- United States

- /

- Capital Markets

- /

- NYSE:BLK

BlackRock (NYSE:BLK) Sees Revenue Growth While Earnings Per Share Declines

Reviewed by Simply Wall St

BlackRock (NYSE:BLK) recently announced its Q1 2025 earnings, showing a rise in revenue to USD 5,276 million, but a decline in net income and EPS. This mixed earnings report coincided with a 6.8% price uptick over the past week. During the same period, the broader market rose 5.4%, suggesting the earnings news perhaps added strength to broader market gains, without deviating significantly from the overall market direction. Despite the profit pressures, BlackRock's revenue growth reinforces its operational momentum, contributing positively to its shares' performance in line with market trends.

Buy, Hold or Sell BlackRock? View our complete analysis and fair value estimate and you decide.

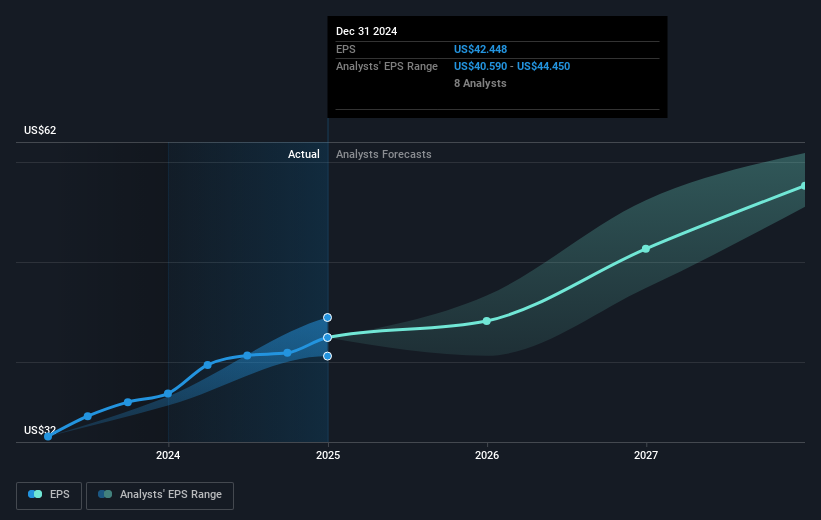

BlackRock's recent earnings announcement, with a rise in revenue to US$5.28 billion but a decline in net income and EPS, aligns with the observed short-term share price increase. This suggests that while profit pressures exist, the company's operational momentum has been acknowledged positively by the market. Importantly, BlackRock's shares have shown considerable growth over a longer term, achieving a total shareholder return of 108.35% over the past five years. This performance is noteworthy, especially when compared to the broader US market's 3.6% return over the past year, although the company's earnings growth of 15.8% lagged behind the industry average of 18.4%.

The earnings report's impact on revenue and earnings forecasts could be significant. Analysts remain optimistic, projecting an increase in revenue and earnings through strategic growth initiatives, including acquisitions and technological advancements. These efforts aim to solidify BlackRock’s market position, particularly in emerging markets, potentially enhancing future revenue streams. The current share price, which recently moved upwards following the earnings announcement, is trading at a discount to the consensus price target of US$1,079.79, indicating a potential upside if the company continues to meet or exceed growth expectations. Amidst mixed profitability signals, the strategic focus on ETFs and technology could bolster BlackRock’s margins and market valuation.

Click to explore a detailed breakdown of our findings in BlackRock's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade BlackRock, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BlackRock might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLK

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives