- United States

- /

- Consumer Finance

- /

- NYSE:BFH

What Bread Financial Holdings (BFH)'s US$75 Million Preferred Equity Raise Means For Shareholders

Reviewed by Sasha Jovanovic

- Bread Financial Holdings, Inc. recently completed a US$75 million fixed-income offering of non-convertible, callable, non-cumulative, perpetual depository shares, following a shelf registration of preferred stock and depository shares earlier in November 2025.

- This capital raise reflects the company's ongoing focus on optimizing its funding structure, which could influence perceptions of balance sheet strength and future financial flexibility.

- Let's explore how Bread Financial's recent move to raise US$75 million in preferred equity could affect its investment narrative and outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Bread Financial Holdings Investment Narrative Recap

If you're considering Bread Financial Holdings, you likely believe in its ability to optimize funding costs and drive earnings from digital payment innovations and expanding co-brand partnerships. The recent US$75 million preferred equity raise supports funding flexibility, but does not meaningfully impact the biggest short-term catalyst, growth from new payment solutions, or the main risk, which is potential pressure on net margins from increased competition and a shift in customer mix. Among recent developments, Bread Financial's US$500 million senior notes offering announced in early November is particularly relevant. This move to refinance higher-cost debt aligns with efforts to lower funding expenses, which is consistent with the objectives behind the new preferred equity raise and could provide some cushion as the company faces competitive and credit-related headwinds. Yet, despite these funding actions, investors should watch for signs that increased competition may cut deeper into profit margins than expected...

Read the full narrative on Bread Financial Holdings (it's free!)

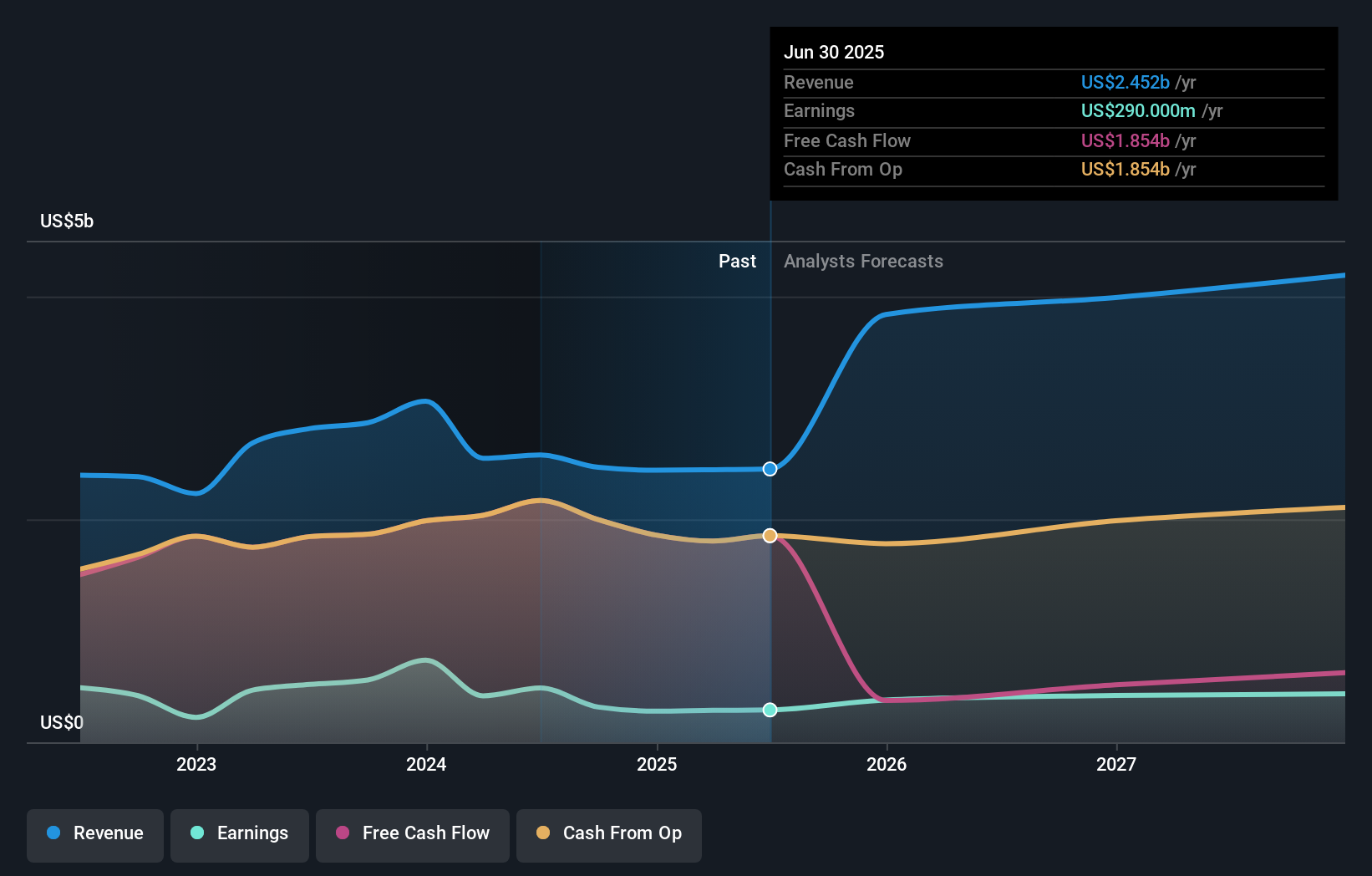

Bread Financial Holdings' narrative projects $4.3 billion in revenue and $379.5 million in earnings by 2028. This requires 20.3% yearly revenue growth and a $89.5 million earnings increase from $290.0 million today.

Uncover how Bread Financial Holdings' forecasts yield a $70.20 fair value, a 4% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community included 1 fair value estimate for Bread Financial at US$70.20 per share, with no range among views. As competition remains intense and pricing remains pressured, it's clear opinions can vary, be sure to consider all the angles when reviewing your own expectations.

Explore another fair value estimate on Bread Financial Holdings - why the stock might be worth just $70.20!

Build Your Own Bread Financial Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bread Financial Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bread Financial Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bread Financial Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bread Financial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BFH

Bread Financial Holdings

Provides tech-forward payment and lending solutions to customers and consumer-based industries in North America.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026