- United States

- /

- Capital Markets

- /

- NYSE:BLK

How IBIT’s Breakout Performance Will Impact BlackRock (BLK) Investors

Reviewed by Sasha Jovanovic

- BlackRock's iShares Bitcoin Trust ETF (IBIT) has recently become the company's most profitable exchange-traded fund, surpassing long-standing products as surging demand for regulated cryptocurrency exposure drives record-high net inflows and assets under management.

- This shift not only highlights IBIT's rapid ascent but also underlines the growing institutional and retail appetite for digital assets, reinforcing BlackRock's leadership position in ETF innovation at a time when cryptocurrency markets are drawing exceptional attention.

- We'll explore how IBIT's historic inflows and profitability are reshaping BlackRock's investment narrative, particularly its positioning in digital asset management.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

BlackRock Investment Narrative Recap

To own BlackRock stock, you must believe in continued demand for its diverse asset management platforms, ETF innovation, and ability to capture inflows across both traditional and digital assets. The record profitability and inflows into the iShares Bitcoin Trust ETF add a significant short-term catalyst, demonstrating BlackRock’s ability to tap new investor interest, but do not materially reduce the key risks of ongoing fee compression and margin pressure, especially as competitors and regulatory changes loom.

Among recent announcements, the launch of the iShares Large Cap 10% Target Buffer ETFs is particularly relevant given the focus on diversifying income streams and providing tailored solutions as fee competition intensifies. These new offerings, targeting downside protection alongside traditional equity exposure, illustrate BlackRock’s efforts to maintain leadership as passive product profitability faces headwinds from price competition and evolving investor demands.

In contrast, investors should be mindful that even as digital asset ETFs flourish, the persistently declining fee rates across BlackRock’s ETF suite could still...

Read the full narrative on BlackRock (it's free!)

BlackRock's narrative projects $28.7 billion revenue and $8.9 billion earnings by 2028. This requires 9.9% yearly revenue growth and a $2.5 billion earnings increase from $6.4 billion today.

Uncover how BlackRock's forecasts yield a $1204 fair value, in line with its current price.

Exploring Other Perspectives

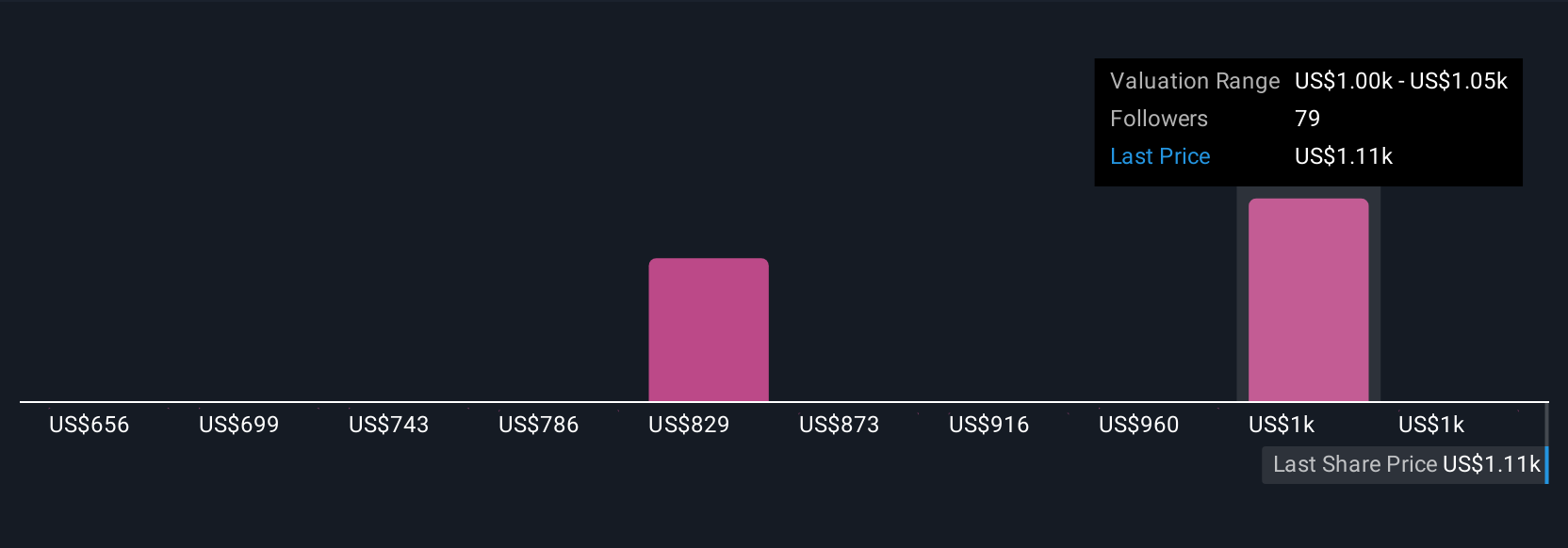

Seventeen fair value estimates from the Simply Wall St Community for BlackRock range from US$679.55 to US$1,391.79 per share. While many see growth from digital assets as a catalyst, the risk of industry-wide fee compression remains a major consideration influencing the company’s earnings outlook, explore these alternative viewpoints to understand how differently market participants are weighing each factor.

Explore 17 other fair value estimates on BlackRock - why the stock might be worth as much as 18% more than the current price!

Build Your Own BlackRock Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BlackRock research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BlackRock research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BlackRock's overall financial health at a glance.

No Opportunity In BlackRock?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackRock might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLK

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives