- United States

- /

- Consumer Finance

- /

- NYSE:BFH

Are Shares of Bread Financial Set for Growth After Digital Payments Expansion?

Reviewed by Bailey Pemberton

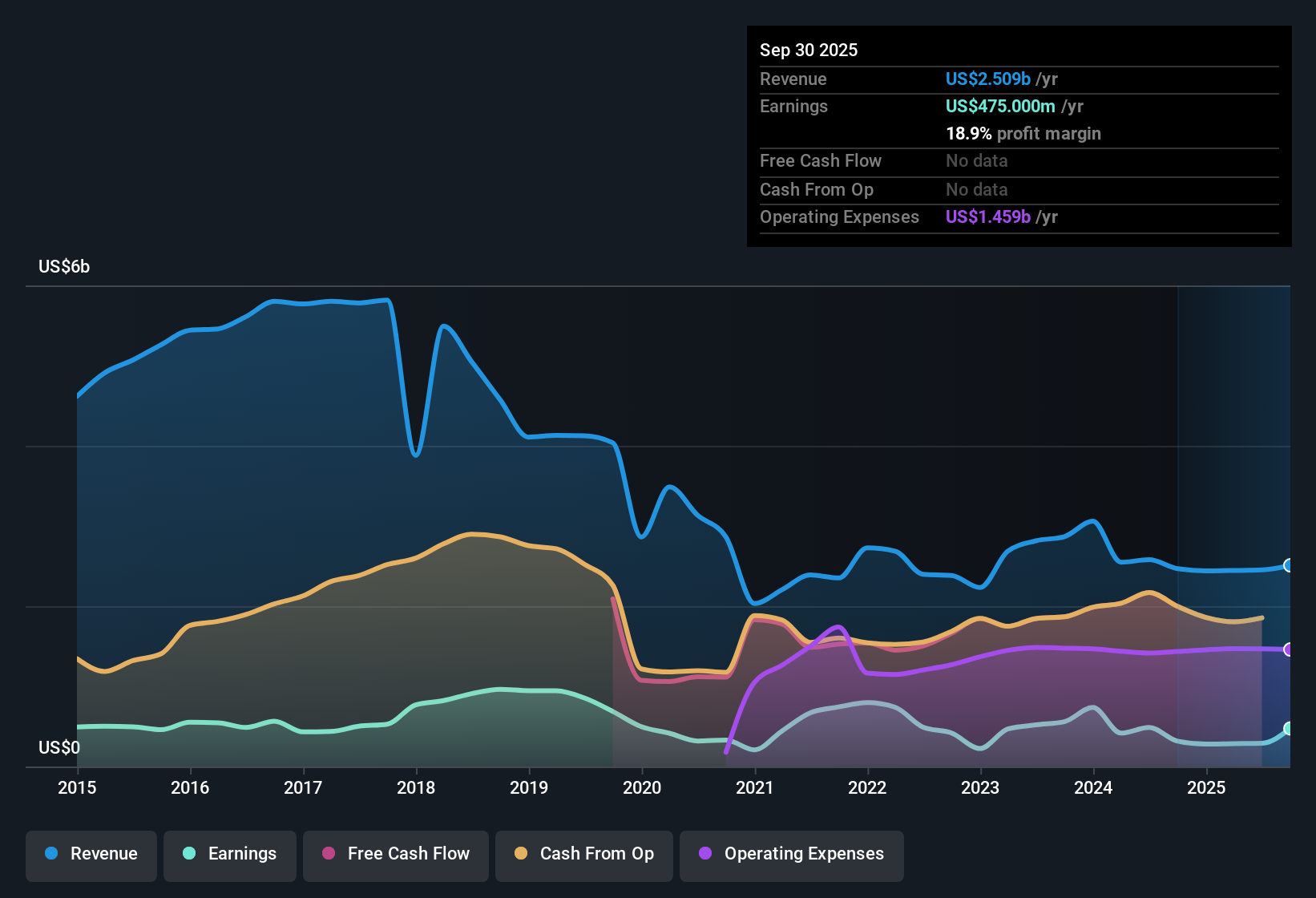

Deciding what to do with Bread Financial Holdings stock right now means cutting through the noise and getting honest about its actual value. If you have been watching the ticker, you might have noticed a bit of a rollercoaster. Over the past year, shares have shot up by 20.4%, while the journey over three and five years has been even more impressive, nearly doubling with 97.6% and 89.2% returns, respectively. Yet, in the last month, the stock slipped by 3.3%, even after gaining 1.3% this past week. It is enough movement to make anyone wonder if the real growth has already happened or if there is more to come.

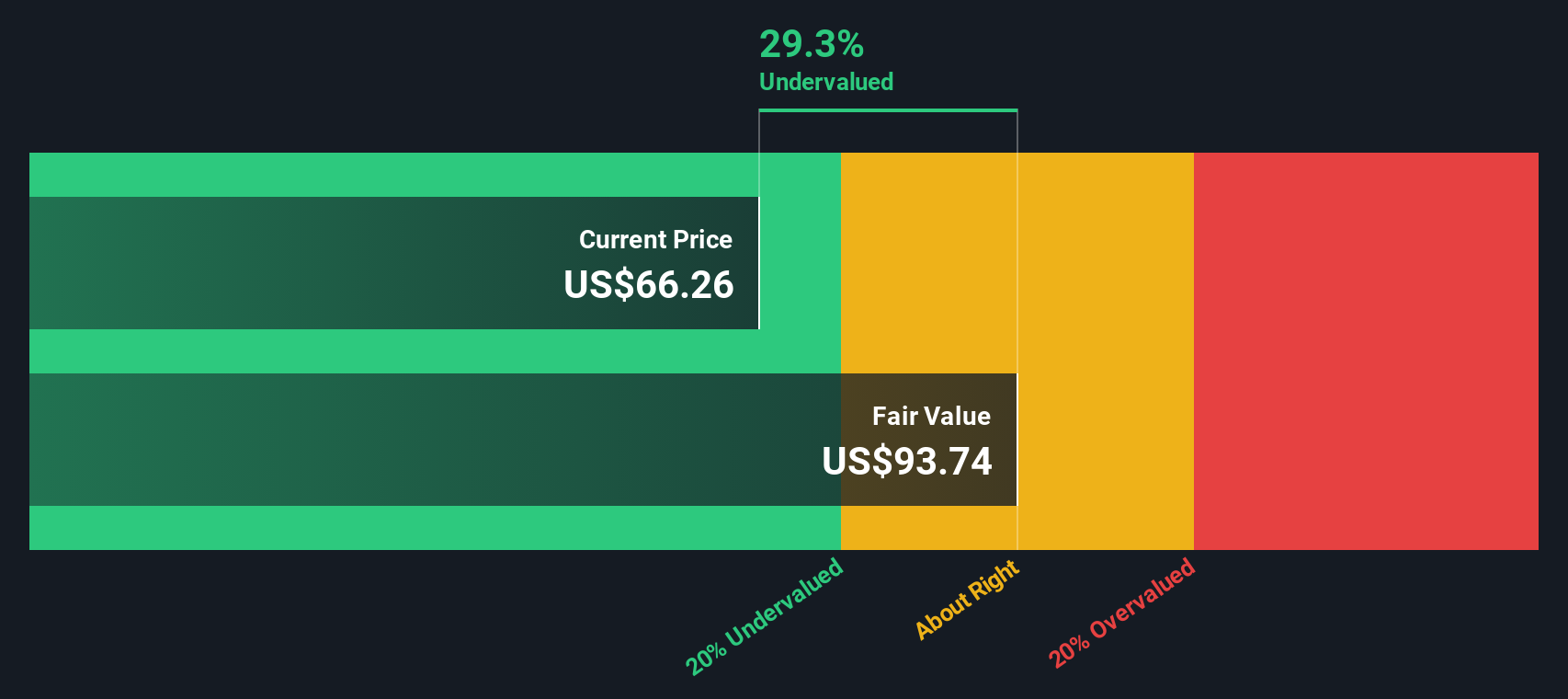

What is behind these swings? Part of the story is renewed investor attention after Bread Financial expanded its digital payments partnerships and further streamlined its credit card business. These moves are designed to keep it essential as shopping trends shift online. These efforts have made many investors take a fresh look at its prospects and risk profile, feeding both optimism and profit-taking. Despite recent volatility, the company’s value score is currently 4 out of 6, which tells us it meets undervaluation criteria on two-thirds of standard checks. That number does not just look good on paper; it sets the stage for a real valuation deep dive.

If you are serious about understanding whether Bread Financial Holdings is a buy, hold, or sell, you need to see how it stacks up across the most respected valuation approaches. Let us break down those methods, and stay tuned, because the most insightful way to weigh a stock’s worth might surprise you at the end.

Why Bread Financial Holdings is lagging behind its peers

Approach 1: Bread Financial Holdings Excess Returns Analysis

The Excess Returns model measures how much a company earns above the minimum required return on its equity, focusing on the efficiency of invested capital and its ability to generate value over time. For Bread Financial Holdings, this approach highlights several key figures.

The company's Book Value stands at $67.94 per share, reflecting the net asset value according to its latest accounts. Analysts estimate a stable Earnings Per Share (EPS) of $8.24, while the cost of equity is almost identical at $8.20 per share. This results in an excess return of just $0.04 per share, meaning the anticipated return above what is required is positive, but minimal. The average Return on Equity is 11.66%, underscoring the company's solid profitability, and the stable Book Value is projected at $70.67 per share, based on a consensus of future analyst estimates.

According to these projections, the Excess Returns model values Bread Financial Holdings at $71.13 per share. Since this represents a 14.9% discount compared to current share prices, the stock appears meaningfully undervalued based on this model.

Result: UNDERVALUED

Our Excess Returns analysis suggests Bread Financial Holdings is undervalued by 14.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Bread Financial Holdings Price vs Earnings

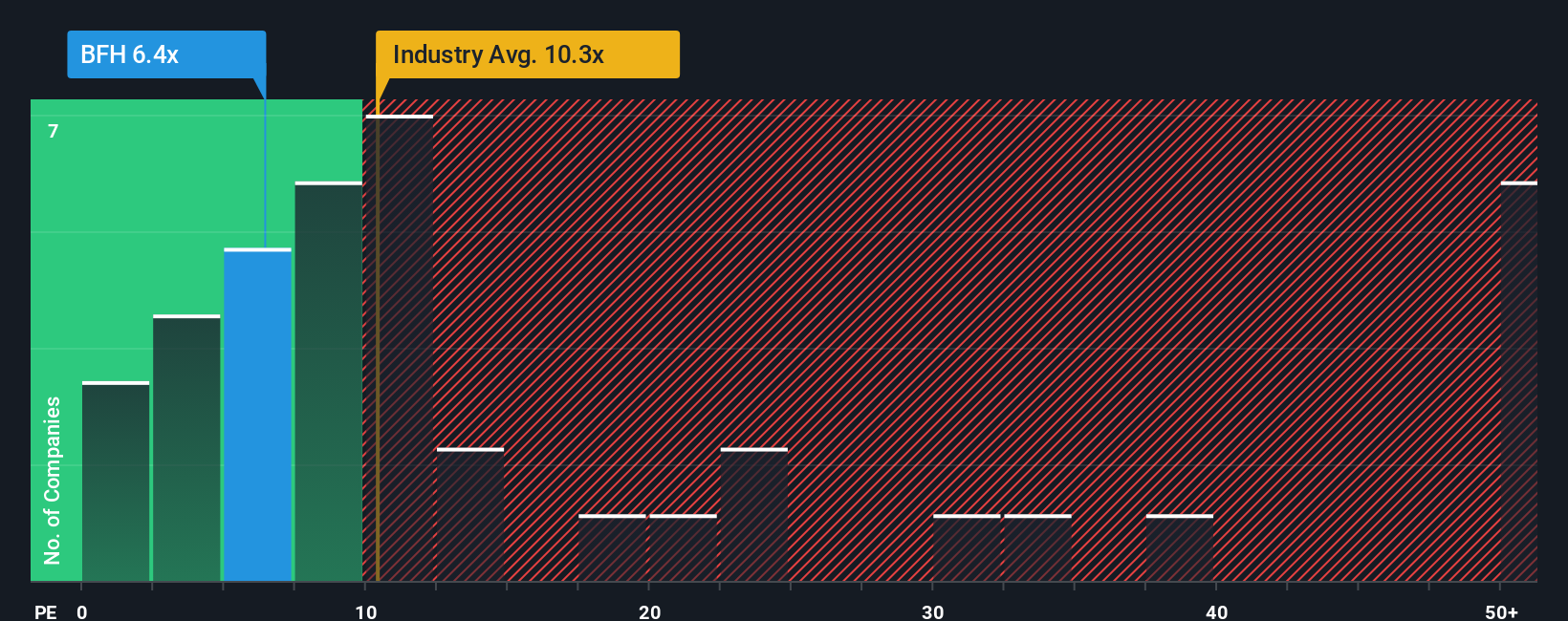

For profitable companies like Bread Financial Holdings, the Price-to-Earnings (PE) ratio is often the most relevant benchmark for valuation. It allows investors to quickly see how much they are paying for every dollar of company earnings. Growth expectations and risk are central here; companies with stronger growth prospects or lower risk profiles typically command higher PE ratios, while slower growth or more uncertainty can justify lower ones.

Bread Financial Holdings currently trades at a PE ratio of 9.74x. To put this in context, the Consumer Finance industry average is 10.48x, while the average for similar peers sits at 13.65x. This means Bread Financial’s shares are priced a bit below the broader industry and notably below the average of its closest competitors.

That said, simply comparing PE ratios can be misleading. This is where Simply Wall St’s “Fair Ratio” comes in, a proprietary measure reflecting what Bread Financial’s PE should reasonably be, based on its earnings growth, risk profile, profit margins, industry conditions, and market cap. By blending these factors, the Fair Ratio (14.62x) offers a more nuanced view than simple peer or industry comparisons can provide.

With the current PE ratio at 9.74x and a Fair Ratio at 14.62x, Bread Financial Holdings appears undervalued on this metric. The gap suggests the market may be overlooking the company’s solid fundamentals and future prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bread Financial Holdings Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are a modern, accessible way to bring your own story and perspective to Bread Financial Holdings by combining your view of the business with real financial forecasts and fair value estimates. Instead of just relying on static ratios or consensus numbers, a Narrative links how you see the company's strategy, risks, and opportunities directly to projected revenue, profit margins, and ultimate share value. On Simply Wall St’s Community page, investors can easily create and update Narratives in a few clicks, drawing from millions of users’ insights and updated instantly as new news or earnings reports come in.

With Narratives, you can compare your calculated fair value to the current share price and see how it evolves as the business or economy shifts, making buy and sell decisions much more personalized and timely. For example, the most optimistic Narrative for Bread Financial Holdings currently estimates a $98 target price, driven by bullish expectations for technology expansion and earnings growth, while the most cautious sees just $51, reflecting competitive pressures and rising costs. This shows how different investor viewpoints can meaningfully shape your own investment strategy.

Do you think there's more to the story for Bread Financial Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bread Financial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BFH

Bread Financial Holdings

Provides tech-forward payment and lending solutions to customers and consumer-based industries in North America.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives