- United States

- /

- Diversified Financial

- /

- NYSE:BRK.A

Subdued Growth No Barrier To Berkshire Hathaway Inc.'s (NYSE:BRK.A) Price

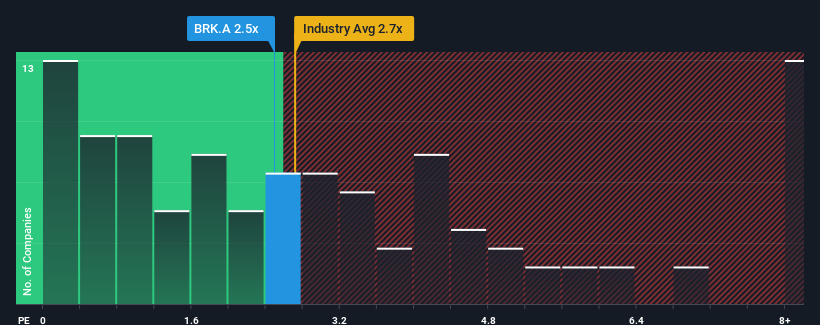

There wouldn't be many who think Berkshire Hathaway Inc.'s (NYSE:BRK.A) price-to-sales (or "P/S") ratio of 2.5x is worth a mention when the median P/S for the Diversified Financial industry in the United States is similar at about 2.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Berkshire Hathaway

What Does Berkshire Hathaway's Recent Performance Look Like?

Recent revenue growth for Berkshire Hathaway has been in line with the industry. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Want the full picture on analyst estimates for the company? Then our free report on Berkshire Hathaway will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Berkshire Hathaway?

In order to justify its P/S ratio, Berkshire Hathaway would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. The latest three year period has also seen an excellent 48% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 9.9% as estimated by the sole analyst watching the company. With the industry predicted to deliver 0.3% growth, that's a disappointing outcome.

In light of this, it's somewhat alarming that Berkshire Hathaway's P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From Berkshire Hathaway's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our check of Berkshire Hathaway's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Before you take the next step, you should know about the 1 warning sign for Berkshire Hathaway that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Berkshire Hathaway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRK.A

Berkshire Hathaway

Through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives