- United States

- /

- Consumer Finance

- /

- NYSE:ALLY

Ally Financial (ALLY) One-Off $423 Million Loss Tests Profit Recovery Narrative

Reviewed by Simply Wall St

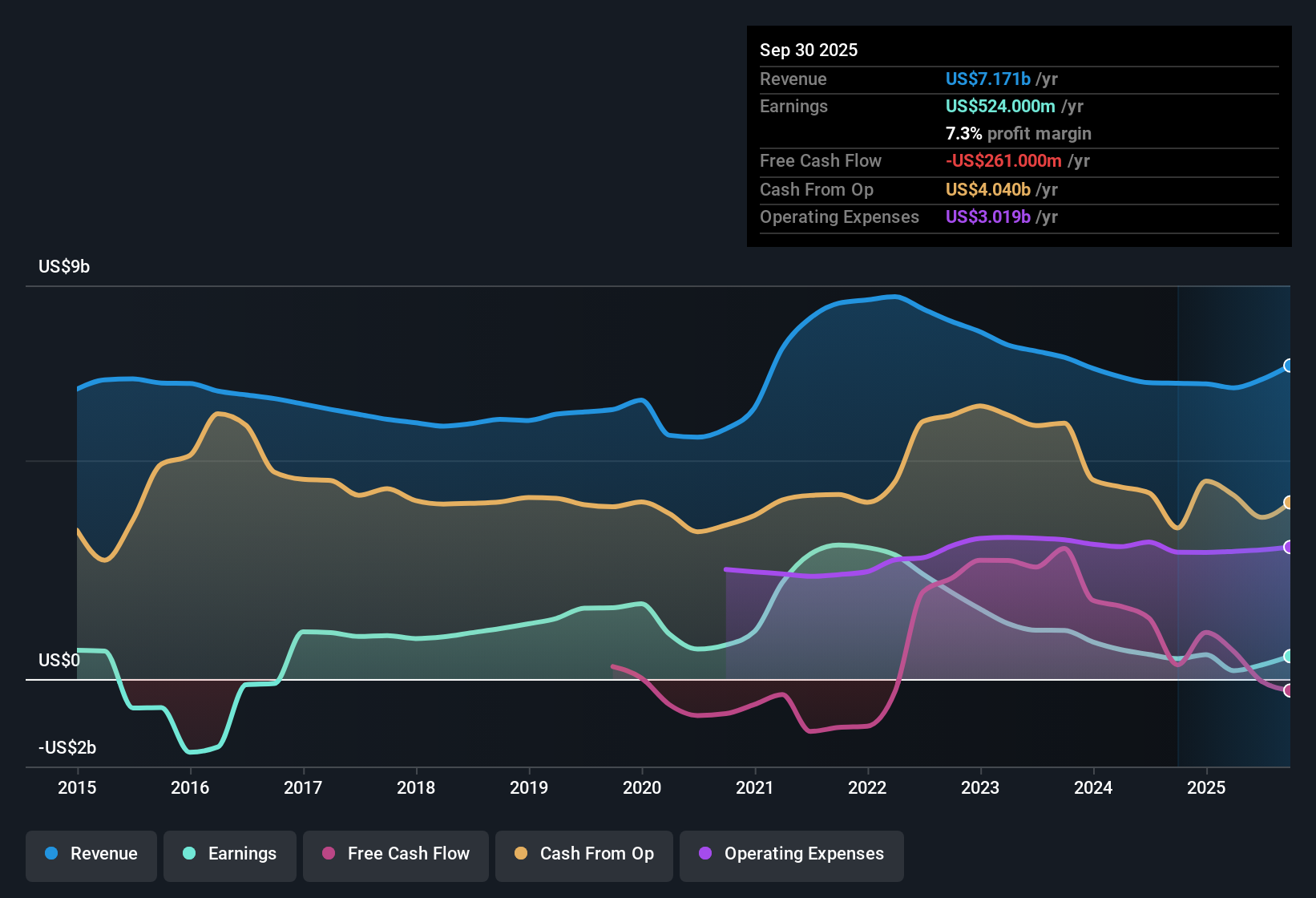

Ally Financial (ALLY) reported a net profit margin of 5.1%, down from last year's 9.2%, as a one-off loss of $423.0 million weighed heavily on the trailing twelve months through September 30, 2025. Over the last five years, earnings have dropped by 31.7% per year, with margin compression and another year of negative earnings growth now on record. Looking forward, investors have reason to watch closely as earnings are forecast to grow at 38.7% per year, well ahead of the US market's average. Shares continue to trade below analyst price targets.

See our full analysis for Ally Financial.Now, let's see how these latest figures hold up when we compare them to the stories shaping market sentiment and community narratives.

See what the community is saying about Ally Financial

Margin Recovery Hangs on Digital Expansion

- Analysts expect Ally’s profit margin to climb from 4.7% today to 18.6% by 2028, signaling a turnaround from the recent slump, with earnings projected to jump from $324.0 million to $1.8 billion over three years.

- According to the analysts' consensus view, digital-first investments and expansion into diversified lending are seen as key drivers behind the expectation for stronger long-term margins.

- The forecasted margin expansion is attributed to both disciplined cost management, as controllers note noninterest, controllable expenses fell for seven straight quarters, and higher revenues from new insurance and fee-based services.

- Strategic moves into high-quality auto loans and risk analytics are projected to both stabilize credit quality and boost yields, setting up a pathway for higher sustainable profit margins.

- Consensus narrative ties improving margins to lasting digital efficiency, but margin recovery will be tested as auto lending remains Ally’s mainstay.

- Sustained outperformance will depend on whether digital scale continues to deepen cost advantages, as rising regulatory and competitive pressures could still limit margin upside.

- The latest financials reinforce the consensus view that digital expansion is central to profit recovery for Ally, but execution risks remain. See how the consensus narrative stacks up to recent results. 📊 Read the full Ally Financial Consensus Narrative.

One-Off Loss Keeps Pressure on Profitability

- The $423.0 million one-time loss weighed on the latest results, leaving net profit margins at 5.1%, down from last year’s 9.2%, and adding to a five-year annualized earnings decline of 31.7%.

- Analysts' consensus view highlights that unless Ally offsets these pressures through cost controls and fee-based revenue growth, profit volatility could persist.

- Heavier dependence on traditional auto lending and runoff in noncore lines like credit cards could heighten Ally’s exposure to further margin swings.

- Credit quality improvements and expense reductions help mitigate some short-term shocks, but ongoing regulatory and competitive headwinds mean that single-year setbacks could repeat if strategic pivots stall.

PE Ratio: A Nuanced Value Signal

- Ally’s price-to-earnings (PE) ratio stands at 32.9x, higher than the US Consumer Finance industry average but below its direct peer group.

- The analysts' consensus narrative contends that Ally’s valuation remains a balancing act, with the stock trading at $38.97 versus a single analyst price target of $48.06.

- The forecasted jump in earnings will need to be delivered to justify a forward PE of 11.4x by 2028. If not, shares may appear expensive relative to industry fundamentals.

- While the current market price sits beneath the consensus price target, historical earnings trends and margin compression prompt analysts to urge caution, suggesting investors should weigh whether the growth case fully offsets recent declines.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ally Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on Ally’s numbers? Shape your unique outlook in just a few minutes and share your view. Do it your way

A great starting point for your Ally Financial research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Ally’s volatile earnings, shrinking profit margins, and valuation uncertainties highlight ongoing exposure to market swings and execution risks.

Want more consistent results? Seek out healthier picks with steadier earnings using stable growth stocks screener (2102 results) to avoid the turbulence holding Ally back.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALLY

Ally Financial

A digital financial-services company, provides various digital financial products and services in the United States, Canada, and Bermuda.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives