- United States

- /

- Capital Markets

- /

- NYSE:AMG

Should Strong Q3 Results and Larger Buybacks at AMG Reshape How Investors View Its Capital Returns?

Reviewed by Sasha Jovanovic

- Affiliated Managers Group recently reported third-quarter 2025 results that exceeded analyst forecasts, supported by improved assets under management, US$9.00 billion in net client inflows, and expanding exposure to private markets and liquid alternatives.

- The company also raised its full-year share repurchase target to at least US$500.00 million, signaling continued emphasis on capital returns and the earnings impact of its partnership model with high-fee alternative affiliates.

- We’ll now examine how the stronger third-quarter results and increased share repurchase plans reshape Affiliated Managers Group’s existing investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Affiliated Managers Group Investment Narrative Recap

To own Affiliated Managers Group, you need to believe its partnership model and tilt toward private markets and liquid alternatives can offset pressures in traditional active equity and industry fee compression. The latest third quarter beat and US$9.00 billion of net inflows support that thesis in the near term, while heightened reliance on a handful of large affiliates remains a key risk that this strong quarter does not fully resolve.

The decision to lift 2025 share repurchases to at least US$500.00 million is particularly relevant here, because it amplifies the earnings impact of AMG’s alternative affiliates just as their contribution rises to more than half of EBITDA. For investors focused on short term catalysts, this combination of stronger economic earnings and stepped up buybacks tightens the link between affiliate performance, capital returns, and overall shareholder outcomes.

Yet, against this backdrop of improving results and higher buybacks, investors should still be aware of the growing concentration risk in a few core affiliates and …

Read the full narrative on Affiliated Managers Group (it's free!)

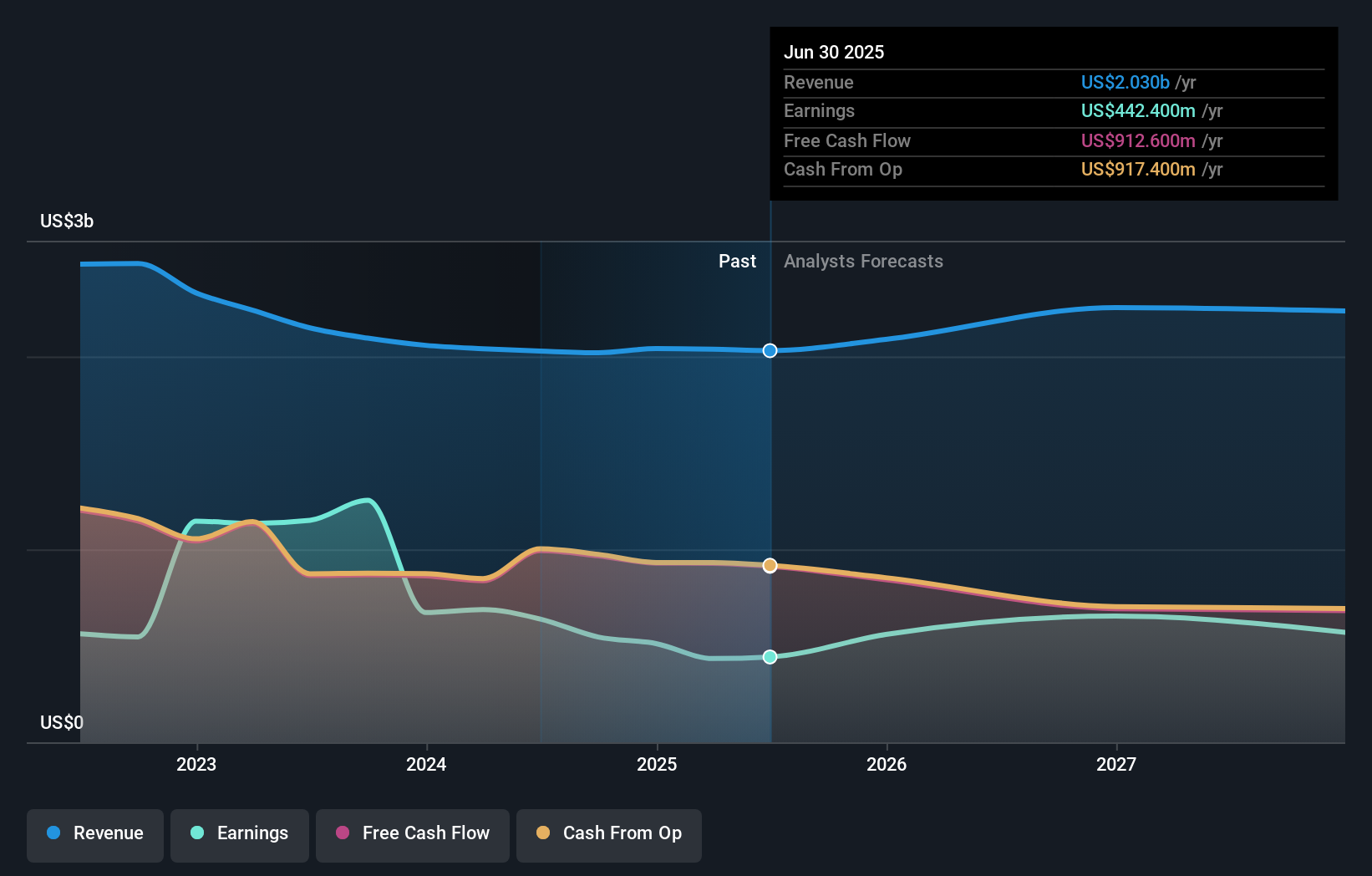

Affiliated Managers Group's narrative projects $2.2 billion revenue and $594.9 million earnings by 2028. This requires 2.7% yearly revenue growth and about $152.5 million earnings increase from $442.4 million today.

Uncover how Affiliated Managers Group's forecasts yield a $307.71 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community cluster between US$290.26 and US$307.71 per share, showing how even a small sample can span a meaningful range. You are seeing these differing views just as AMG’s heavier tilt toward private markets and liquid alternatives raises both the potential earnings contribution from higher fee strategies and the exposure to more volatile fundraising cycles, so it is worth comparing several perspectives before forming a view.

Explore 2 other fair value estimates on Affiliated Managers Group - why the stock might be worth as much as 13% more than the current price!

Build Your Own Affiliated Managers Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Affiliated Managers Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Affiliated Managers Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Affiliated Managers Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMG

Affiliated Managers Group

Through its affiliates, operates as an investment management company providing investment management services to mutual funds, institutional clients,retails and high net worth individuals in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026