- United States

- /

- Capital Markets

- /

- NYSE:AMG

Here's Why We Think Affiliated Managers Group (NYSE:AMG) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Affiliated Managers Group (NYSE:AMG). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Affiliated Managers Group

Affiliated Managers Group's Improving Profits

Affiliated Managers Group has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. In impressive fashion, Affiliated Managers Group's EPS grew from US$14.04 to US$32.82, over the previous 12 months. Year on year growth of 134% is certainly a sight to behold.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. To cut to the chase Affiliated Managers Group's EBIT margins dropped last year, and so did its revenue. This is less than stellar for the company.

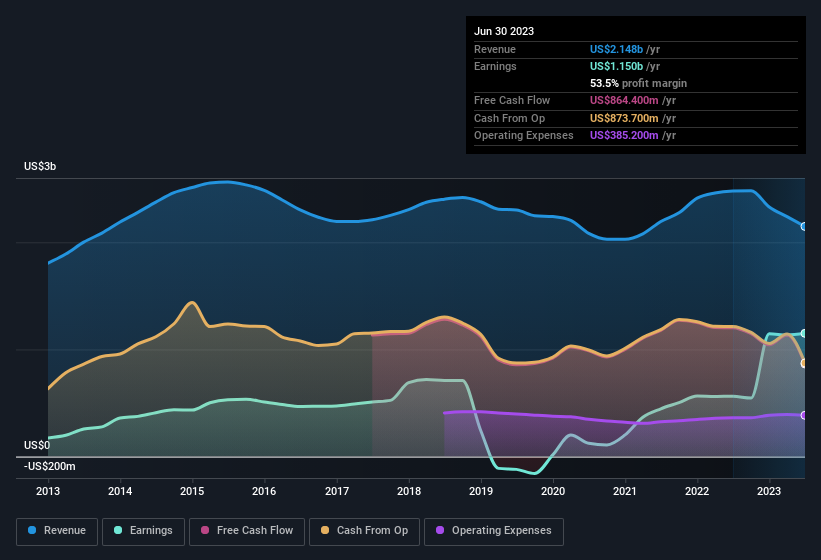

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Affiliated Managers Group's future EPS 100% free.

Are Affiliated Managers Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The first bit of good news is that no Affiliated Managers Group insiders reported share sales in the last twelve months. Even better, though, is that the Independent Director, Reuben Jeffery, bought a whopping US$501k worth of shares, paying about US$137 per share, on average. Purchases like this can offer an insight into the faith of the company's management - and it seems to be all positive.

The good news, alongside the insider buying, for Affiliated Managers Group bulls is that insiders (collectively) have a meaningful investment in the stock. With a whopping US$73m worth of shares as a group, insiders have plenty riding on the company's success. This would indicate that the goals of shareholders and management are one and the same.

Is Affiliated Managers Group Worth Keeping An Eye On?

Affiliated Managers Group's earnings per share growth have been climbing higher at an appreciable rate. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Affiliated Managers Group belongs near the top of your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Affiliated Managers Group (at least 1 which is significant) , and understanding them should be part of your investment process.

Keen growth investors love to see insider buying. Thankfully, Affiliated Managers Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AMG

Affiliated Managers Group

Through its affiliates, operates as an investment management company providing investment management services to mutual funds, institutional clients,retails and high net worth individuals in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives