- United States

- /

- Diversified Financial

- /

- NYSE:APO

Is Apollo a Bargain After Recent 24% Drop in 2025?

Reviewed by Bailey Pemberton

Thinking about Apollo Global Management and wondering whether now is the moment to make a move? You are not alone. After all, this name has made waves before, boasting an eye-popping 225.7% gain over the last five years. Yet more recently, things have been a little rockier. Shares have dropped 8.5% in the past week and are down 23.6% year to date. The mood around private equity firms like Apollo has shifted as market tides have changed, with increased investor caution about the future pace of dealmaking and risk appetite across the industry.

That said, not all downturns signal a reason to head for the exits. Sometimes, price moves are more a reflection of broader sentiment than the company's underlying value. In fact, Apollo Global Management currently scores a 4 out of 6 on our valuation checks, suggesting it might be more undervalued than many of its peers. That is worth paying close attention to, especially if you believe recent weakness could be temporary in nature.

But before jumping to conclusions, it is essential to break down how this valuation score came to be. In the next section, we are going to walk through several common approaches investors use to determine whether a stock is genuinely undervalued or just flashing a tempting price tag. Plus, we will discuss an even more insightful way to put Apollo's valuation into context, one that often gets overlooked.

Why Apollo Global Management is lagging behind its peers

Approach 1: Apollo Global Management Excess Returns Analysis

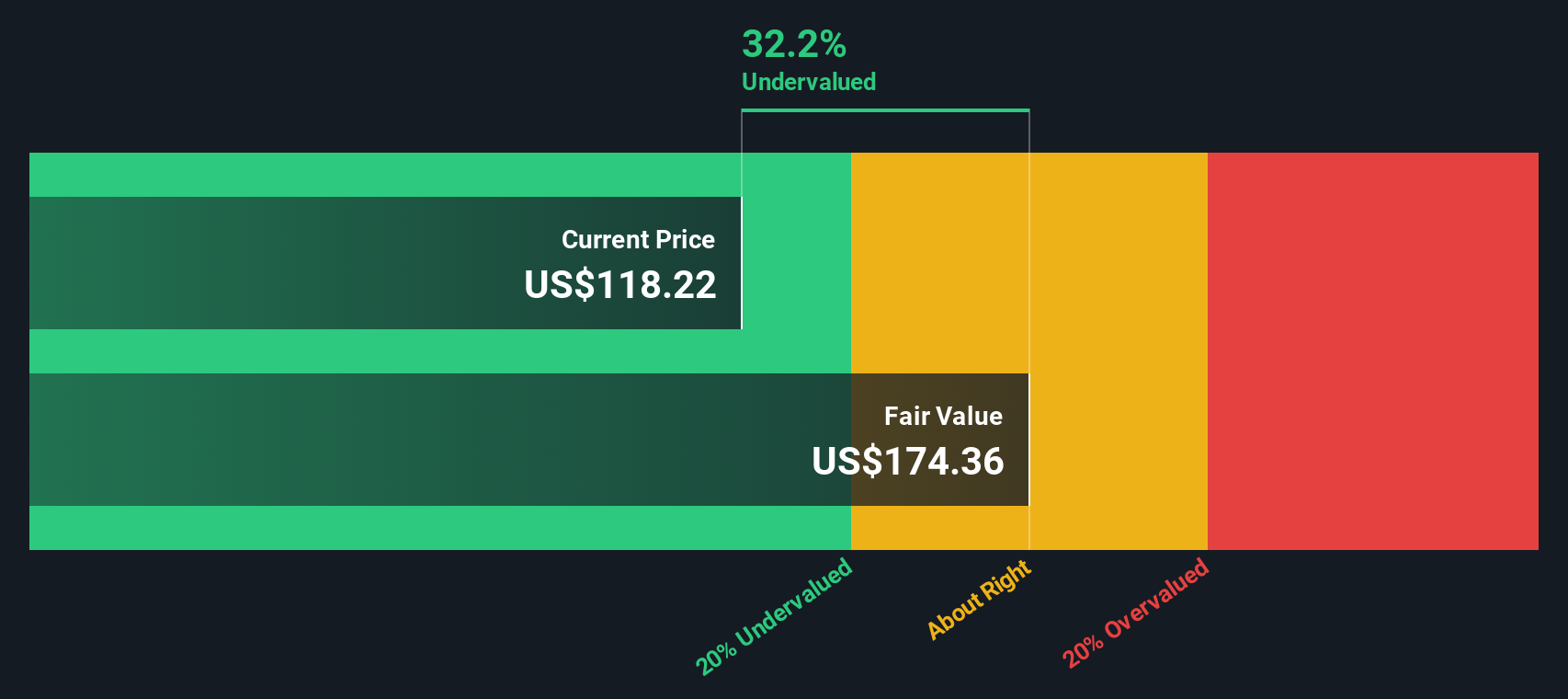

The Excess Returns valuation approach measures how efficiently a company reinvests its capital above its cost of equity. For Apollo Global Management, this model highlights its historical strength in generating returns well above what investors require for the risk they are taking.

