- United States

- /

- Diversified Financial

- /

- NYSE:APO

Will Apollo (APO) Sports Capital Shift Signal a Deeper Change in Its Long-Term Growth Priorities?

Reviewed by Sasha Jovanovic

- In recent days, Apollo Global Management launched Apollo Sports Capital, a new investment business focused on the global sports and live events sector, while also naming Al Tylis as CEO and Jaycee Pribulsky as Partner and Chief Sustainability Officer. These developments reflect Apollo's intention to build expertise in sports investing and to elevate its sustainability leadership through senior appointments with deep industry experience.

- Notably, Apollo's expansion into sports and sustainability comes as it seeks to broaden its investment offerings and integrate long-term value strategies across its portfolio.

- We will review how Apollo's creation of a dedicated sports capital unit signals a shift in its investment narrative and long-term growth priorities.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Apollo Global Management Investment Narrative Recap

Shareholders in Apollo Global Management need conviction in the firm's ability to scale its investment platform while navigating execution challenges and aligning internal resources, as these factors remain pivotal to meeting long-term growth targets. The recent launch of Apollo Sports Capital and the appointment of experienced industry leaders do not materially impact the most immediate catalyst for the stock, progress on credit origination and spread-related earnings, nor do they address the key risk of execution hurdles within a competitive market.

Of Apollo’s recent announcements, the launch of three new European Long-Term Investment Funds (ELTIFs) stands out for its relevance to growth catalysts, as it signals further expansion of Apollo's platform and diversified access points for investors seeking private market returns. This expansion ties directly to the firm’s aim of building fee-related earnings and meeting demand for alternative asset strategies, although it does not mitigate short-term execution risks or competitive pressures.

Yet, against these opportunities, it is vital for investors to keep in mind the underlying risk if execution issues begin to undermine projected growth, especially as...

Read the full narrative on Apollo Global Management (it's free!)

Apollo Global Management's narrative projects $1.1 billion in revenue and $6.6 billion in earnings by 2028. This requires a 64.6% yearly revenue decline and an increase in earnings by $3.5 billion from the current $3.1 billion.

Uncover how Apollo Global Management's forecasts yield a $161.86 fair value, a 29% upside to its current price.

Exploring Other Perspectives

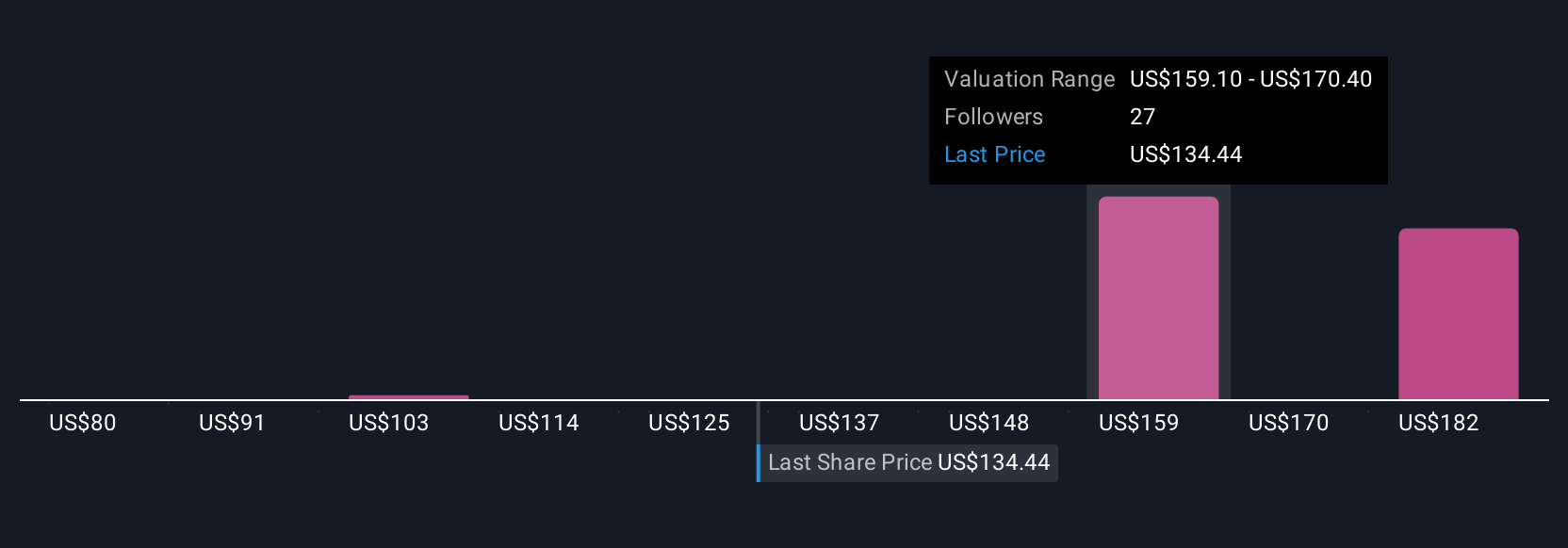

Six fair value estimates from the Simply Wall St Community range from US$80 to US$193 per share. While execution challenges remain top of mind, these contrasting perspectives highlight just how widely investor opinions can vary, explore several viewpoints before forming your own.

Explore 6 other fair value estimates on Apollo Global Management - why the stock might be worth as much as 53% more than the current price!

Build Your Own Apollo Global Management Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Apollo Global Management research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Apollo Global Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Apollo Global Management's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APO

Apollo Global Management

A private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives