- United States

- /

- Capital Markets

- /

- NYSE:BLK

BlackRock (NYSE:BLK) AI Partnership Expands With NVIDIA and xAI Aiming For US$30 Billion Capital Unlock

Reviewed by Simply Wall St

BlackRock (NYSE:BLK) experienced a 6% increase in its share price over the past week, a movement that can be closely linked to the recent expansion of its AI Infrastructure Partnership (AIP). The inclusion of prominent tech companies like NVIDIA and xAI adds significant value to the initiative, underscoring advancements in AI-driven economic growth. Meanwhile, the market has seen mixed performances, with the Dow Jones up slightly, while the S&P 500 and Nasdaq Composite experienced minor declines. Notwithstanding broader market uncertainties, the strategic partnerships and investment goals with energy giants like GE Vernova and NextEra Energy may have instilled confidence among investors. The broader market's climb of 2% over the same period indicates a general recovery, which likely further supported the positive momentum for BlackRock’s stock performance as the AIP promises substantial investment potential in AI and energy infrastructure.

Buy, Hold or Sell BlackRock? View our complete analysis and fair value estimate and you decide.

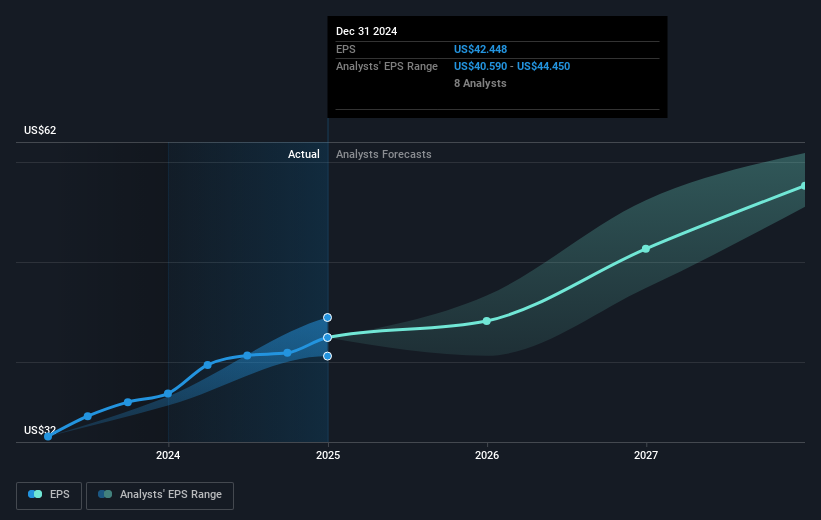

Over the past five years, BlackRock enjoyed a total shareholder return of 139.50%, showcasing the company's robust ability to deliver value to its shareholders. Although BlackRock's revenue growth didn't match the industry's quick pace, its consistent earnings growth played a pivotally supportive role. The company's strategic expansion into private markets was marked by the acquisition of HPS Investment Partners, announced in December 2024, which aimed to boost its private credit capabilities.

Additionally, BlackRock's product innovation included the launch of several ETFs, such as the iShares Managed Futures Active ETF in March 2025, aligning with evolving market demands. On the dividend front, BlackRock demonstrated reliability by declaring dividend increases, such as the 2% rise in January 2025 to US$5.21 per share. While BlackRock underperformed the US Capital Markets industry over the past year, it still outperformed the overall US Market, which saw an 8.1% return, reflecting its resilient long-term performance amidst changing market dynamics.

Explore historical data to track BlackRock's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackRock might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLK

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives