- United States

- /

- Capital Markets

- /

- NYSE:AAMI

Is Acadian’s Early Bond Redemption and New Credit Lines Reframing Its Capital Structure Strategy (AAMI)?

Reviewed by Sasha Jovanovic

- Acadian Asset Management Inc. has now completed the redemption of all US$275,000,000 of its 4.800% Senior Notes due July 27, 2026, funded by a previously arranged US$200,000,000 term loan and cash on hand.

- By pairing this early bond redemption with a new three-year term loan and a US$175,000,000 revolving credit facility maturing in 2028, the firm is reshaping its funding mix and financial flexibility.

- Next, we’ll examine how this early bond redemption and expanded revolving credit capacity could influence Acadian Asset Management’s broader investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

What Is Acadian Asset Management's Investment Narrative?

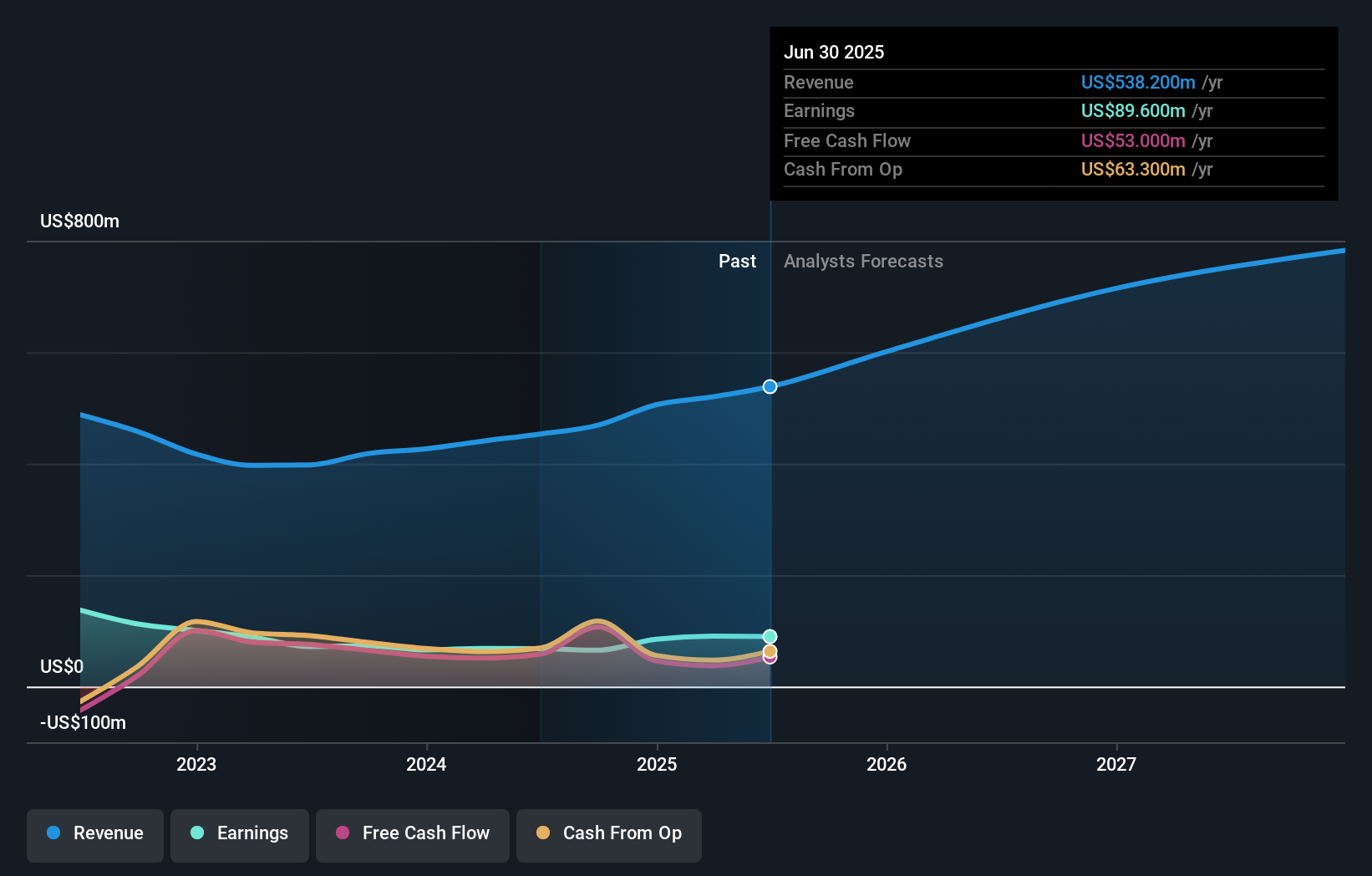

To own Acadian Asset Management, you have to be comfortable backing an asset manager that couples mid-teens revenue growth with high reported returns on equity, but also carries meaningful leverage and relies heavily on non-cash earnings. The early redemption of the US$275,000,000 4.800% notes, funded by a new US$200,000,000 term loan and cash, tweaks that equation rather than transforming it. In the near term, the key catalysts still sit around sustaining recent earnings momentum, preserving client assets and fee rates, and continuing the steady mix of dividends and buybacks. The enlarged US$175,000,000 revolver modestly improves liquidity and gives Acadian more room to support buybacks or invest in the business, but it does not fully resolve concerns that debt is not well covered by operating cash flow. Investors should weigh that funding shift against a share price that has already re-rated strongly over the past year.

However, investors should not overlook how reliant Acadian still is on debt-funded flexibility. Acadian Asset Management's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on Acadian Asset Management - why the stock might be worth as much as $19.70!

Build Your Own Acadian Asset Management Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Acadian Asset Management research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Acadian Asset Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Acadian Asset Management's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AAMI

Acadian Asset Management

BrightSphere Investment Group Inc. is a publically owned asset management holding company.

Acceptable track record with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026