Key figures shed light on Apollo's capital effectiveness. The company shows a Book Value of $31.33 per share and a Stable EPS of $11.45 per share, calculated using the median return on equity from the past five years. Notably, the average Return on Equity stands at 20.64%, a robust figure for diversified financials. With a Cost of Equity of $4.67 per share, Apollo's calculated Excess Return is $6.78 per share, a meaningful surplus. Projections indicate a Stable Book Value of $55.49 per share, drawing on future estimates from two analysts.

Plugging these numbers into the Excess Returns Model yields an estimated intrinsic value of $182.44 per share. Compared to its current share price, this suggests Apollo Global Management is trading at a 30.6% discount to its intrinsic value, signaling strong undervaluation based on excess returns potential and capital efficiency.

Result: UNDERVALUED

Our Excess Returns analysis suggests Apollo Global Management is undervalued by 30.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

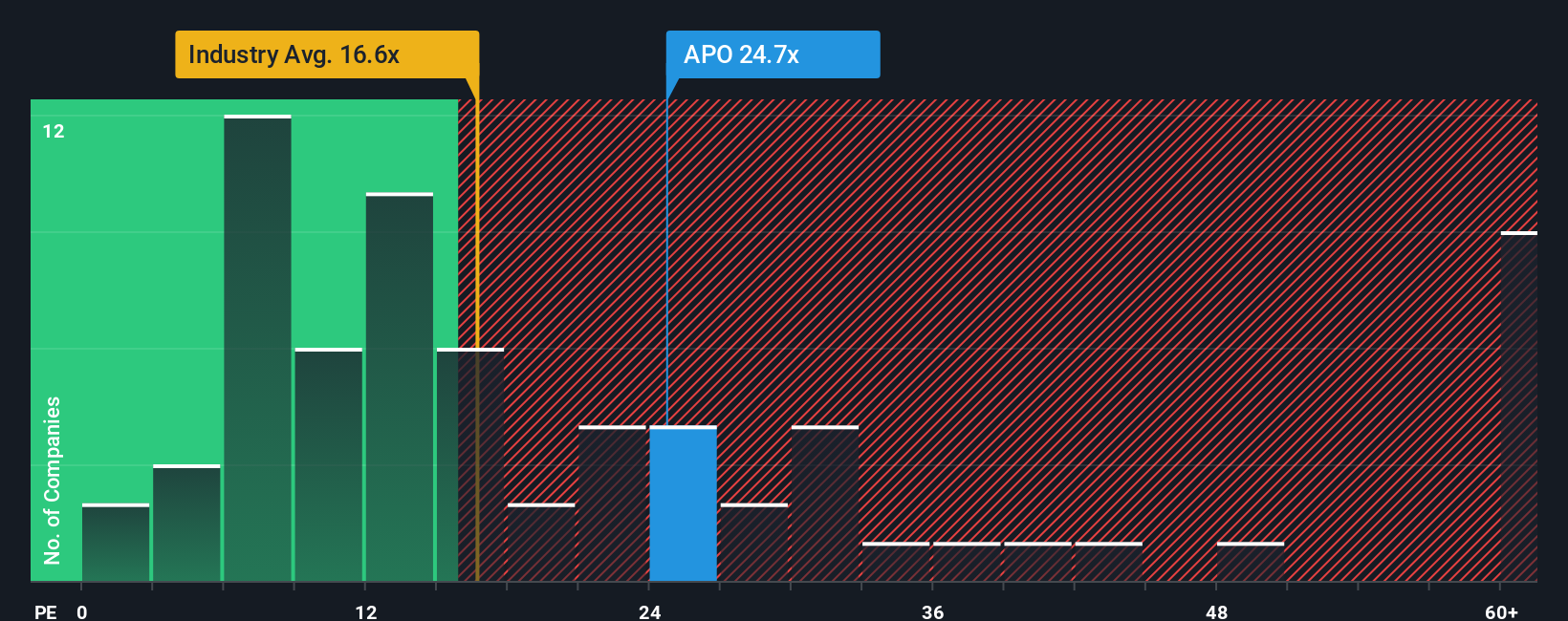

Approach 2: Apollo Global Management Price vs Earnings

For profitable companies such as Apollo Global Management, the Price-to-Earnings (PE) ratio is a widely used valuation metric. Since it relates the company’s market price to its actual earnings, it gives investors a snapshot of how much they are paying for each dollar of profits. This makes it especially useful when evaluating established firms with consistent profitability.

