- United States

- /

- Capital Markets

- /

- NYSE:BLK

BlackRock (BLK): Assessing Value After Recent Share Price Pause

Reviewed by Kshitija Bhandaru

BlackRock (BLK) shares have edged slightly lower over the past week, giving investors a moment to reassess after a period of steady growth. The company remains in focus as market participants look for clues about its next move.

See our latest analysis for BlackRock.

After a strong run earlier in the year, BlackRock’s share price has pulled back slightly this week, suggesting some investors are locking in gains or reassessing the near-term outlook. The broader trend remains positive, with an 11.3% year-to-date share price return and an impressive 16.7% total shareholder return over the past twelve months, signaling steady long-term momentum.

If you’re watching financial leaders like BlackRock, now’s a smart moment to broaden your perspective and discover fast growing stocks with high insider ownership

With the stock pulling back after a period of strong gains, investors are left to wonder whether BlackRock’s recent momentum leaves room for further upside, or if the company’s future prospects are already fully reflected in its share price.

Most Popular Narrative: 5.9% Undervalued

BlackRock’s latest fair value is now well above the last close, with the narrative suggesting shares still have more to run. Let’s examine the drivers that could influence this outlook.

BlackRock's expansion into private markets through acquisitions like HPS Investment Partners, GIP, and ElmTree positions the company to capitalize on the secular shift of institutional assets into alternatives and infrastructure. This strategy is driving higher-fee revenue streams and long-term earnings growth.

Wonder what bold growth assumptions are behind these numbers? The narrative recalibrates BlackRock’s future using projections for top-line expansion, margin improvements, and sustained leadership in emerging markets. Insiders will want to dissect which variables make the difference in this story. Dive in for the full financial playbook.

Result: Fair Value of $1,203.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including sustained fee compression and challenges integrating recent acquisitions. These factors could weigh on margins and test BlackRock’s growth strategy.

Find out about the key risks to this BlackRock narrative.

Another View

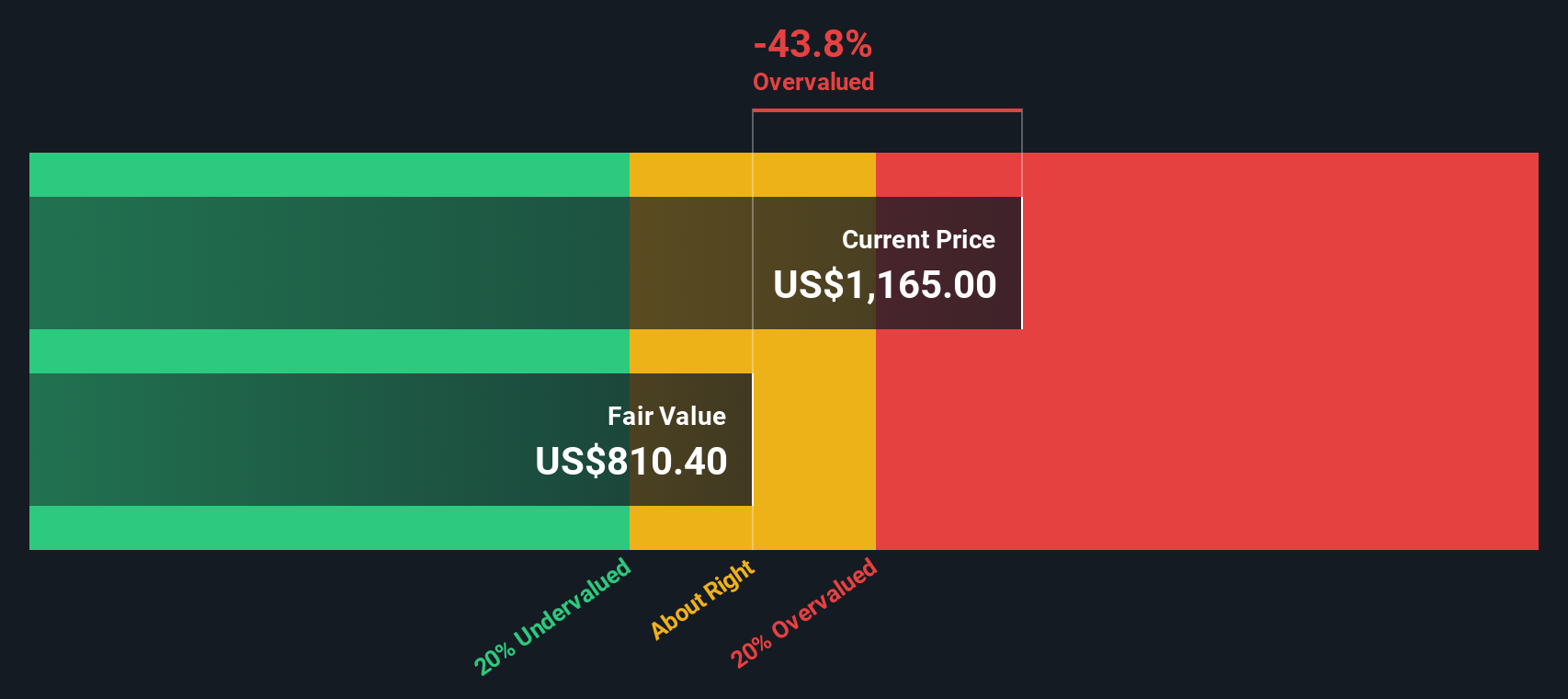

While the analyst price target and consensus narrative see BlackRock as undervalued, our SWS DCF model offers a less optimistic perspective. According to this model, BlackRock is trading above its estimated fair value, which suggests there may be less upside than initially indicated. Is this a caution sign or simply a difference in analytical approach?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BlackRock for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BlackRock Narrative

If you’d rather test the numbers yourself or form a unique perspective, tap into the data and build a custom view in just a few minutes with Do it your way.

A great starting point for your BlackRock research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make your next smart move by checking out powerful opportunities beyond BlackRock. These handpicked screens showcase the real standouts you do not want to overlook.

- Boost your portfolio’s growth by targeting high-potential companies featured in these 891 undervalued stocks based on cash flows, where strong fundamentals meet attractive valuations.

- Capitalize on innovation in healthcare by spotting future leaders spearheading artificial intelligence breakthroughs with these 33 healthcare AI stocks.

- Uncover income powerhouses selected for robust payouts when you check out these 19 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackRock might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLK

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026