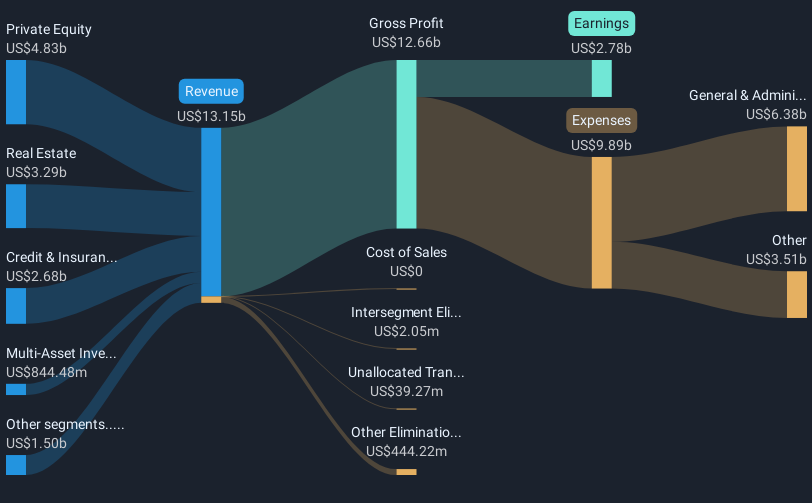

Blackstone (NYSE:BX) is reportedly in talks to acquire TXNM Energy, making the company the leading bidder after others dropped out, according to recent discussions. This potential acquisition focus appears in line with Blackstone's growth strategy and could add weight to its recent 16.84% share price increase over the last month. Additional sector activities include Blackstone's Q1 earnings, showing a revenue decline, and their launch of a multi-asset credit interval fund, which could bolster investor interest in its offerings. Despite a market rise of 3.9% recently, these company-specific developments have likely reinforced Blackstone's price movement.

We've spotted 3 warning signs for Blackstone you should be aware of, and 1 of them is significant.

The potential acquisition of TXNM Energy by Blackstone could influence the company's growth narrative, enhancing its infrastructure portfolio and possibly increasing revenue streams. This aligns with Blackstone's broader strategy of expanding its asset management capabilities and exploring new sector ventures. Over the last five years, Blackstone's total shareholder return, combining share price appreciation and dividends, showed impressive growth, reaching 234.54%. This suggests robust long-term performance, albeit recent efforts to reposition within infrastructure and digital spheres may come with risks of higher operational costs or revenue fluctuations.

In the past year, Blackstone's performance relative to the industry reveals a mixed picture, as the company underperformed the US Capital Markets industry, which returned 25.3%. Analysts' revenue and earnings forecasts reflect expectations of moderate growth, tempered by challenges associated with scaling large capital deployments and potential inefficiencies. The recent 16.84% share price rise, potentially buoyed by acquisition talks, contrasts the forecasted bearish target of US$144.73, indicating cautious optimism among investors. While the current stock sits below consensus fair values, how the acquisition scene plays out will be key in shaping long-term valuation and growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BX

Blackstone

An alternative asset management firm specializing in private equity, real estate, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives