- United States

- /

- Consumer Finance

- /

- NYSE:AXP

American Express (NYSE:AXP) Announces Regular US$0.82 Quarterly Dividend

Reviewed by Simply Wall St

American Express (NYSE:AXP) recently affirmed its quarterly dividend, declaring $0.82 per share, amidst a backdrop of key corporate activities, including share repurchases and strong earnings. Over the last quarter, the stock saw an 8% rise, largely consistent with the broader market trend. While geopolitical tensions in the Middle East and the Fed's impending rate decision kept markets on edge, American Express's robust Q1 earnings and continual buyback commitments provided solid investor confidence. The company's strategic financial moves, such as debt issuance, coupled with broader market resilience, contributed to a stable upward trajectory in its share price.

Every company has risks, and we've spotted 1 weakness for American Express you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

American Express's affirmed dividend of US$0.82 per share is reflective of continued investor confidence amidst ongoing share repurchases and robust earnings in a challenging macroeconomic landscape. The company's recent 8% stock rise aligns with market trends, suggesting stability. Over a longer period, American Express shares have yielded a total return of 214.43% over five years, highlighting significant shareholder value creation. Compared to the past year, where American Express matched the US Consumer Finance industry's return of 28.6%, this long-term performance underscores the company's resilience and growth trajectory.

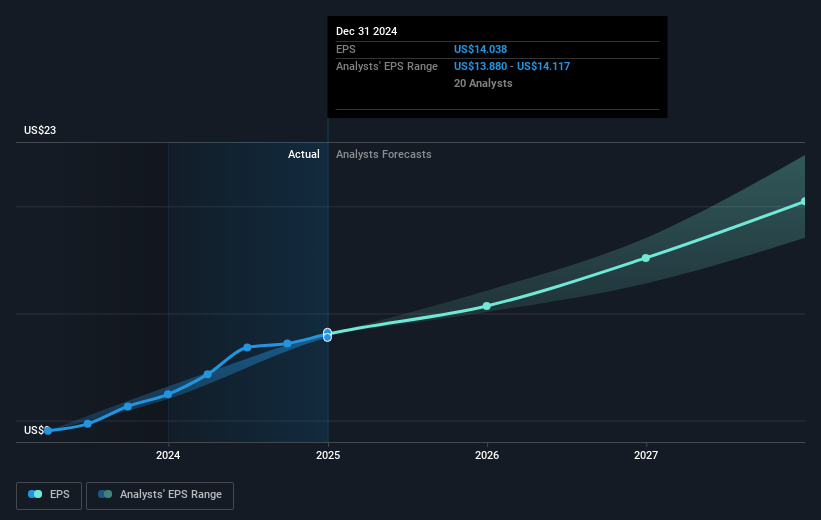

The news of strong earnings and share buybacks may support continued investor confidence, potentially bolstering the revenue and earnings projections. However, with macroeconomic uncertainties and challenges such as deceleration in airline spending, the company could face pressures that may dampen future growth expectations. Still, strong customer spending and a diversified revenue base could provide a stable foundation. With a current share price of US$276.24, the price movement presents a slight discount to the consensus analyst price target, suggesting possible upside potential if the company navigates its challenges effectively.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AXP

American Express

Operates as integrated payments company in the United States, Europe, the Middle East and Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, the Caribbean, and Internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives