- United States

- /

- Consumer Finance

- /

- NYSE:ALLY

Ally Financial (ALLY): Valuation in Focus as Restructuring Accelerates with Layoffs and Boardroom Changes

Reviewed by Simply Wall St

Ally Financial (ALLY) has caught investor attention after announcing another round of layoffs, trimming about 2% of its workforce. This move comes alongside board appointments intended to refine the company’s strategy and enhance operational efficiency.

See our latest analysis for Ally Financial.

Ally Financial’s management shakeup and cost-cutting moves have come as investors keep a close eye on momentum. After a steady rally, the latest 1-year total shareholder return stands at 16.2%, with the 3-year total return showing an impressive 71%. While short-term share price returns have bounced between modest gains and pullbacks, the bigger picture suggests the company’s strategic overhaul could be fueling fresh optimism about future growth and risk management.

If shifting strategies and boardroom moves have you curious about where tomorrow’s leaders might come from, you could discover new opportunities with fast growing stocks with high insider ownership

With Ally shares currently trading around 21% below analyst price targets and impressive management changes underway, investors may be wondering if the current valuation is a chance to buy in or if future growth is already reflected in the price.

Most Popular Narrative: 17.6% Undervalued

Ally Financial's most widely followed narrative sees the stock trading well below its fair value. With shares last closing at $39.62 and a fair value estimate of $48.06, the numbers are catching attention and setting off debate about where the company’s real potential lies.

The accelerating demand for digital banking and app-based financial services is enabling Ally's all-digital business model to acquire and retain customers more efficiently, supporting ongoing net customer growth and driving higher deposit stability. This should support long-term revenue and net margin expansion as the cost advantages of digital scale deepen.

Want an inside look at what’s fueling this bullish valuation? The future scenario leans on surging profits, ramped-up margins, and projections rarely granted to traditional banks. Unlock the narrative now to see what’s behind these ambitious growth targets and why analysts are betting big on a digital edge.

Result: Fair Value of $48.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory pressures or a downturn in auto lending volumes could quickly challenge Ally's current growth story and interrupt its valuation momentum.

Find out about the key risks to this Ally Financial narrative.

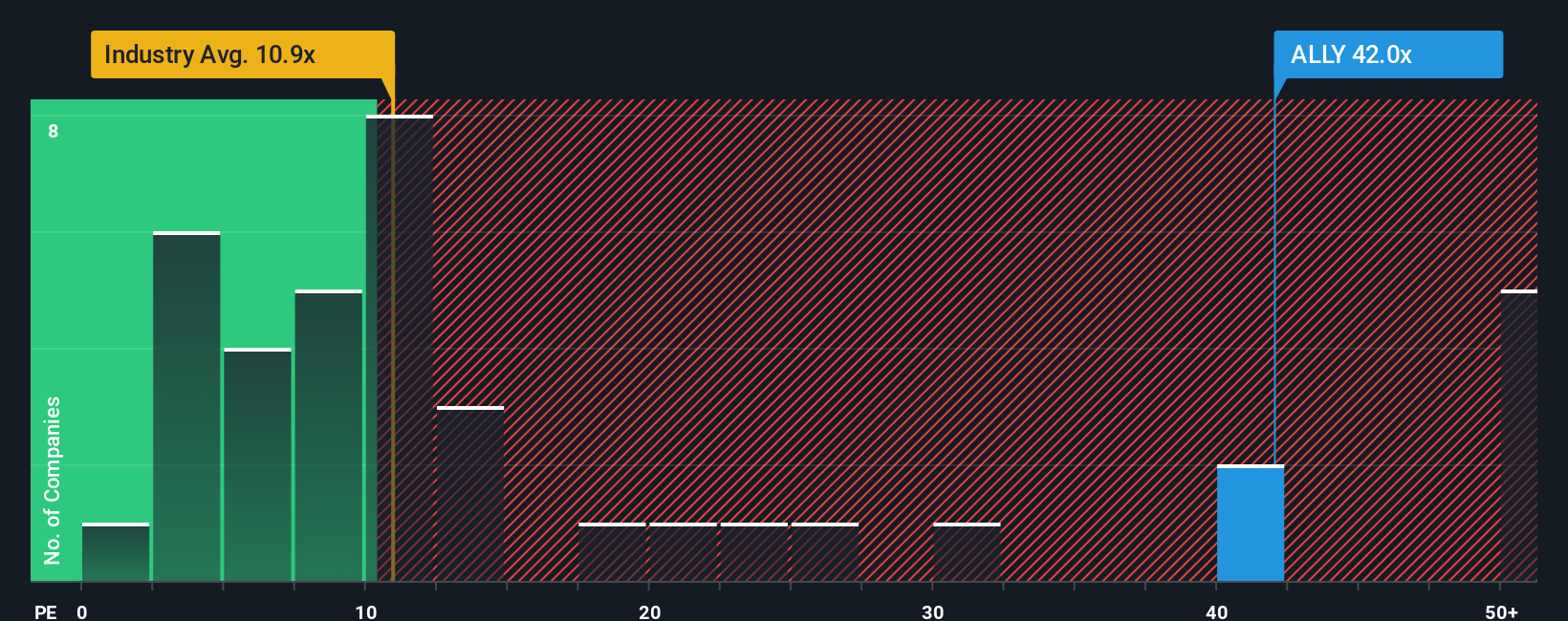

Another View: What Do Earnings Multiples Say?

Looking through the lens of earnings ratios, Ally Financial trades at 23.3 times earnings. This figure is below the average of peers at 47.4 times, but higher than the industry average of 10.7 times. When compared to its fair ratio of 21.6, this suggests shares are not as inexpensive as the earlier analysis implies. This leaves open the question of whether optimism is already priced in or if more upside remains.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ally Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ally Financial Narrative

If you want to dig deeper, challenge the consensus, or shape your own outlook, you can build a personal thesis in just a few minutes with Do it your way.

A great starting point for your Ally Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Broaden your horizons and take charge of your investing journey by searching out stocks that match your goals.

- Boost your passive income strategy and review top picks delivering yields over 3% by checking out these 20 dividend stocks with yields > 3%.

- Catch the wave of innovation and tap into future leaders in artificial intelligence with these 26 AI penny stocks, packed with companies at the forefront of this powerful trend.

- Tap into value by spotting promising businesses trading well below their intrinsic value by scanning these 840 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALLY

Ally Financial

A digital financial-services company, provides various digital financial products and services in the United States, Canada, and Bermuda.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives