- United States

- /

- Capital Markets

- /

- NYSE:BLK

BlackRock (BLK): Assessing Valuation as Shares Extend Steady Climb

Reviewed by Kshitija Bhandaru

See our latest analysis for BlackRock.

BlackRock’s share price has steadily built momentum over the past year, with a 1-year total shareholder return of nearly 25% signaling that investors are rewarding its consistent growth and solid earnings backdrop. While day-to-day moves have been modest, the bigger story is a pattern of confidence supported by positive fundamentals and a healthy long-term trajectory.

If BlackRock’s sustained gains have you thinking bigger, this could be the perfect time to discover fast growing stocks with high insider ownership

But with BlackRock currently trading near its all-time high, investors are left wondering if there is real value left to capture or if the optimism about future growth has already been reflected in the price.

Most Popular Narrative: 3.6% Undervalued

Despite closing at $1,160.54, BlackRock's most closely followed narrative estimates a fair value of $1,203.69. This suggests there could still be value yet to be realized from here. Investors watching this stock may want to examine what justifies the difference in those numbers given the company's strong current price.

BlackRock's expansion into private markets through acquisitions like HPS Investment Partners, GIP, and ElmTree positions the company to capitalize on the secular shift of institutional assets into alternatives and infrastructure. This strategy drives higher-fee revenue streams and long-term earnings growth. The company's global platform and targeted expansion in emerging markets, such as India and the Middle East, align with the continued growth in global wealth and the investable asset base. This approach supports AUM growth and future fee accretion as capital markets and retirement systems develop in these regions.

What is fueling this calculated price potential? The future valuation depends on much more than BlackRock’s brand or scale. Bold projections about new market growth, earnings runway, and the potential for record-setting profitability are just the beginning. Ready to see how the details add up? The full narrative reveals what powers this ambitious fair value.

Result: Fair Value of $1,203.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent fee compression and regulatory headwinds could challenge BlackRock's margins and limit the extent to which its projected growth actually materializes.

Find out about the key risks to this BlackRock narrative.

Another View: DCF Model Offers a Reality Check

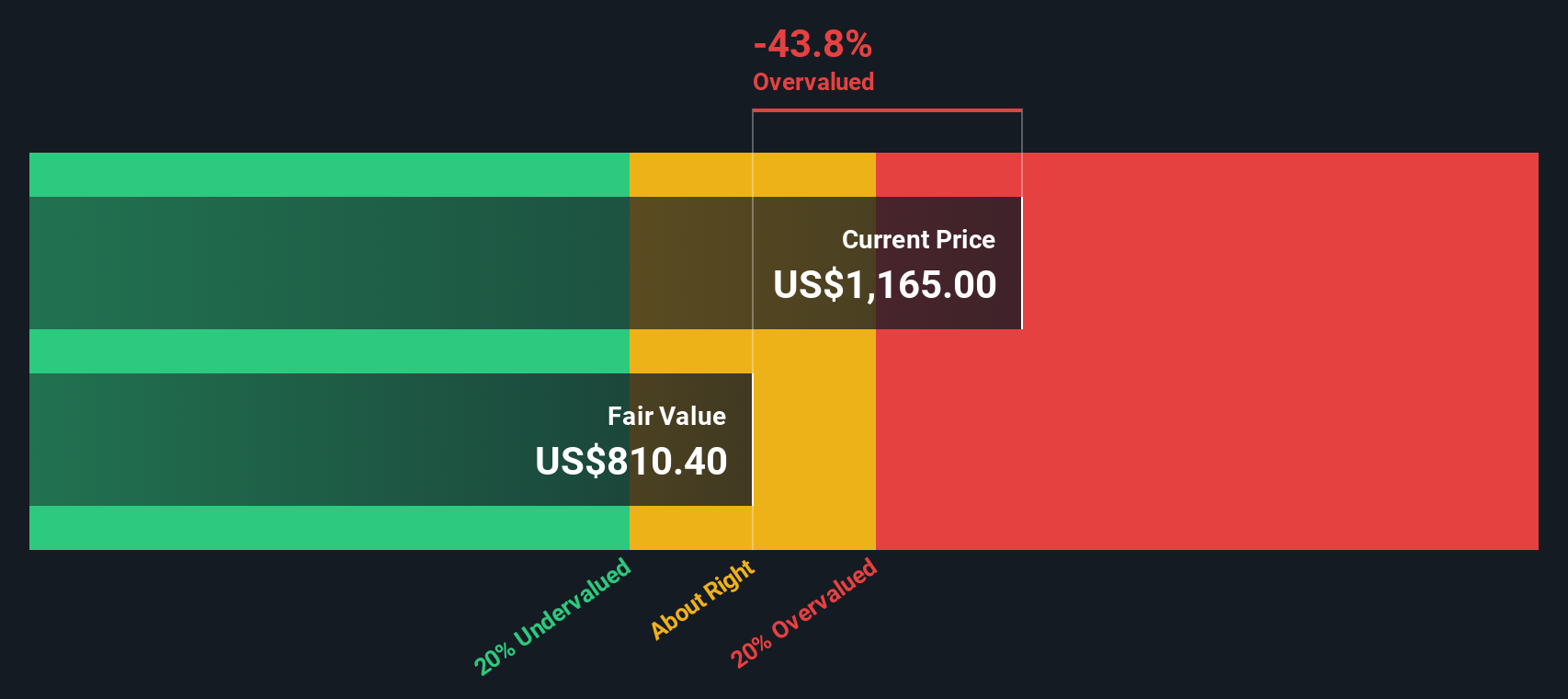

While the most popular narrative points to BlackRock being 3.6% undervalued, our SWS DCF model shows a starkly different picture. According to this method, BlackRock's current share price is well above its calculated fair value, suggesting it may actually be overvalued. How much weight should you give to growth narratives if intrinsic value measures point the other way?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BlackRock for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BlackRock Narrative

If you believe there's another side to the story or want to take a hands-on approach, it's easy to dive into the numbers and build your own unique narrative in just a few minutes. Do it your way

A great starting point for your BlackRock research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Seize the chance to find fresh opportunities you won’t want to miss. The Simply Wall Street Screener surfaces standout stocks based on what matters most to investors right now.

- Pinpoint high-yield contenders and maximise your income potential when you check out these 19 dividend stocks with yields > 3% that consistently deliver strong returns.

- Spot the innovators reshaping entire industries with artificial intelligence. Tap directly into these 24 AI penny stocks and stay a step ahead in tomorrow’s economy.

- Capitalize on hidden value by targeting these 910 undervalued stocks based on cash flows where market prices haven’t caught up to true potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackRock might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLK

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives