- United States

- /

- Diversified Financial

- /

- NYSE:AGM

Federal Agricultural Mortgage (AGM): Assessing Valuation After Recent Subtle Moves in the Stock

Reviewed by Simply Wall St

Most Popular Narrative: 11.6% Undervalued

The most widely followed narrative suggests that Federal Agricultural Mortgage is currently trading at a discount to its fair value, based on future earnings potential and quantitative growth assumptions.

Expansion into renewable energy, broadband, and infrastructure finance is driving significant new business volume and higher spreads. This is positioning Farmer Mac to benefit from increasing demand for financing related to sustainability and rural connectivity initiatives, which should support revenue and earnings growth going forward.

Curious how this company’s bold push into new markets could reshape its outlook? The narrative hinges on ambitious forecasts, including aggressive growth and margin calculations that are uncommon for a traditional lender. Want to see which data points support this near double-digit discount to fair value? The underlying numbers could surprise you.

Result: Fair Value of $226.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent regulatory changes and rising credit losses in new segments could quickly undermine the optimistic outlook for Federal Agricultural Mortgage.

Find out about the key risks to this Federal Agricultural Mortgage narrative.Another View: Discounted Cash Flow Tells a Different Story

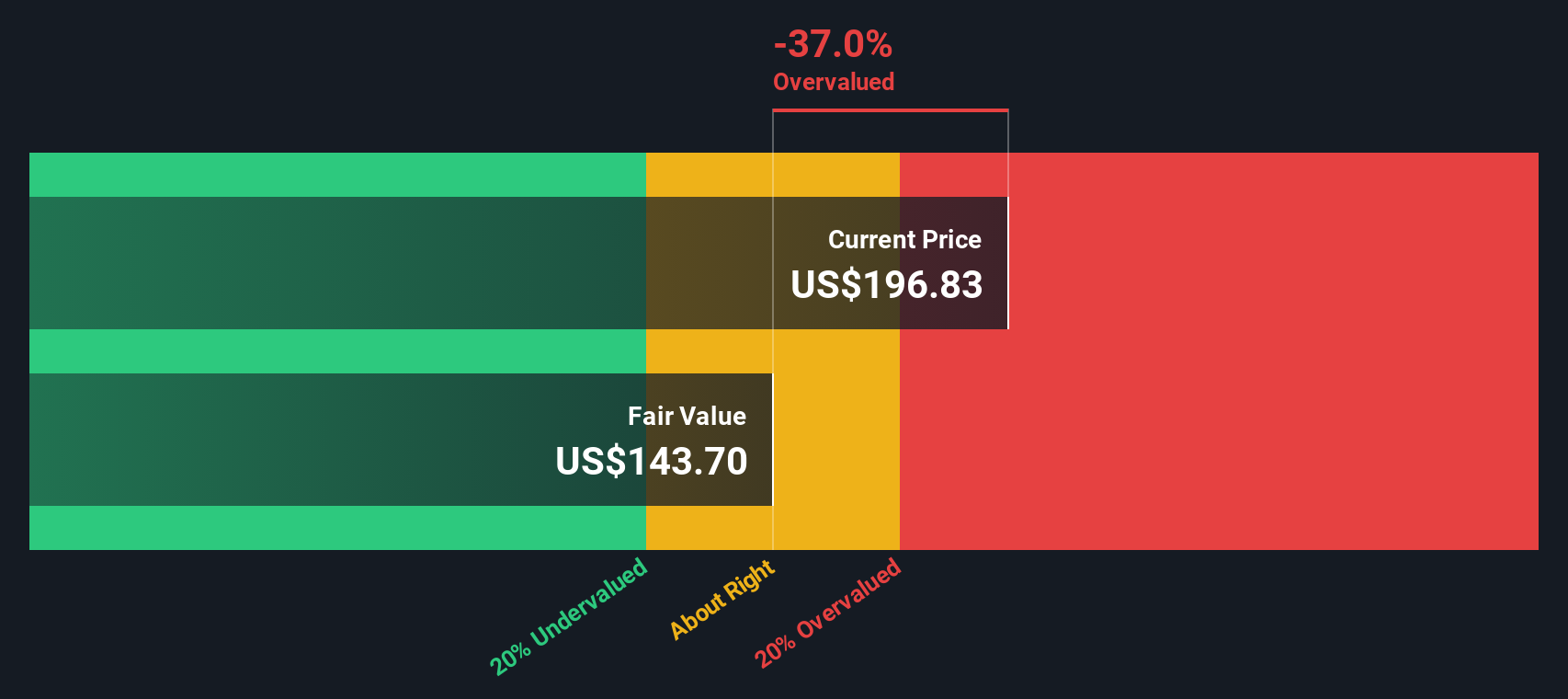

Our DCF model, which takes a different approach by projecting future cash flows, actually presents a much less optimistic picture for Federal Agricultural Mortgage. This method suggests the market may be getting ahead of itself. Could real value lie elsewhere?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Federal Agricultural Mortgage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Federal Agricultural Mortgage Narrative

If you have a different angle or want to dig deeper into the numbers yourself, you can pull together your own narrative in just a few minutes. Do it your way.

A great starting point for your Federal Agricultural Mortgage research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More High-Potential Ideas?

Why settle for the usual suspects? Uncover unique investment opportunities that could transform your portfolio by checking out these timely stock ideas right now.

- Tap into the powerful momentum behind strong earnings and low valuations by considering undervalued stocks based on cash flows.

- Ride the wave of healthcare innovation and find companies reshaping medicine through smarter technology with healthcare AI stocks.

- Catch the upside in small-cap names with strong fundamentals by evaluating penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGM

Federal Agricultural Mortgage

Provides a secondary market for various loans made to borrowers in the United States.

Established dividend payer and fair value.

Market Insights

Community Narratives