- United States

- /

- Capital Markets

- /

- NYSE:BKKT

Bakkt Holdings, Inc. (NYSE:BKKT) Shares Fly 53% But Investors Aren't Buying For Growth

Bakkt Holdings, Inc. (NYSE:BKKT) shareholders would be excited to see that the share price has had a great month, posting a 53% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.8% in the last twelve months.

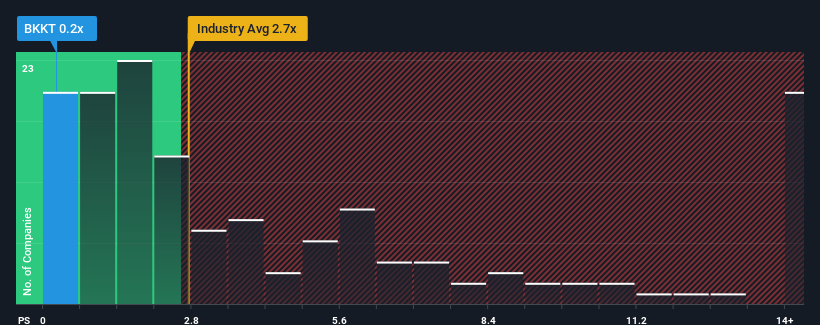

Although its price has surged higher, Bakkt Holdings may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Capital Markets industry in the United States have P/S ratios greater than 2.7x and even P/S higher than 7x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Bakkt Holdings

What Does Bakkt Holdings' P/S Mean For Shareholders?

Bakkt Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Bakkt Holdings will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Bakkt Holdings?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Bakkt Holdings' to be considered reasonable.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 87% during the coming year according to the three analysts following the company. That's not great when the rest of the industry is expected to grow by 8.0%.

With this in consideration, we find it intriguing that Bakkt Holdings' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Bakkt Holdings' recent share price jump still sees fails to bring its P/S alongside the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's clear to see that Bakkt Holdings maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Bakkt Holdings' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Bakkt Holdings (of which 3 are a bit unpleasant!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Bakkt Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BKKT

Bakkt Holdings

Offers software as a service and application programming interface solutions for crypto and loyalty, powering engagement, and performance.

Adequate balance sheet slight.

Market Insights

Community Narratives