Of course, what constitutes a “fair” PE ratio depends on factors like expected earnings growth and risk. Higher growth potential or lower business risk often justifies a higher PE, while industries facing uncertainty or slower expansion usually trade at lower multiples. Apollo currently trades at a PE ratio of 22.9x. For context, this compares to the Diversified Financial industry average of 16.1x and a peer average of 21.3x, suggesting that Apollo is priced slightly above its typical industry and peer group levels.

Simply Wall St’s proprietary Fair Ratio model helps investors dig deeper by assessing not just growth prospects and risk, but also company-specific factors like profit margins, size, and broader industry conditions. This model calculates a Fair Ratio of 24.8x for Apollo, which is higher than its current PE. Because the Fair Ratio accounts for more nuanced realities than the blanket industry or peer averages, it provides a clearer guide for evaluating whether Apollo’s current price makes sense. Since Apollo’s PE is below its Fair Ratio, the shares appear to offer better value than headline multiples alone might suggest.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Apollo Global Management Narrative

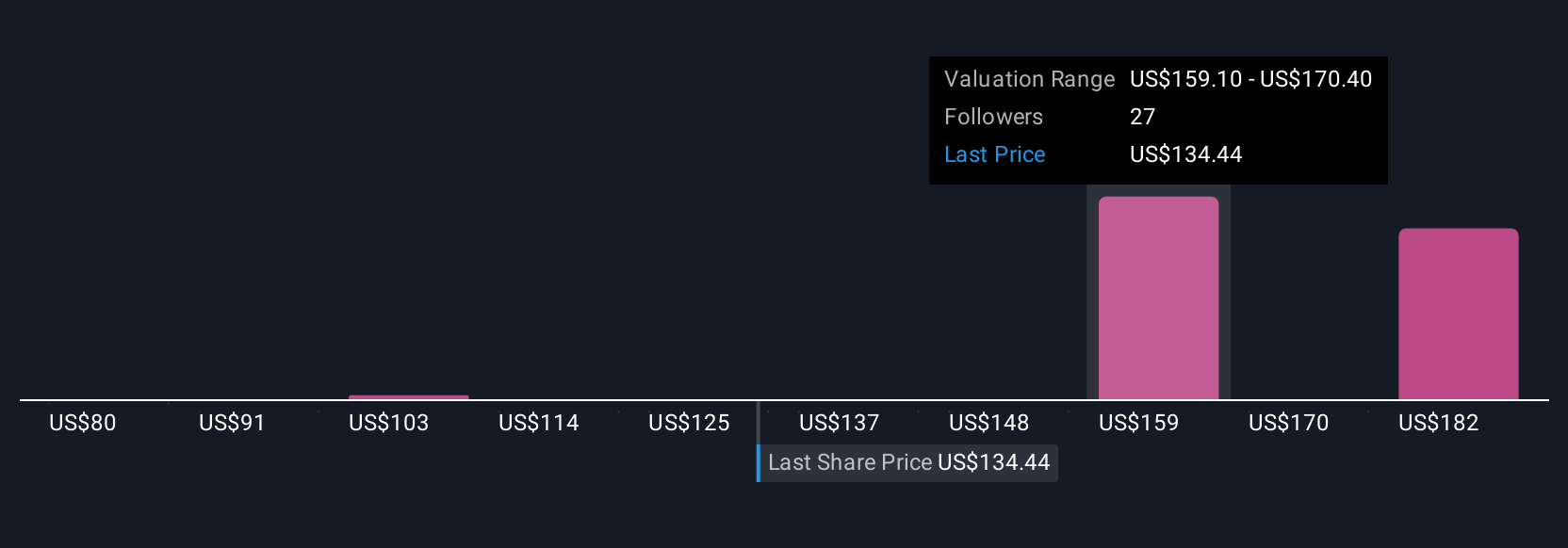

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story of the company, where you connect what you believe about Apollo Global Management, such as its future revenue, profits, margins, and fair value, to the numbers, adding context and personal insight behind your investment decisions.

Instead of just following market sentiment, Narratives let you build a forecast based on your convictions and relate it directly to a company’s fair value. This bridges the story you see unfolding with financial reality. Narratives are easily created and shared on the Simply Wall St Community page, helping millions of investors make transparent, personalized decisions about when to buy or sell as you compare your fair value to the current price.

They are updated automatically as news and earnings are released, so you can react quickly to new developments and keep your views fresh. For example, some investors see Apollo’s S&P 500 inclusion and global opportunities driving a price target as high as $178.0, while others, factoring in risks, arrive at a more cautious $117.7. This demonstrates how Narratives can empower you to invest with confidence based on your unique perspective.

Do you think there's more to the story for Apollo Global Management? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APO

Apollo Global Management

A private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives