- United States

- /

- Capital Markets

- /

- NYSE:ADX

Flexible Distribution Option Could Be a Game Changer for ADX (Adams Diversified Equity Fund)

Reviewed by Simply Wall St

- Adams Diversified Equity Fund declared a distribution of US$0.46 per share, payable on August 28, 2025, offering shareholders the option to receive it in cash or additional shares, with the share valuation set at the closing NYSE market price on August 15, 2025.

- This announcement, alongside the confirmation of the Fund’s forthcoming first-half 2025 results, highlights an active period for shareholder communications and potential capital allocation decisions.

- With the choice between cash or stock for the distribution, we’ll examine how this flexibility shapes Adams Diversified Equity Fund’s investment narrative.

What Is Adams Diversified Equity Fund's Investment Narrative?

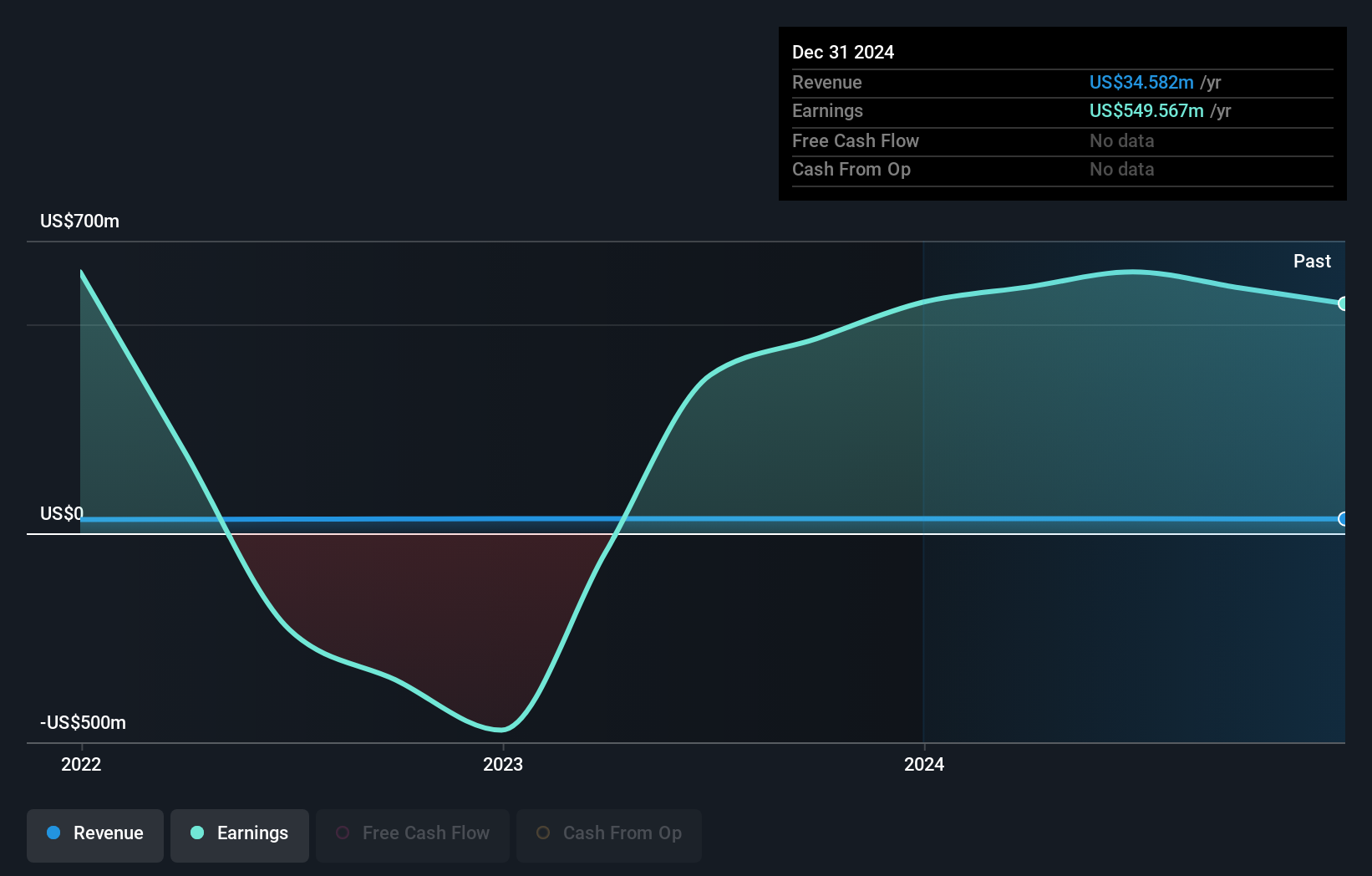

If you’re considering Adams Diversified Equity Fund, you’re essentially buying into a long-established equity fund with an active capital allocation strategy, meaningful distributions, and a focus on shareholder flexibility. The big picture for shareholders hinges on trust in disciplined management and a belief that combining regular returns with buyback programs can drive value over the long term, even as recent results have been heavily influenced by one-off items. The news of another US$0.46 per share distribution, with the option to receive cash or stock, offers flexibility but doesn’t appear to materially alter short-term catalysts or address fundamental risks: dividend sustainability remains a concern given its unstable track record, and earnings have been volatile, partly due to non-recurring gains. While recent price movements have edged upward, this news event likely reinforces rather than transforms the immediate outlook.

On the other hand, the underlying dividend risks should not be overlooked. Adams Diversified Equity Fund's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Build Your Own Adams Diversified Equity Fund Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adams Diversified Equity Fund research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Adams Diversified Equity Fund research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adams Diversified Equity Fund's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover 13 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADX

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives