- United States

- /

- Capital Markets

- /

- NYSE:ASA

What Does Saba Capital’s Latest ASA (ASA) Share Purchase Reveal About Shareholder Confidence?

Reviewed by Sasha Jovanovic

- On December 1, 2025, Saba Capital Management, L.P., a ten percent owner of ASA Gold & Precious Metals Ltd, purchased 9,560 shares of common stock at US$53.46 per share, amounting to approximately US$511,077, and now indirectly owns 5,256,192 shares in the company.

- A large insider acquisition by a key stakeholder like Saba Capital Management, L.P. can indicate strong confidence in ASA Gold & Precious Metals Ltd’s outlook and may shape perceptions among investors.

- We’ll explore how this substantial share purchase by a major shareholder fits into ASA Gold & Precious Metals' current investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is ASA Gold and Precious Metals' Investment Narrative?

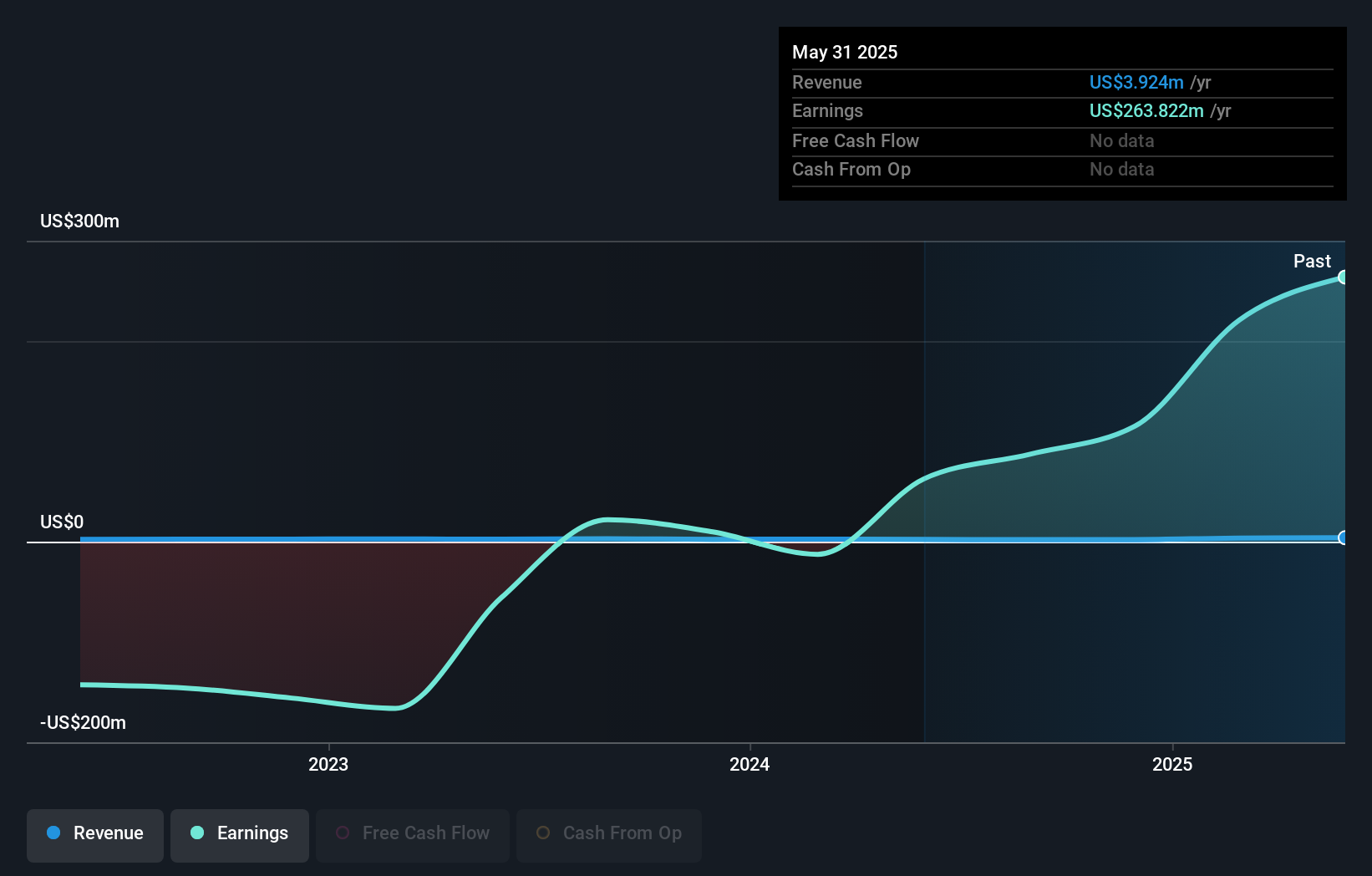

For anyone considering ASA Gold and Precious Metals, the key conviction centers on long-term exposure to precious metals and the wider mining sector, within a structure that emphasizes capital returns and active governance. The recent sizeable share purchase by Saba Capital Management, L.P., a major shareholder previously involved in high-profile governance disputes, may shift near-term sentiment around control and oversight. While the acquisition signals stakeholder confidence, analysis to date suggests limited impact on the most critical short-term drivers: ongoing board changes and legal outcomes remain at the forefront. The company’s impressive recent returns and strong profitability are tempered by a relatively inexperienced management and board, as well as the outsized effect of one-off gains. With Saba increasing its stake, investor focus may turn to board stability and resolution of legal uncertainties in the upcoming quarters.

However, behind the impressive numbers, board inexperience is an important consideration investors should be aware of.

Exploring Other Perspectives

Explore another fair value estimate on ASA Gold and Precious Metals - why the stock might be worth as much as $8.38!

Build Your Own ASA Gold and Precious Metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ASA Gold and Precious Metals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ASA Gold and Precious Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ASA Gold and Precious Metals' overall financial health at a glance.

No Opportunity In ASA Gold and Precious Metals?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASA

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026